As shown in the IEA’s recently released Global Hydrogen Review 2024, the cumulative hydrogen production capacity reaching Final Investment Decision has doubled compared to last year. Promisingly, low-emission ammonia comprises a significant portion of both the mature project pipeline and secured offtake volume.

Content Related to International Energy Agency (IEA)

Article

Global Hydrogen Review 2024: FID doubles, low-emission ammonia takes center stage

Kevin Rouwenhorst October 15, 2024

Article

Renewable ammonia in China: full speed ahead

Kevin Rouwenhorst February 28, 2024

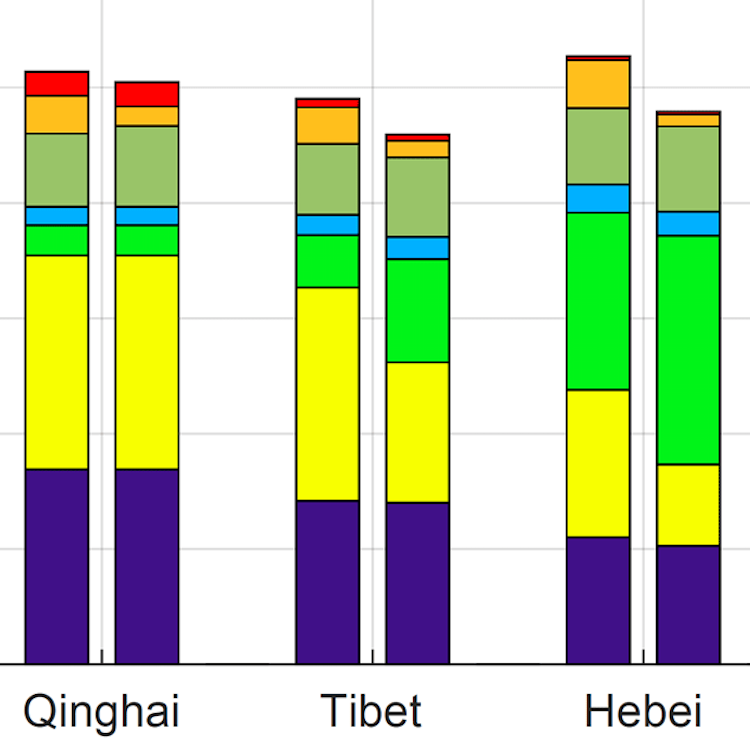

China is keeping pace with IEA predictions for electrolyzer installations, with as much as 55% of the world’s total capacity to be installed there by 2028. Coupled with strong wind-power resources, domestic manufacturing capabilities and multiple economic drivers to transition away from coal-based ammonia production, China is ideally positioned to speed up the deployment of renewable ammonia projects.

