South Korea to Launch Major Fuel Cell Vehicle Initiative

By Stephen H. Crolius on July 26, 2018

Where will fuel cell vehicles (FCVs) first achieve critical mass? Japan and California spring to mind as likely jurisdictions. South Korea not so much. That situation could change, though, with recent announcements from the Ministry of Trade, Industry, and Energy (MTIE) in Seoul. In fact, planned public and private sector investments could push South Korea to the front of the FCV pack.

But while hydrogen-related activity of this nature can create opportunities for ammonia energy, the question always looms: are the key players in the implementing jurisdiction aware of the enabling roles ammonia can play? Hyundai is unquestionably a key player in South Korea’s FCV landscape, and, courtesy of its support for the Australian ammonia-to-hydrogen fueling demonstration that will kick off in August, there is no doubt that Hyundai is aware. In fact, the company could become a champion of ammonia-based FCV fueling.

According to an April 25, 2018 MTIE press release, “Vice Minister Lee Inho signed a memorandum of understanding with leaders from hydrogen-related industries to establish special purpose companies (SPCs) that will embark on an infrastructure development project for hydrogen fueling stations in Korea.” Hyundai Motor Company President Chung Jin-haeng was among the attendees at the signing ceremony.

A May 2, Hydrogen Fuel News article reported that “the government expects to see some 15,000 fuel cell vehicles on the road by 2022. These vehicles will be supported by 310 hydrogen stations that will all be open to the public by that time.”

In a follow-up meeting held on June 25, according to a BusinessKorea article, the South Korean government and private-sector companies including Hyundai, diversified manufacturer Hyosung Heavy Industries, and SK Gas “will invest 190 billion won [USD$169 million] this year and 420 billion won [USD$374 million] next year. By 2022, 2.6 trillion won [USD$2.3 billion] will be invested in hydrogen car production facilities, hydrogen bus production, hydrogen storage containers for buses, and stack plant expansion.” The goal will be to “stay ahead of the game in the global hydrogen car market.”

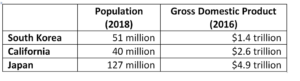

The South Korean initiative will outstrip both Japan and California in financial support for FCV market development. Japan is hoping to see rapid growth in its population of FCVs (40,000 FCVs in 2020, 200,000 in 2025, and 800,000 in 2030), but has only earmarked ¥45 billion ($405 million) for FCV-related subsidies through 2020 – a yearly spending rate that is less than a third of the one projected by South Korea. And it is targeting an installed base of only 160 fueling stations by 2020. (Click here for the Ammonia Energy post on this topic.)

California does not have distinct targets for FCVs but develops plans instead for the broader category of zero-emission vehicles (ZEVs). In January, the Governor proposed a target of five million ZEVs by 2030 and an investment program worth USD$2.5 billion through 2025. It appears, however, that only $500-$600 million of this amount would be devoted to FCVs (specifically to the completion of 140 fueling stations needed to bring the state’s total to 200). The balance would be used for 250,000 electric vehicle charging stations.

Hyundai launched its FCV program in 2000, working through three generations of vehicle prototyping before introducing its ix35/Tucson FCV to the commercial market in 2014. (The generations are described in a company document from 2013.) According to Green Car Reports, sales of the ix35 amounted to a “few hundred units.” The company’s fifth-generation product, dubbed the Nexo, had its official unveiling in January and went on sale in South Korea in March. It is currently being rolled out in Europe. U.S. sales are scheduled to start by the end of the year.

The BusinessKorea article indicates that the MTIE initiative is intended to correct a history of policy inconsistency that “has been hindering the development of hydrogen fuel cell vehicles in Korea.” To guarantee progress, the initiative will take on the economic hurdles that render the path of mass FCV uptake so challenging. In November 2018 an SPC will be established with the mission of building fueling stations at 30% less capital expense than current practice allows. The sale of the FCVs themselves will be subsidized through 2022 with a 450 billion won (USD$405 million) slice of the initiative’s funds. Finally, the price of hydrogen will also be subsidized so that the fuel cost per kilometer for an FCV will be 70 won (USD$0.063), vs. 155 won (USD$0.139) for gasoline, 92 won (USD$0.083) for diesel, and 83 won (USD$0.075) for LPG.

While a subsidy program of this scale may prove effective, it will certainly be an expensive way to establish a socially beneficial product in the marketplace. And the product’s success will only be sustainable if its economics are competitive once the subsidies are withdrawn. And this is why Hyundai’s participation in Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO) ammonia-to-hydrogen fueling demonstration (mentioned most recently in this Ammonia Energy post) is so important. The company will know from first-hand experience what the cost profile of the technology is and will be able to compare it to the economics of supply using on-site electrolysis, liquid hydrogen, and other methods.

For its part, Australia is looking to South Korea as an important market for hydrogen that can be produced from its abundant renewable energy resources. Last year, the State of South Australia issued a report on green hydrogen (click here for the Ammonia Energy post) that included a discussion of hydrogen supply for South Korea’s future fleet of fuel cell transit buses.

What might the Green Hydrogen market look like in the future? . . .

In 2016, South Korea’s finance minister was reported to announce plans to replace the country’s 26,000 CNG powered buses with hydrogen-powered buses, representing around 475,000 tonnes of hydrogen consumption per year . . .Assuming that hydrogen is produced in South Australia from renewable energy, a hydrogen carrier, such as ammonia, is used to transport the fuel to South Korea, and based on metrics for the 2027 full scale ammonia plant involving around 28,000 tonnes of H2 per year per plant, 17 full scale 600t per day ammonia production facilities are required to meet this demand. This would be an investment of approximately [AUD]$15bn [USD$11.1 billion] in the plant alone . . .

South Australia’s Green Hydrogen Study, Section 6.4: Scale of industry / future renewable uptake, September 2017

Thanks to the MTIE initiative, the two countries may converge on this path sooner rather than later.