Sawafuji Moves toward Commercialization of NH3-to-H2 System

By Stephen H. Crolius on June 14, 2018

On May 28 Sawafuji Electric Company issued a press release detailing advances made over the last year on the ammonia-to-hydrogen conversion technology it has been jointly developing with Gifu University. The main area of progress is the rate of hydrogen generation, but the key takeaway from the announcement is that Sawafuji has set a schedule that culminates in product commercialization in 2020.

Professor Shinji Kambara, now Director of the Next Generation Research Center at Gifu University, initially succeeded in using non-thermal plasma to dissociate ammonia into its constituent elements in 2011. The use of non-thermal plasma allows the reaction to proceed at atmospheric pressure and ambient temperature. The basic architecture developed by Kambara consisted of a double-tube quartz glass structure with a ground electrode wrapped around the outer tube and a high-voltage electrode inserted into the inner tube. The tubes are separated by a gap of a few millimeters. The plasma facilitates the dissociation reaction as gaseous ammonia flows through the gap.

The 2011 device succeeded as a proof of concept but was not able to produce the hydrogen purity needed for many applications. Between 2011 and 2012, Kambara addressed this problem by replacing the outer (ground) electrode with a 20-micron membrane of palladium alloy fused onto a thin sheet of iron. In addition to conducting electricity, the membrane selectively allows hydrogen radicals to pass through it. A March 2017 press release reported that, through further refinement, the device was now able to produce hydrogen of 99.999% purity (i.e., contaminants not exceeding 10 parts per million). (The press release was the topic of a March 2017 Ammonia Energy post.) The ISO standard for hydrogen used in fuel cells does not stipulate an absolute hydrogen purity level but rather not-to-exceed levels for a list of prevalent contaminants. Ammonia may not exceed 0.1 ppm.

The March 2017 press release indicated that Sawafuji had become a full partner in the research effort by 2012, although Gifu University was still positioned as the lead entity. The situation is reversed in the May 2018 recent release, with Sawafuji as the announcing party and Gifu University cited as the company’s collaborator. Sawafuji is a mid-tier Japanese manufacturer of electrical devices such as generators and alternators, and appliances such as refrigerators. Its fiscal year 2016 revenues were ¥25,708 million (US$234 million).

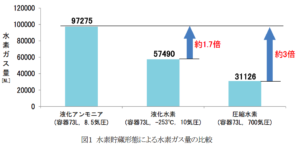

The time rate of ammonia-to-hydrogen conversion appears to have been a key focus of technology refinement over the last several months. A graphic included in the press release gives the rate of hydrogen generation from a single conversion module in March 2017 as 3.6 normal-liters of hydrogen (0.06 kg) per hour. By August 2017, that figure had risen to 78 NL (1.2 kg) per hour. In March 2018, it had risen to 150 NL (2.4 kg) per hour. And now the company has set a target of 500 NL (7.9 kg) per hour.

Conversion of ammonia to high-purity hydrogen is a well-populated arena in the ammonia energy space. Over the last two years, Ammonia Energy posts have covered, in addition to the Sawafuji/Gifu University program, development efforts at Japan’s Hiroshima University, the U.K.’s Oxford University, Australia’s Commonwealth Science and Industrial Research Organization (CSIRO), and the start-up companies RenCat (based in Denmark), Bettergy (based in the U.S. and a recipient of funds under the USDOE’s REFUEL program), and Tower Power (based in the U.K. but focused on markets in southern Africa).

The explanation for the widespread interest starts with the proton-exchange membrane (polymer-electrolyte) fuel cell. A scan of the nascent hydrogen energy economy shows that PEM fuel cells are at the technological core of early beachheads in transportation and logistics, distributed power generation in the built environment, and off-grid electricity supply (for example for cellular telephone towers in remote locations). The PEM fuel cell owes this position to two key attributes: high power density, allowing compact and lightweight packaging; and relatively low operating temperatures in the 80-100 degree C range, supporting quick start-up and shut-down cycling, and superior durability. According to market research firm Grand View Research, PEM fuel cells currently represent a $4 billion global market that is expected to experience 20% compound annual growth through 2025.

At the same time, the difficulties of managing elemental hydrogen as an energy commodity are well documented and widely if not universally acknowledged. So the rationale is compelling for a device that can serve as an “adapter” between ammonia supply and hydrogen use by efficiently and completely converting the one to the other.

A high-purity conversion device must do two things: 1) “crack” the ammonia molecule into nitrogen and hydrogen; and 2) extract from the resulting atomic soup a stream of hydrogen that meets stipulated purity standards. Catalysts are at the heart of the first step; separation techniques (that may involve distinct catalysts) are at the heart of the second.

The contrast between Sawafuji’s and RenCat’s approaches illustrates the diversity of methods and the resulting tradeoffs. For the cracking step, RenCat uses an iron-nickel catalyst system which is “inexpensive compared to . . . the Ru/Al2O3 typically used for high conversion ammonia cracking.” Although the Gifu system originally did without catalysts altogether, Kambara subsequently added an (unspecified) ammonia decomposition catalyst in the front stage.

But even more significant, in RenCat’s view, is their use in the back stage of a “mixed metal oxide catalyst which can remove trace ammonia impurity in hydrogen to the level of 0.1 ppm.” They contrast this with systems like Sawafuji’s that use palladium-based approaches: “RenCat technology replaces €22,000/kg Pd membrane with €1/kg metal oxides.” On the other hand, RenCat’s device has an operating temperature of about 300 degrees C vs. Sawafuji’s ability to operate at ambient temperatures.

This cost vs. operating temperature tradeoff may play out during commercialization in consequential ways. Sawafuji identifies central-station and distributed power generation, and transportation, as its target markets (along with hydrogen supply for industrial processes). By contrast, per the Ammonia Energy post, “RenCat’s initial target market is stationary power in developing countries, where the electric grid either doesn’t exist or isn’t reliable – specifically, the fast-growth market for supplying power to remote cell phone towers across Africa and Asia.”

Per Grand View Research, grid-integrated power generation and transportation applications currently make up 93% of the fuel cell market and are expected to maintain this dominant position for the foreseeable future. Remote power has a slice of the remaining 7%, which also includes auxiliary power units and applications related to personal electronics. The competitive dynamics between Sawafuji, RenCat, Tower Power, and commercialization efforts that may emerge from the other research programs, will make the 2020s a lively decade.