Article

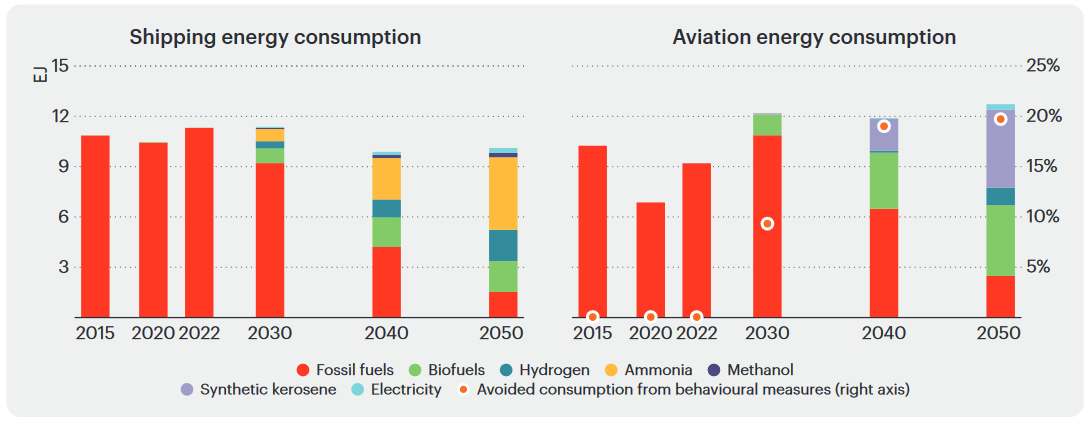

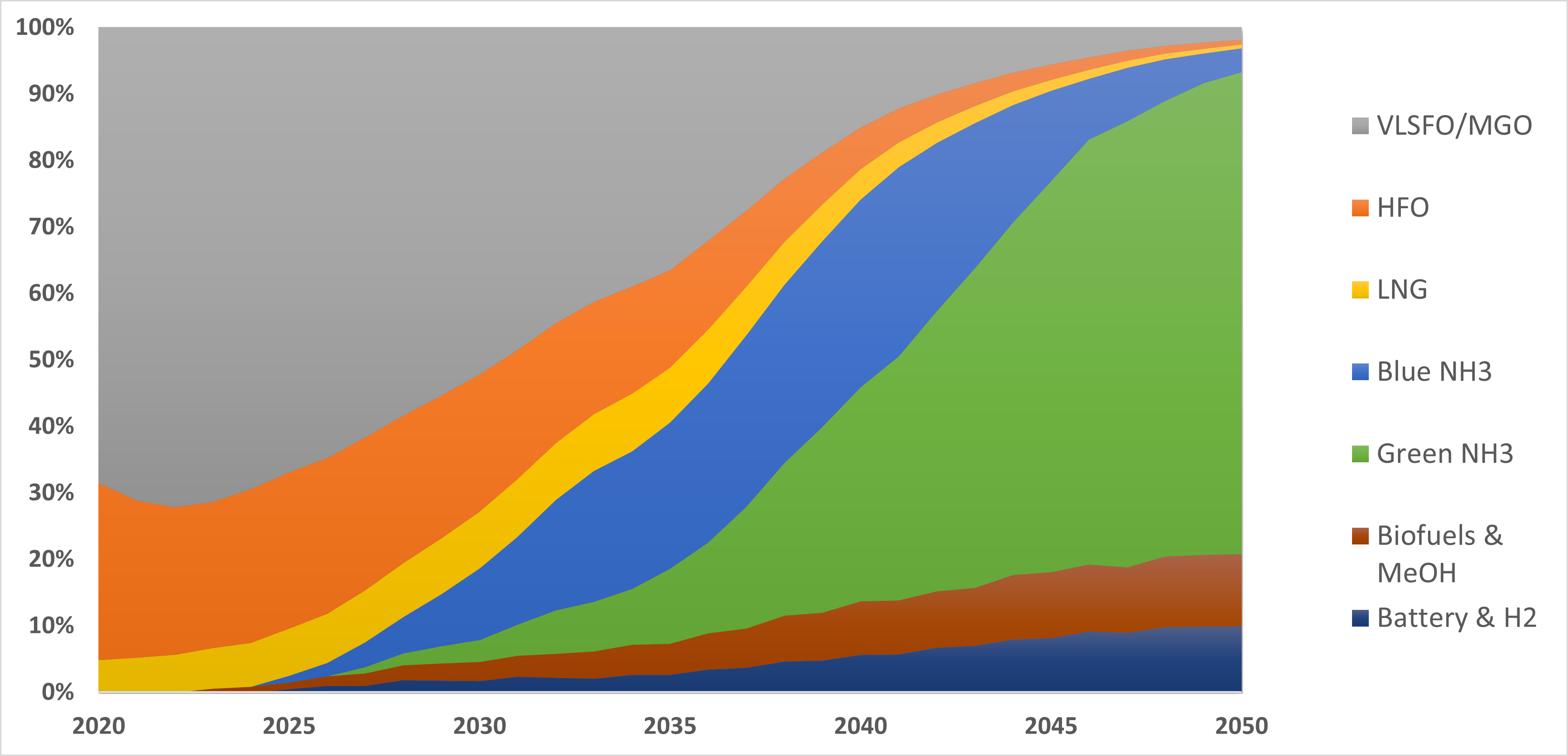

IEA: ammonia key to decarbonising shipping by 2050

Julian Atchison October 03, 2023

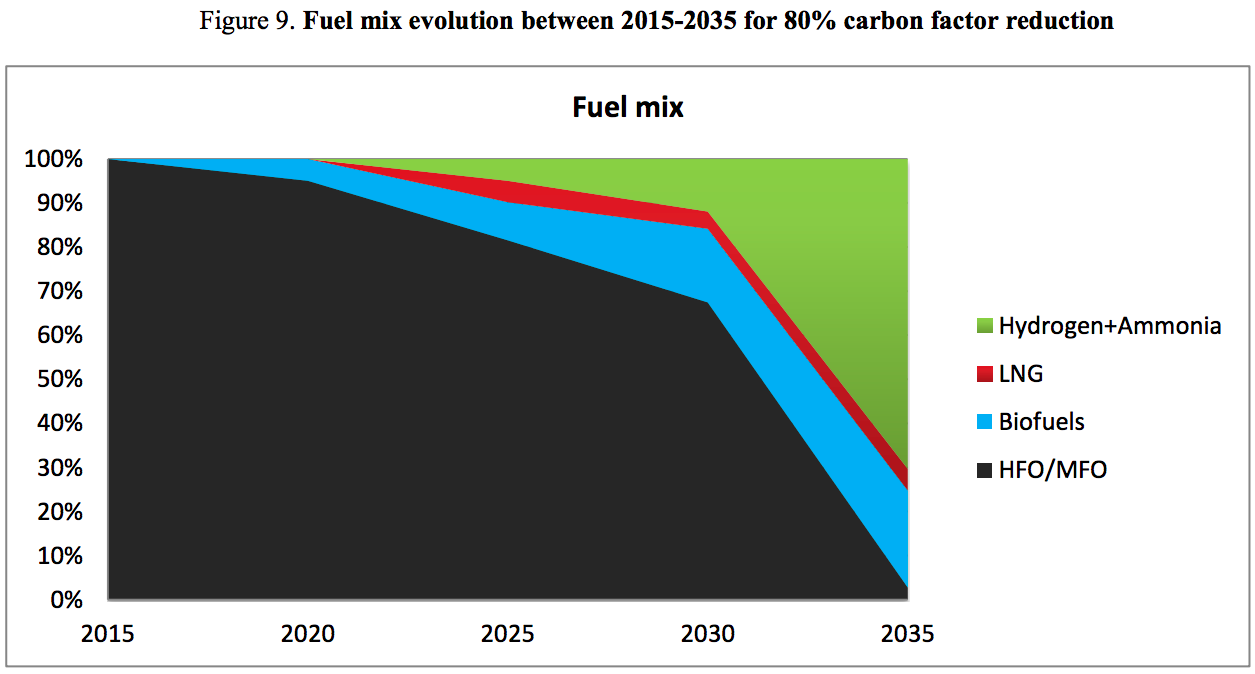

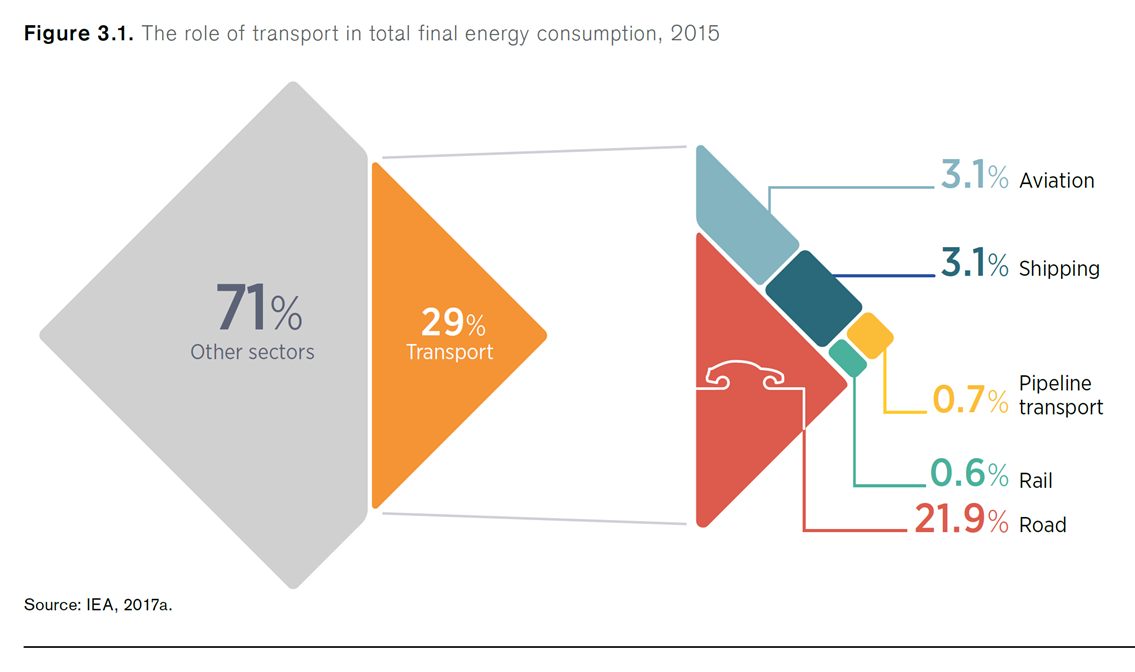

With international shipping activity to more than double by 2050, the IEA forecasts that ammonia’s share of final energy consumption in the industry will rise to 44% in 2050, with a suite of other low-carbon fuels to play smaller roles. Lloyd’s Register & OCI HyFuels have also forecast that ammonia (and particularly electrolytic ammonia) will become the most significant fuel in the maritime sector by 2050.

Article

Certification 101: New Hydrogen Council Report

Oscar Pearce August 29, 2023

Hydrogen Certification 101, the Hydrogen Council’s new report, provides a helpful summary of key certification terminology and concepts. It is the latest report to advocate for mutual recognition as a solution to inconsistency in energy policy, while also delving into practical measures to support the fundamental design principles of certification schemes.

Article

Scrap “green” and “blue” hydrogen, use emissions intensity instead: new IEA report

Oscar Pearce May 05, 2023

The International Energy Agency has proposed a new taxonomy for hydrogen definitions based on emissions intensity, moving away from color labels. In Towards hydrogen definitions based on their emissions intensity, the IEA proposes a set of nine distinct, technology-neutral emissions intensity bands. The report also advocates for an international approach to ensure interoperability between certification schemes, and suggests that a mutual recognition approach based on the IPHE’s emissions methodology is the best way forward.

Article

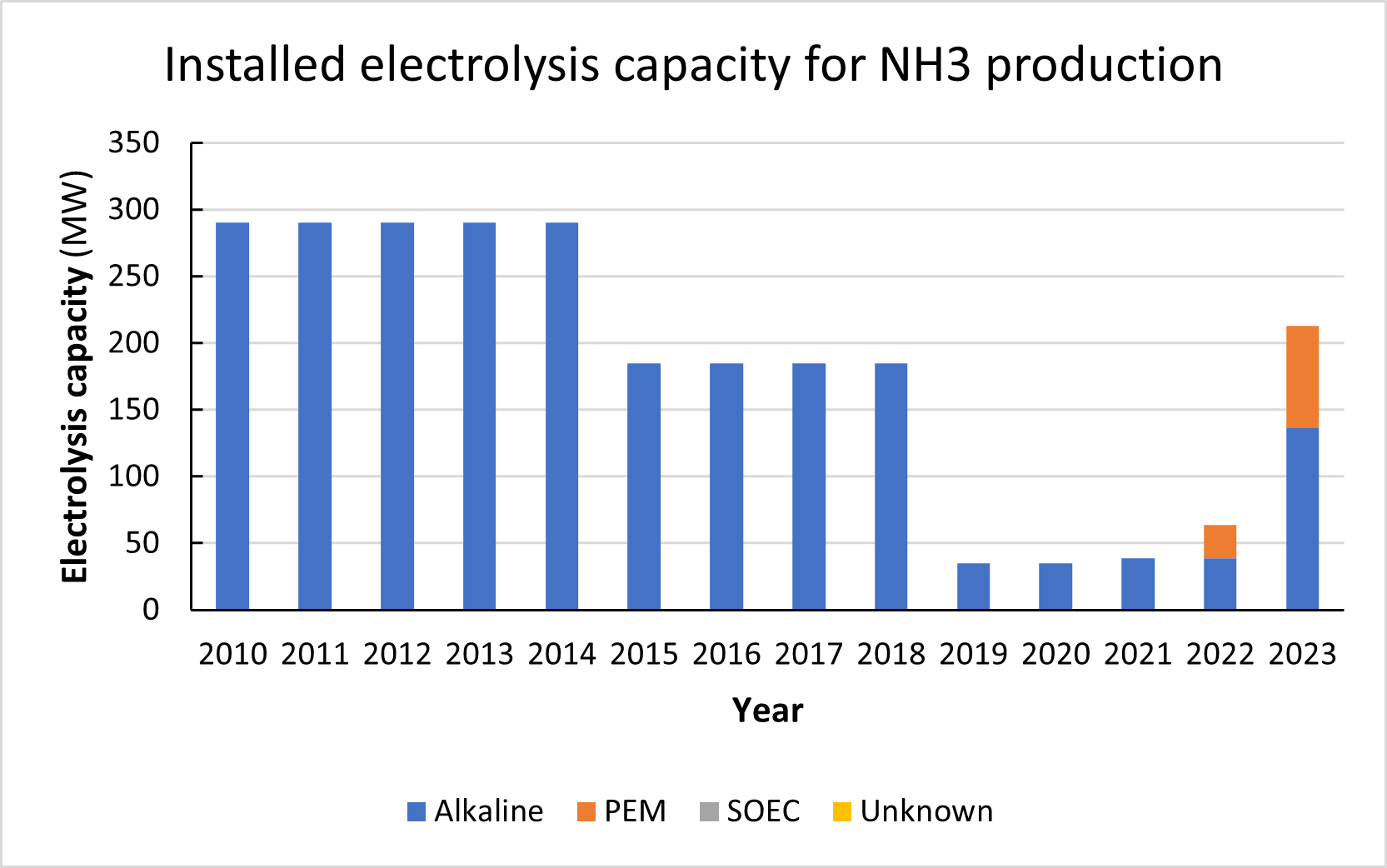

Technology status: ammonia production from electrolysis-based hydrogen

Kevin Rouwenhorst January 31, 2023

Electrolysis-based ammonia production peaked worldwide around 1970, before the economies of scale and cheap gas feedstock led to its decline. With decarbonization and climate-neutral industrial processes now a critical priority, electrolysis-based ammonia production has re-emerged as a long-term solution. From a base of 10,000 tonnes per year worldwide production in 2020, as much as 100 million tonnes per year of electrolysis-based ammonia could be produced by the end of this decade, driven by a dramatic roll-out of renewable energy generation and installed electrolyzer capacity.

Article

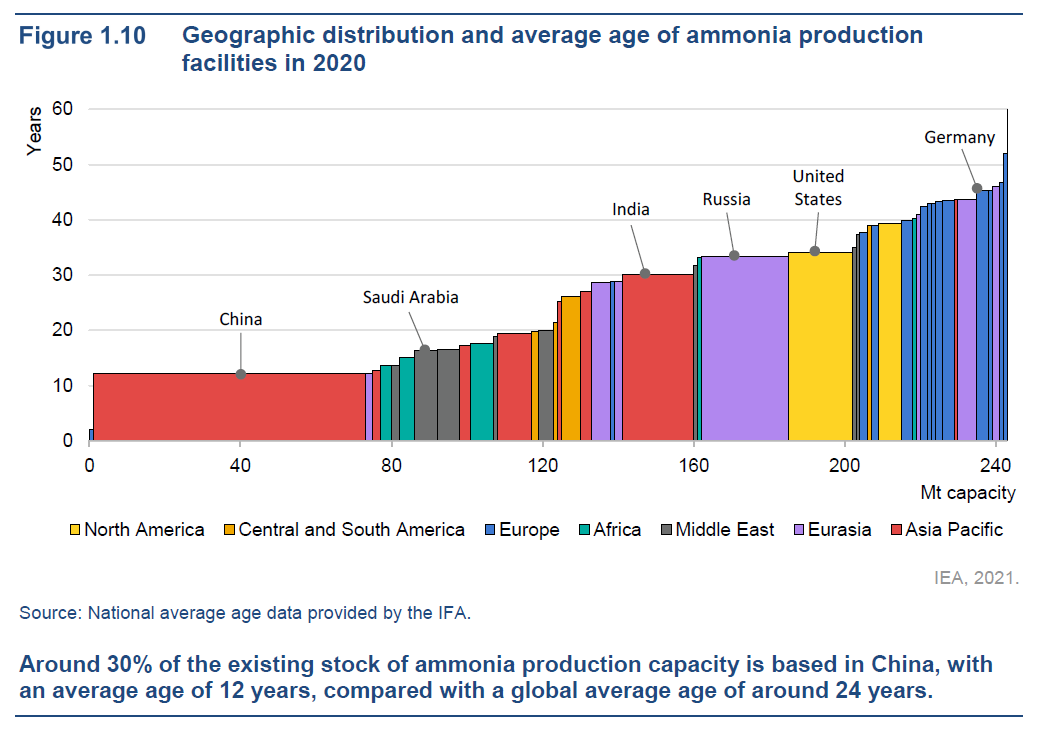

IEA publishes Ammonia Technology Roadmap

Kevin Rouwenhorst October 19, 2021

Last week, the International Energy Agency (IEA) published the Ammonia Technology Roadmap, in which the pathway to nitrogen fertilizer production up to 2050 was highlighted. Various scenarios were introduced, ranging from a baseline scenario to a sustainable development scenario (SDS) and a net zero emissions (NZE) by 2050 scenario. Demand, decarbonization costs and technology pathways were all explored in detail.

Article

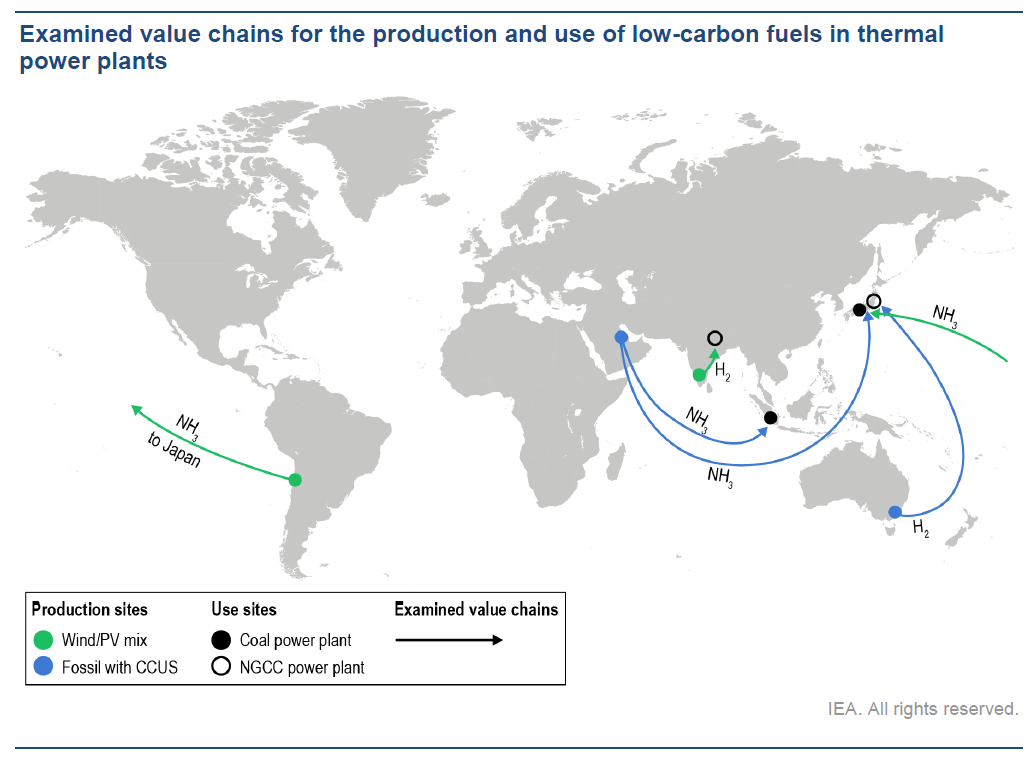

New IEA report: using low-carbon ammonia to decarbonise power

Julian Atchison October 11, 2021

The Role of Low-Carbon Fuels in the Clean Energy Transitions of the Power Sector forecasts a significant role for low-carbon hydrogen and ammonia in decarbonising the power sector, and highlights the promising results of co-firing trials to date (both coal power plants and gas turbines). The report also outlines some key next steps to enable the widespread use of these low-carbon fuels.

Article

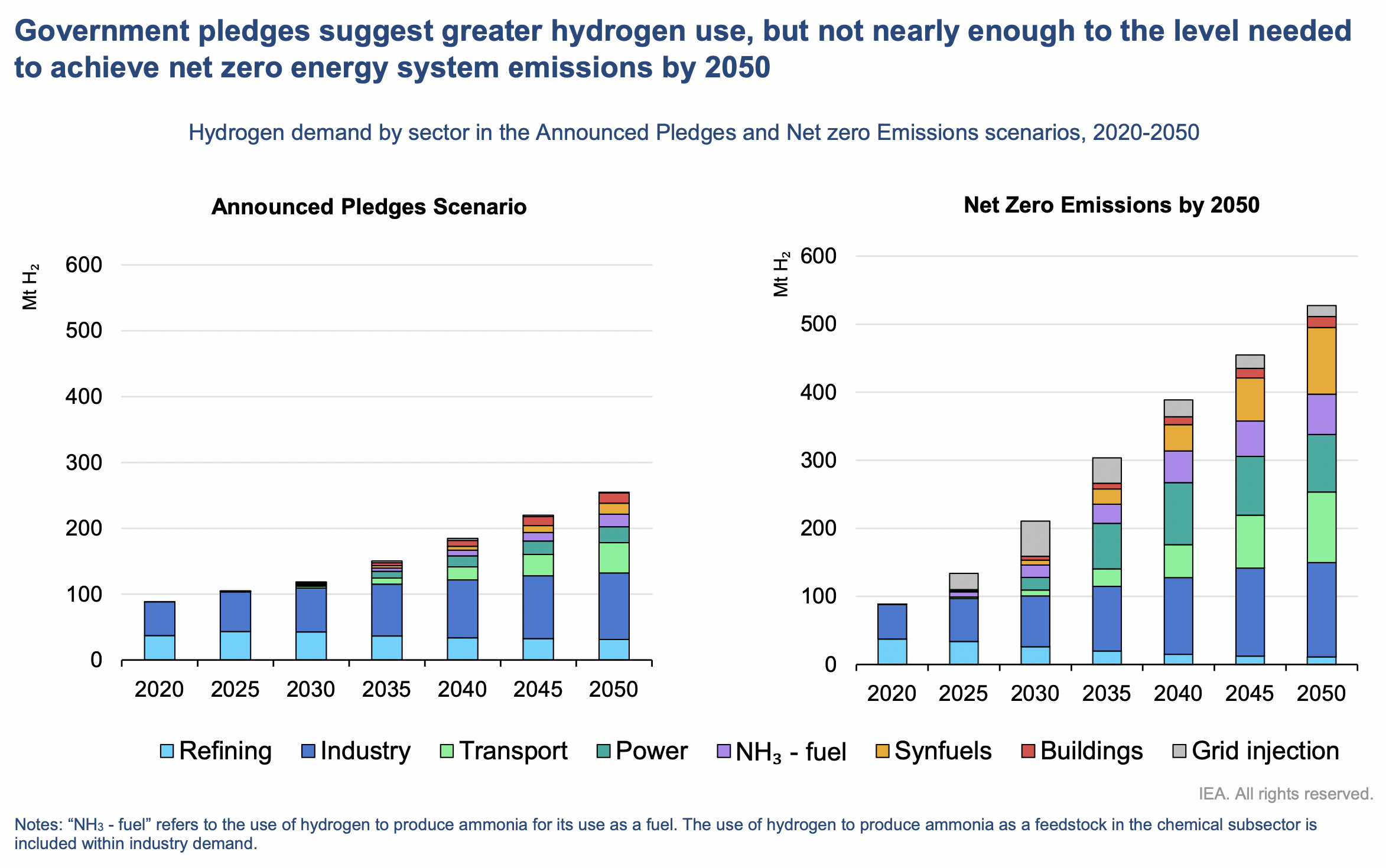

IEA's latest Global Hydrogen Review includes fuel ammonia

Julian Atchison October 07, 2021

The Global Hydrogen Review is an annual publication by the International Energy Agency to track progress in hydrogen production and demand. And - for the first time ever - the publication includes ammonia in its break down of current & future hydrogen markets, including the use of ammonia as a maritime fuel.

Article

How green are green and blue hydrogen?

Cedric Philibert October 07, 2021

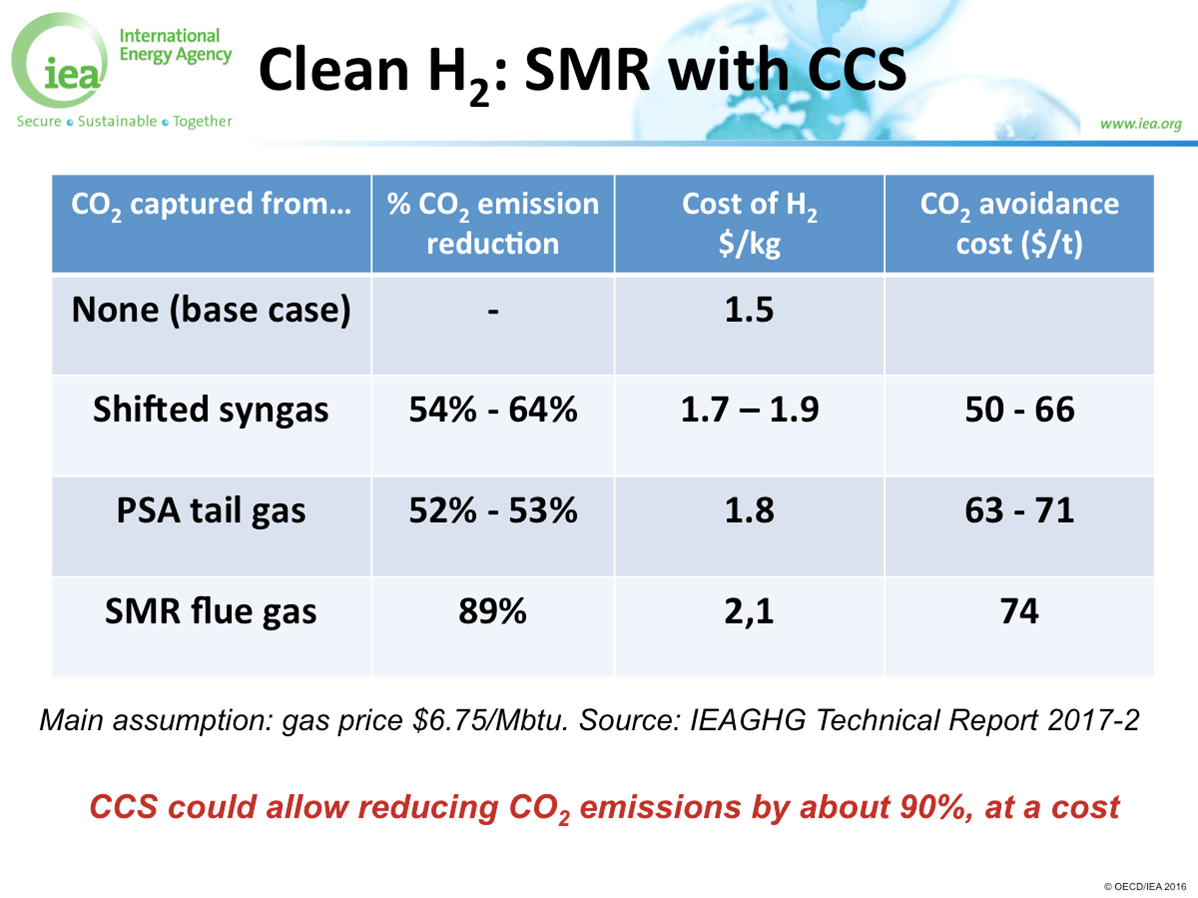

In August, Robert Howarth and Mark Jacobson, respectively from Cornell and Stanford Universities, published “How green is blue hydrogen”, an examination of the lifecycle greenhouse gas emissions (GHG) of blue hydrogen, i.e., hydrogen from steam methane reforming with carbon dioxide capture and storage (CCS). How valid were the assumptions behind the study, were the calculations correct and can a realistic case be argued for blue hydrogen going forward?

Article

The Cost of CO2-free Ammonia

Bunro Shiozawa November 12, 2020

If ammonia is to be introduced into the energy system as a CO2-free fuel, its cost must be at least competitive with that of other CO2-free fuels such as CO2-free hydrogen. In the discussion below I consider the cost aspect of CO2-free ammonia. To state my conclusion at the beginning, the cost of CO2-free ammonia can be less than 30 yen/Nm3-H2, which is the 2030 cost target for hydrogen energy set by the Japanese government in its "Basic Hydrogen Strategy” for introducing hydrogen energy into Japan.

Article

New IEA Report: One Take on the Sustainable Energy Economy

Stephen H. Crolius September 17, 2020

Last week the International Energy Agency released Energy Technology Perspectives 2020. The report has an upbeat tone, envisioning a high degree of feasibility for the development and deployment of relevant technologies. For those working in the sustainable energy field, though, the aspect of greatest interest may be the relative weights placed on fossil fuels, bioenergy, and hydrogen.

Article

Hydrogen Council Releases Landmark Report

Stephen H. Crolius January 23, 2020

The Hydrogen Council this week released Path to hydrogen competitiveness: A cost perspective. The report carries some big news. Low-carbon hydrogen can become much more cost-competitive, much more quickly, than is generally appreciated.

Article

Updating the literature: Ammonia consumes 43% of global hydrogen

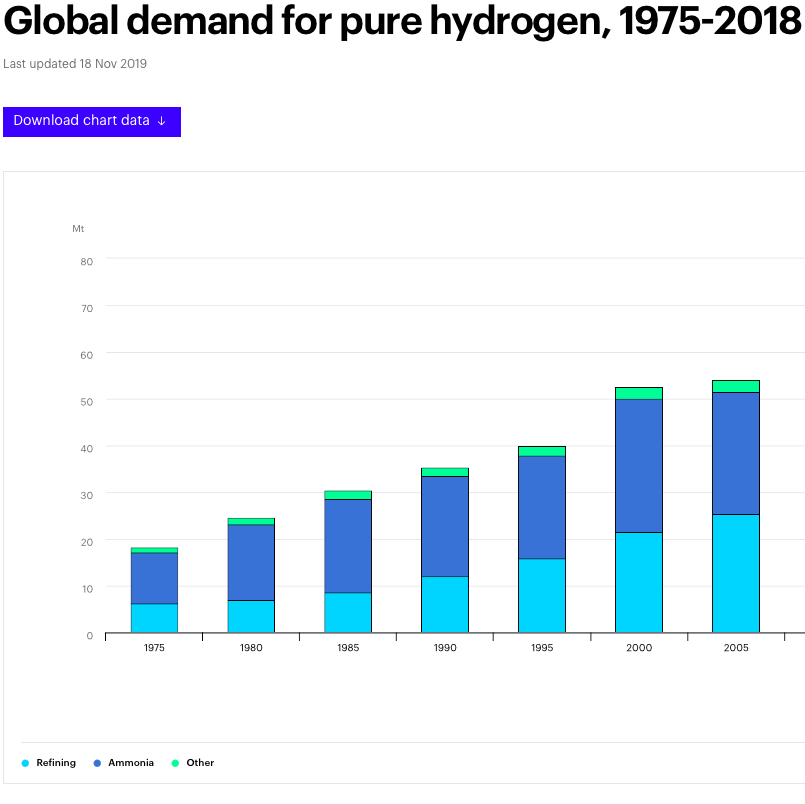

Trevor Brown January 03, 2020

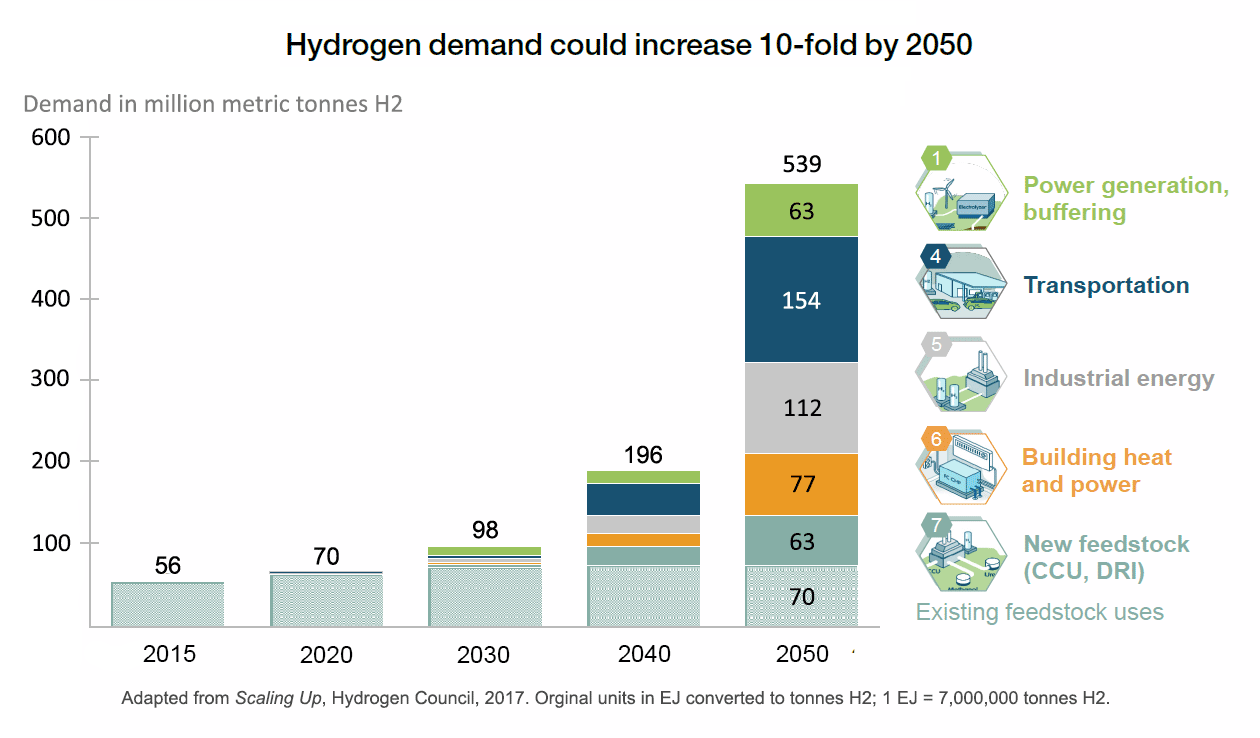

For years, many people — myself included — have been saying that ammonia consumes 55% of the hydrogen produced around the world. Although there are many authoritative sources for this figure, I knew that it was likely out of date. Until now, I had overlooked the International Energy Agency (IEA) 2019 report, The Future of Hydrogen, which provides up-to-date (and publicly downloadable) data for global hydrogen demand since 1975. According to the IEA, ammonia represented almost 43% of global hydrogen demand in 2018; refining represented almost 52%, and "other" demands accounted for 6%.

Presentation

Keynote Speech: Hydrogen and Ammonia: Building Global Momentum

Philibert will speak of the current considerable momentum on hydrogen and the consideration it is given in many countries. Based on a variety of recent reports, including the major IEA Future of Hydrogen report, he will show the evolution of the global thinking on the role of hydrogen in the energy transition from a narrow focus on light-duty fuel-cell vehicles to a much broader spectrum including the chemical and steelmaking industry sub-sectors, long-haul transportation on land, sea and in the air, the power sector, and buildings. Hydrogen is also valued for its potential use as a carrier for clean renewable…

Article

Safety of Ammonia Energy: First Up, the Maritime Use Case?

Stephen H. Crolius November 07, 2019

ANNUAL REVIEW 2019: Ammonia. A hazardous chemical, no doubt. But is it too hazardous to use as an energy vector? This is a legitimate question that must be addressed as other aspects of the ammonia energy concept advance. It is also a question whose unique context can be evoked with two other questions: Haven’t the safety issues already been identified and resolved over the last 100 years of widespread agricultural and industrial use? And even if they have, how will the general public react when proposals for expanded ammonia infrastructure suddenly appear? The earliest tip of this particular iceberg came into view this year when the Dutch naval architecture firm C-Job released Safe and Effective Application of Ammonia as a Marine Fuel.

Article

Ammonia in China: change is coming

Trevor Brown November 07, 2019

ANNUAL REVIEW 2019: In the ammonia industry, Chinese data is notoriously hard to verify. Without question, the country produces more ammonia today than any other nation, and yet it has recently closed million of tons of annual capacity. Its cities are smothered in pollution, and its coal-based ammonia plants use the dirtiest technologies available. Huge questions remain. One answer is clear: China has repeatedly proven its desire and ability to become a global leader in developing and deploying clean technologies in the explicit effort to combat climate change. Within China, therefore, the question of large-scale adoption of ammonia energy technologies is increasingly becoming simpler. When?

Article

Ammonia Energy Mainstreaming Expands to Governments

Stephen H. Crolius October 25, 2019

ANNUAL REVIEW 2019: An item in the last Annual Review described an upwelling of attention for ammonia energy from mainstream media outlets. Over the last 12 months, the process of 'mainstreaming' has started to spread to another important constituency: governments.

Article

The Evolving Context of Ammonia-Coal Co-Firing

Stephen H. Crolius July 18, 2019

Co-firing ammonia in a coal-fueled boiler, a concept under active development in Japan, received positive notice in the International Energy Agency’s recently published report, The Future of Hydrogen. So far serious scrutiny of the co-firing concept is limited to Japan. In the fullness of time, the demand side of the concept may take root in other countries. The supply side, however, could have near-term global relevance.

Article

An Open Letter to the International Energy Agency

Stephen H. Crolius July 08, 2019

To the Authors of The Future of Hydrogen: First I would like to thank you for an excellent report. I have devoted two Ammonia Energy posts to The Future of Hydrogen. If you read them, you will see that my appraisal is overwhelmingly positive. But I am writing this letter because I take issue with your characterization of ammonia's hazard profile. I hereby submit that your discussion in this regard is inaccurate and unhelpful.

Article

Ammonia Figures Prominently in IEA Hydrogen Report

Stephen H. Crolius June 27, 2019

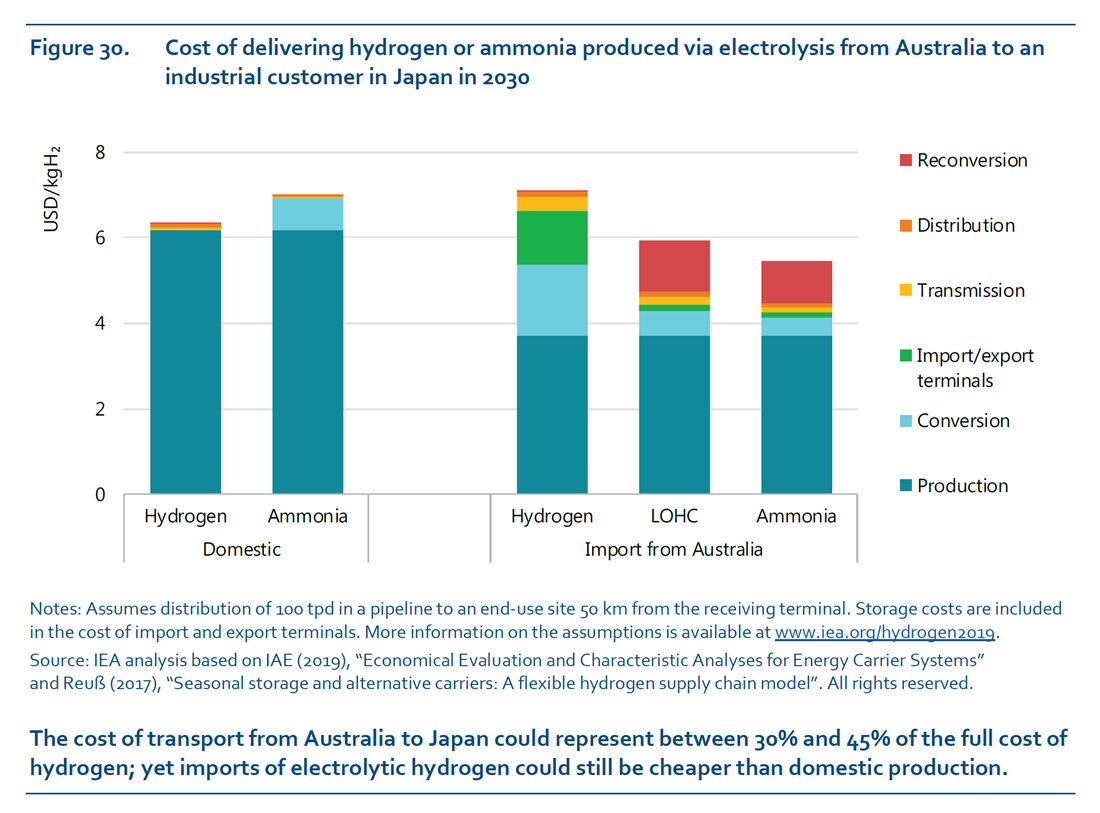

Two weeks ago the International Energy Agency released The Future of Hydrogen, a 203-page report that “provides an extensive and independent assessment of hydrogen that lays out where things stand now; the ways in which hydrogen can help to achieve a clean, secure and affordable energy future; and how we can go about realising its potential.” In this, the second part of a two-part article, the report's extensive treatment of ammonia is considered.

Article

IEA Releases Forward-Looking Hydrogen Report

Stephen H. Crolius June 20, 2019

Last week the International Energy Agency released The Future of Hydrogen, a 203-page report that “provides an extensive and independent assessment of hydrogen that lays out where things stand now; the ways in which hydrogen can help to achieve a clean, secure and affordable energy future; and how we can go about realising its potential.” In this, the first part of a two-part article, the report's overall strengths are considered. The second part will focus on the report's discussion of ammonia as a contributor to the emerging hydrogen economy.

Article

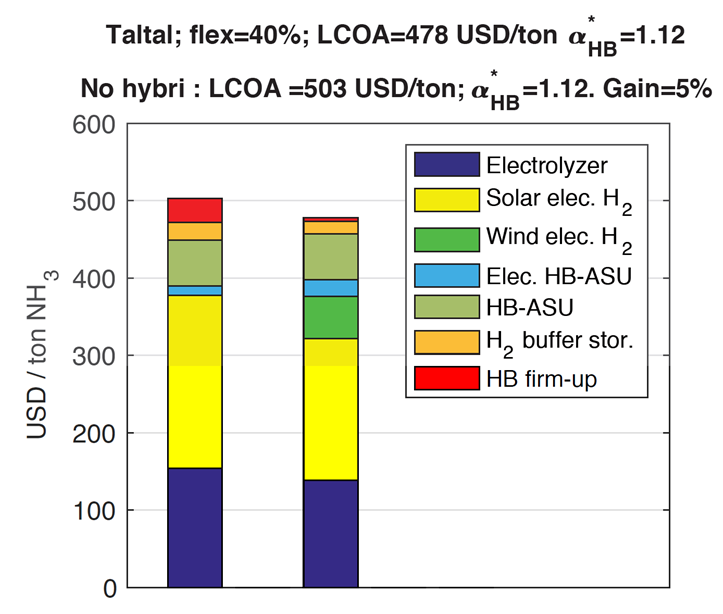

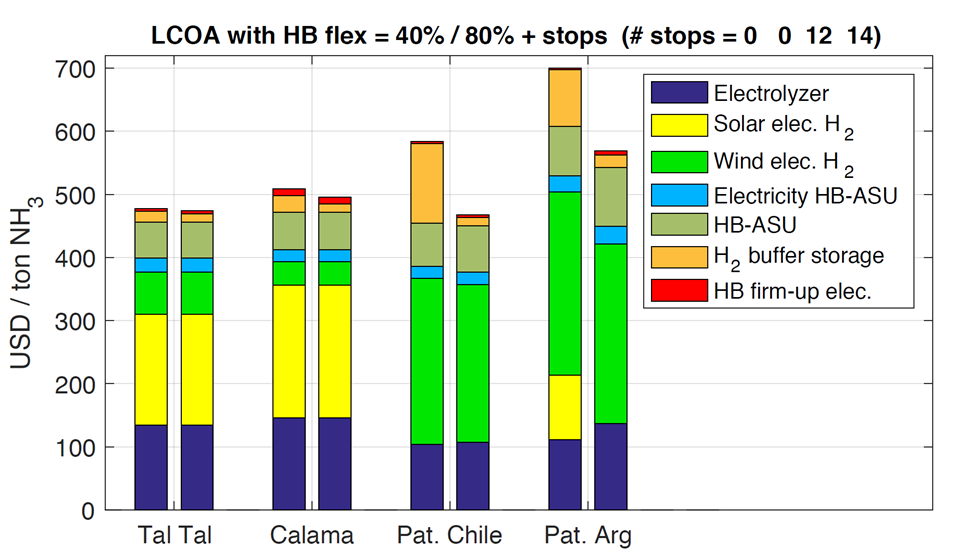

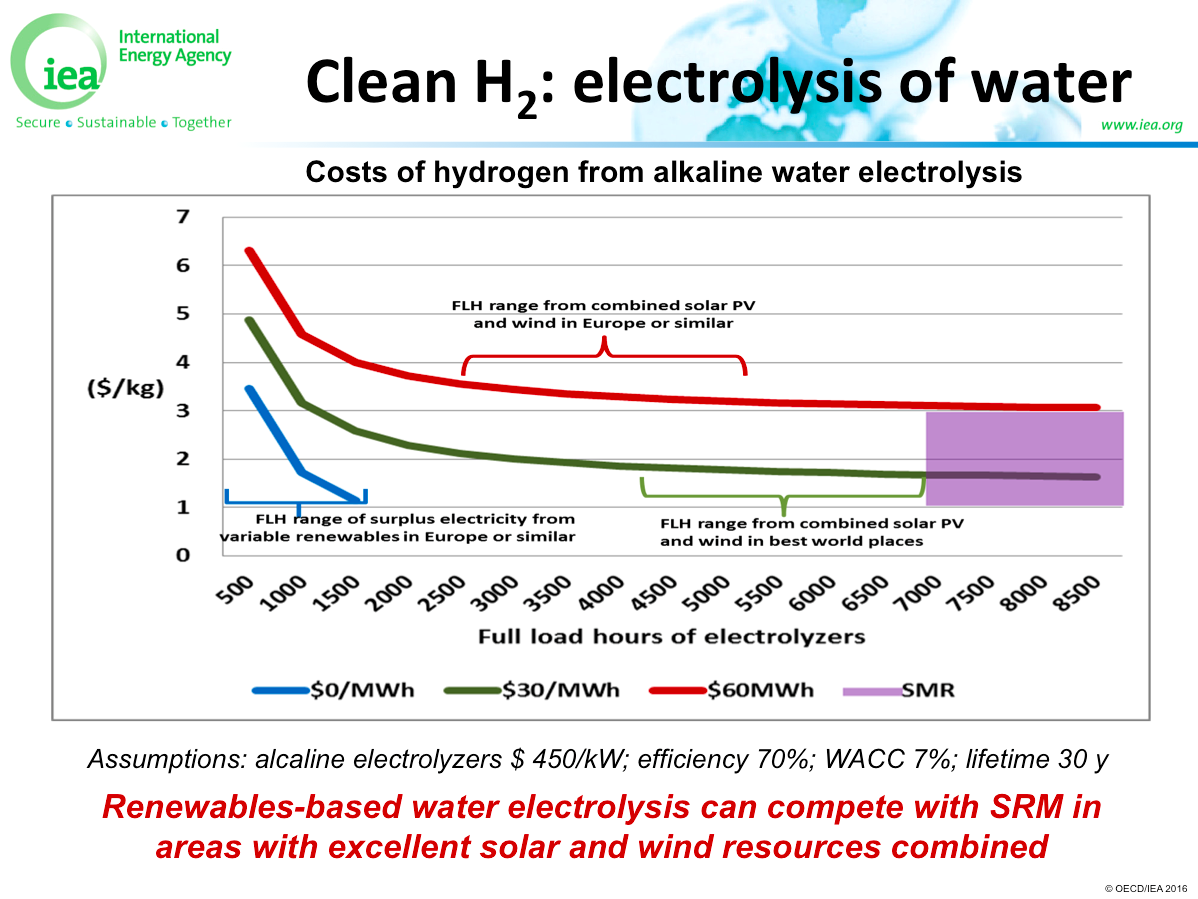

Study Models NH3 Economics from Variable Energy Resources

Stephen H. Crolius May 28, 2019

Last week IEA Consultant Julien Armijo and IEA Senior Analyst Cédric Philibert submitted their study Flexible Production of Green Hydrogen and Ammonia from Variable Solar and Wind Energy: Case Study of Chile and Argentina to the International Journal of Hydrogen Energy and concurrently posted it on ResearchGate. The study addresses one of the key questions of the energy transition: what are the economics of producing hydrogen, or a hydrogen carrier such as ammonia, at sites with excellent renewable energy resources? The answer, framed in terms of the cost-competitiveness in local markets of green ammonia vs. conventionally produced brown ammonia, casts an encouraging light on the eventual prospects for international trade in green ammonia as an energy commodity.

Article

IEA Completes Two Power-to-Ammonia Reports

Stephen H. Crolius May 03, 2019

The International Energy Agency has completed two reports that examine the economics of hydrogen and ammonia production based on wind and solar electricity generation. Both reports were written by IEA Consultant Julien Armijo under the supervision of IEA Senior Analyst Cédric Philibert. One focuses on China and formalizes the findings and conclusions that were the subject of a February 2019 Ammonia Energy post. The other focuses on Chile and Argentina. Both reports cast an encouraging light on the near-term cost-competitiveness of green ammonia vs. conventionally produced brown ammonia in specific national markets.

Article

IEA Analysis: Green Chinese P2A Could Compete with Brown NH3

Stephen H. Crolius February 28, 2019

The IEA has developed a rigorous economic model to examine the proposition that resource intermittency can be managed by siting hydrogen facilities where variable renewable energy (VRE) resources have complementary daily and seasonal production profiles. Last month, IEA Senior Analyst Cédric Philibert shared modeling results from selected sites in China with an audience at the Energy Research Institute in Beijing. The exercise offers a first quantitative look at two important questions. First, what is the economic impact of "VRE stacking"? And second, what is the relative cost position of ammonia produced via a stacking approach?

Article

This Week in Hydrogen

David White September 27, 2018

September 10–14 gave us five remarkable events both evidencing and advancing the rise of hydrogen in transportation and energy. Any one of them would have made it a significant week; together they make a sea change.

Article

The Offshore-Wind / Ammonia Nexus

Stephen H. Crolius June 07, 2018

In early April the Business Network for Offshore Wind held its 2018 International Offshore Wind Partnering Forum in Princeton, New Jersey in the U.S.. Ammonia energy was not on the agenda, at least as a matter of formal programming. But it did come up during a panel session entitled “Offshore Wind Energy Hydrogen Production, Grid Balancing and Decarbonization.” We know this because Steve Szymanski, Director of Business Development for Proton OnSite (a subsidiary of Norway’s Nel ASA), was on the panel and says he was the one to bring it up. The topic attracted “a lot of interest and a lot of good questions,” Szymanski said. Nel is an industry member of the NH3 Fuel Association.

Article

Carbon Capture Set to Advance in the U.S.

Stephen H. Crolius May 11, 2018

The United States Congress passed a measure on February 9 that could galvanize the production of low-carbon ammonia in the U.S. The measure, included within the Bipartisan Budget Act of 2018, amends Section 45Q of the Internal Revenue Code, titled “Credit for Carbon Dioxide Sequestration”. That section, originally adopted in 2008, created a framework of tax credits for carbon capture and sequestration. 45Q’s impact in the intervening years has been minimal, an outcome attributed by experts to the relatively low prices assigned to CO2 sequestration and the fact that tax credits would be allowed only for the first 75 million tonnes of sequestered CO2. The new legislation increases the tax credit per tonne of CO2 placed in secure geological storage from $20 to $50, and for CO2 used for enhanced oil recovery from $10 to $35. It eliminates the credits cap altogether. With these changes, it now seems possible that low-carbon ammonia could find itself on an equal economic footing with “fossil” ammonia – and this could have consequences well beyond American agricultural markets.

Article

What drives new investments in low-carbon ammonia production? One million tons per day demand

Trevor Brown April 20, 2018

Last week, the International Maritime Organization (IMO) formally adopted its Initial GHG Strategy. This means that the shipping industry has committed to "reduce the total annual GHG emissions by at least 50% by 2050," and completely "phase them out, as soon as possible in this century." This also means that a global industry is searching for a very large quantity of carbon-free liquid fuel, with a production and distribution infrastructure that can be scaled up within decades. The most viable option is ammonia. How much would be required? Roughly one million tons of ammonia per day.

Article

P2X, Ammonia Highlighted for Long-Haul Road Transport, Shipping

Stephen H. Crolius April 19, 2018

The International Renewable Energy Agency (IRENA), in partnership with the International Energy Agency (IEA) and Renewable Energy Policy Network for the 21st Century (REN21), released a report this month entitled "Renewable Energy Policies in a Time of Transition." The 112-page document is a comprehensive survey of technologies, policies, and programs that have current or prospective roles in the global transition to a sustainable energy economy. For the ammonia energy community, one of its conclusions stands out in vivid relief: "Developing P2X is crucial because it plays a key role in decarbonising long haul road transport, aviation and shipping sectors that are difficult to decarbonize ... The overall recommendation for developing P2X is to focus on the development of ammonia for the shipping sector as well as long haul road transport, where few or no competing low carbon technologies exist and P2X is expected to be economically viable."

Article

Green Ammonia Consortium Comes to the Fore in Japan

Stephen H. Crolius December 21, 2017

On December 8, the Nikkei Sangyo Shimbun ran a story about the future of coal-fired electricity generation in Japan. The story touched on topics ranging from the plumbing in a Chugoku Electric generating station to the Trump administration’s idiosyncratic approach to environmental diplomacy. And it contained this sentence: “Ammonia can become a ‘savior’ of coal-fired power.” Clearly an explanation is in order.

Article

Renewable Energy for Industry: IEA's vision for green ammonia as feedstock, fuel, and energy trade

Trevor Brown November 10, 2017

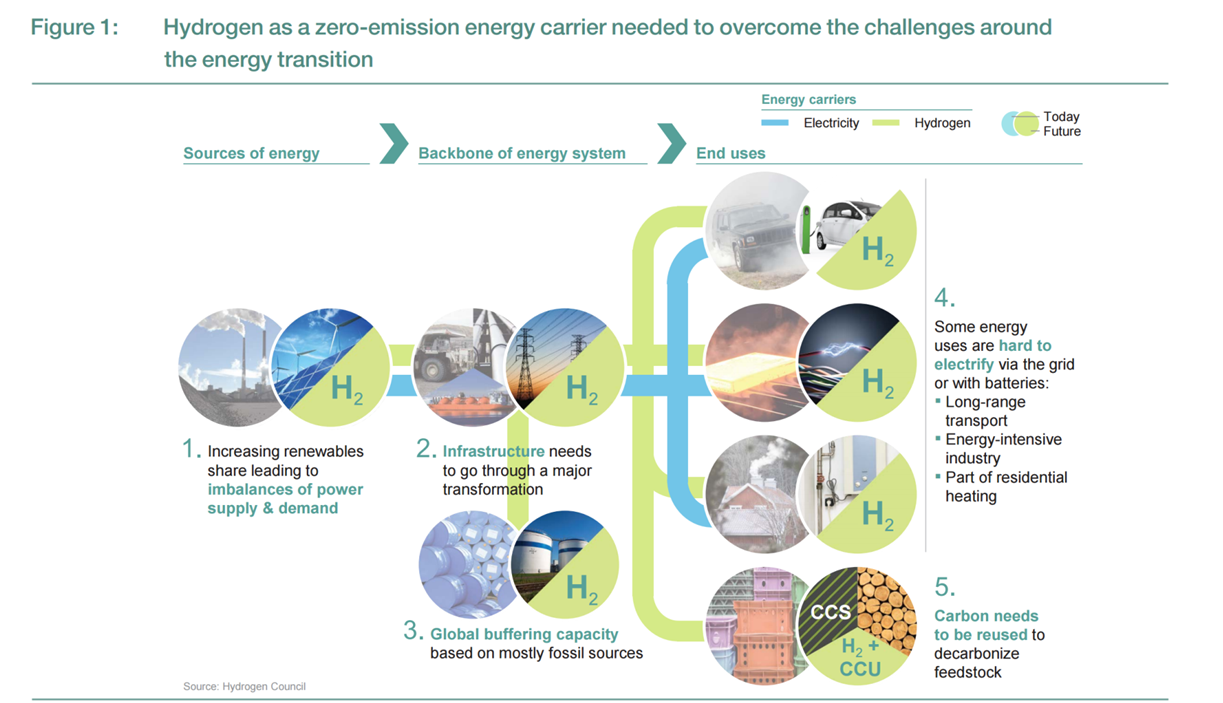

This morning in Beijing, China, the International Energy Agency (IEA) launched a major new report with a compelling vision for ammonia's role as a "hydrogen-rich chemical" in a low-carbon economy. Green ammonia would be used by industry "as feedstock, process agent, and fuel," and its production from electrolytic hydrogen would spur the commercial deployment of "several terawatts" of new renewable power. These terawatts would be for industrial markets, additional to all prior estimates of renewable deployment required to serve electricity markets. At this scale, renewable ammonia would, by merit of its ease of storage and transport, enable renewable energy trading across continents. The IEA's report, Renewable Energy for Industry, will be highlighted later this month at the COP23 in Bonn, Germany, and is available now from the IEA's website.

Article

Renewable Hydrogen in Fukushima and a Bridge to the Future

Stephen H. Crolius October 19, 2017

On August 1, 2017 the Japan Government’s New Energy and Industrial Technology Development Organization (NEDO) announced that it will proceed with funding for the construction of a hydrogen production plant in Namie Township, about ten kilometers from the site of the Fukushima nuclear disaster. The project’s budget is not mentioned, but the installation is projected to be “the largest scale in the world” -- in other words, a real bridge to the future and not a demonstration project. The project no doubt has a variety of motivations, not least the symbolic value of a renewable hydrogen plant rising in the shadow of the Fukushima Daiichi nuclear station. In economic terms, though, it appears to be a dead end. This is unfortunate because a similarly conceived project based on ammonia could be a true bridge-building step that aligns with leading-edge developments elsewhere in the world.

Article

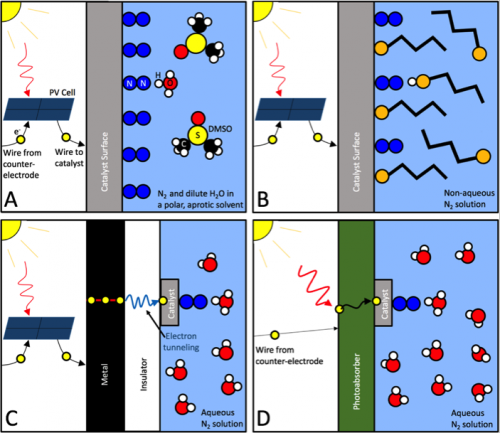

Overcoming the Selectivity Challenge in Electrochemical Ammonia Synthesis

Trevor Brown October 06, 2017

In the last 12 months ... The research community has made great progress toward solving the "selectivity challenge" in electrochemical ammonia synthesis. Although, rather than an actual solution, mostly what we have is a range of sophisticated work-arounds that succeed in making this problem moot.

Article

Yara's Solar Ammonia Plant is a Key Step toward Global Trade in Renewable Energy

Stephen H. Crolius October 05, 2017

In the last 12 months ... Yara's Australian unit announced plans to build a pilot plant to produce ammonia using solar power. This is a key step in Australia's efforts to develop its economy around clean energy exports, and could lead to a new system of global trade in which renewable ammonia is an energy commodity.

Article

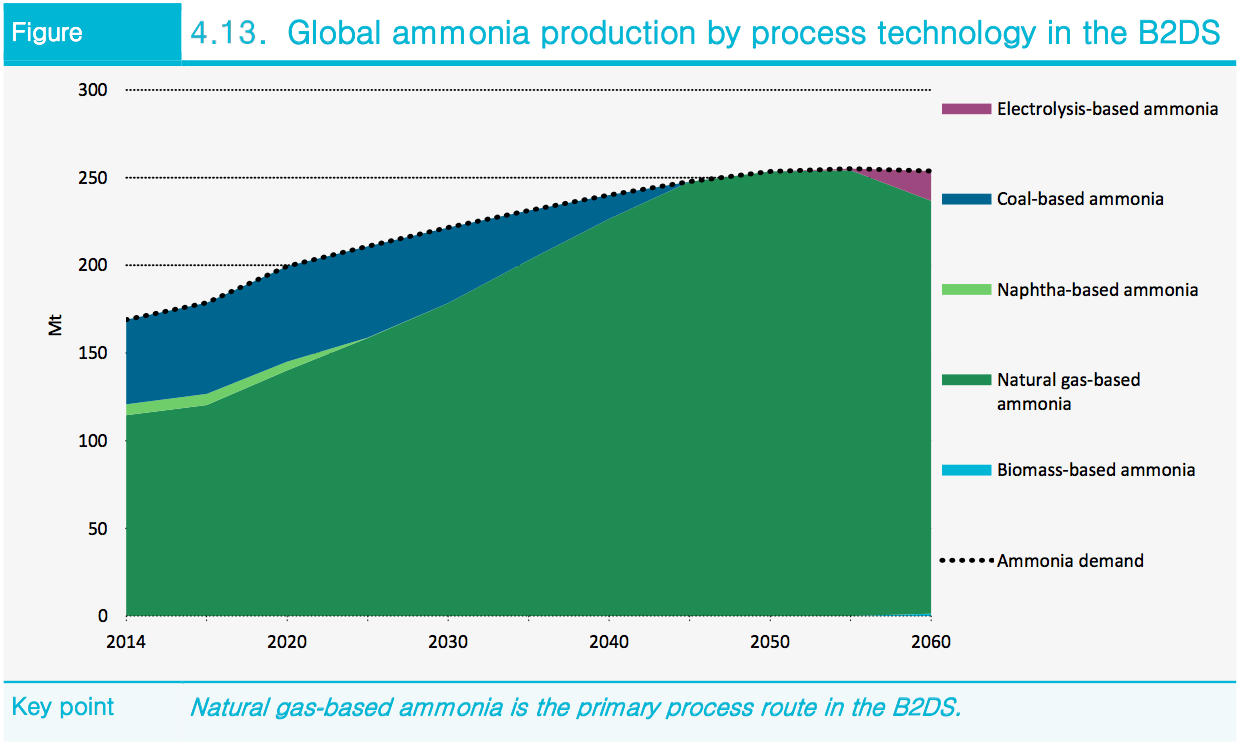

The International Energy Agency's scenarios for renewable ammonia

Trevor Brown June 29, 2017

The International Energy Agency (IEA) has just published Energy Technology Perspectives 2017, the latest in its long-running annual series, subtitled "Catalysing Energy Technology Transformations." In this year's edition, for the first time, ammonia is featured in two major technology transformations. First, ammonia production is shown making a significant transition away from fossil fuel feedstocks and towards electrification, using hydrogen made with electrolyzers. And, following this assumption that sustainable ammonia will be widely available in the future, the IEA takes the next logical step and also classifies ammonia "as an energy carrier," in the category of future "electricity-based fuels (PtX synthetic fuels)." The inclusion of this pair of technology transformations represents a major step towards broader acceptance of ammonia as an energy vector, from the perspectives of both technical feasibility and policy imperative.

Article

Report from the European Conference: Renewable Ammonia cost-competitive with Natural Gas Ammonia

Trevor Brown June 23, 2017

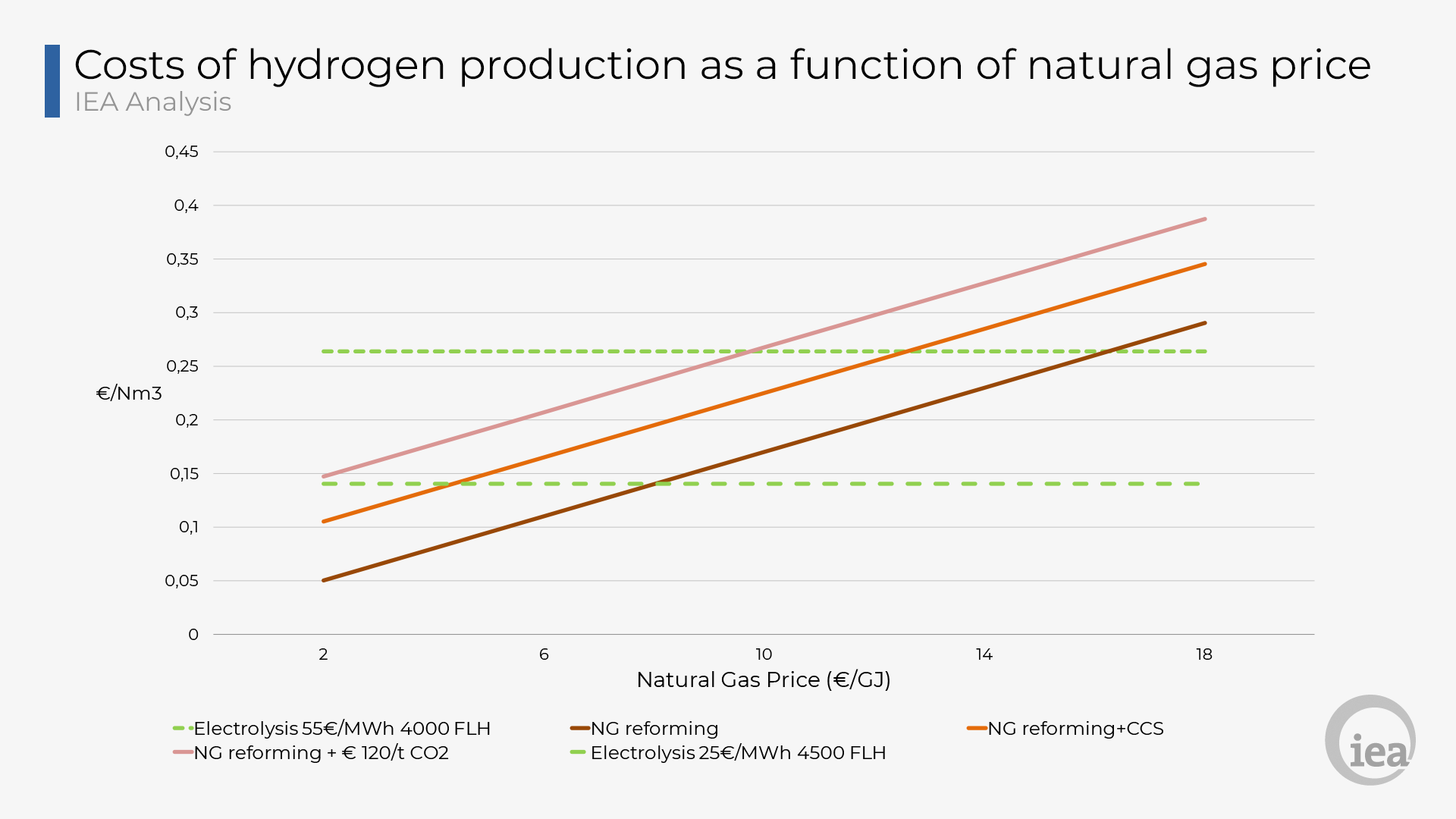

The viability of producing ammonia using renewable energy was one of the recurring themes of the recent Power to Ammonia conference in Rotterdam. Specifically, what cost reductions or market mechanisms would be necessary so that renewable ammonia - produced using electrolytic hydrogen in a Haber-Bosch plant - would be competitive with normal, "brown" ammonia, made from fossil fuels. A number of major industry participants addressed this theme at the conference, including Yara and OCI Nitrogen, but it was the closing speech, from the International Energy Agency (IEA), that provided the key data to demonstrate that, because costs have already come down so far, renewable ammonia is cost-competitive in certain regions today.

Article

The Hydrogen Consensus

Stephen H. Crolius April 27, 2017

Let’s say there is such a thing as the “hydrogen consensus.” Most fundamentally, the consensus holds that hydrogen will be at the center of the sustainable energy economy of the future. By definition, hydrogen from fossil fuels will be off the table. Hydrogen from biomass will be on the table but the amount that can be derived sustainably will be limited by finite resources like land and water. This will leave a yawning gap (in the U.S., 60-70% of total energy consumption) that will be filled with the major renewables -- wind, solar, and geothermal -- and nuclear energy. This may be as far as the consensus goes today, but more detail is now emerging on the global system of production and use that could animate a hydrogen economy.

Article

IEA calls for renewable hydrogen and carbon-free ammonia

Trevor Brown April 21, 2017

This week, an important new voice joined the chorus of support for renewable ammonia and its potential use as an energy vector - the International Energy Agency (IEA). In his article, Producing industrial hydrogen from renewable energy, Cédric Philibert, Senior Energy Analyst at the IEA, identifies a major problem with the hydrogen economy: hydrogen is currently made from fossil fuels. But his argument for producing hydrogen from renewable energy leads almost inevitably to ammonia: "In some not-too-distant future, ammonia could be used on its own as a carbon-free fuel or as an energy carrier to store and transport energy conveniently."