The Hydrogen Consensus

By Stephen H. Crolius on April 27, 2017

Let’s say there is such a thing as the “hydrogen consensus.”

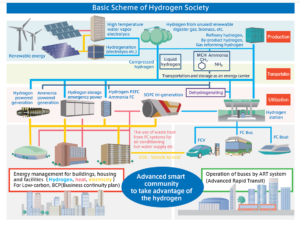

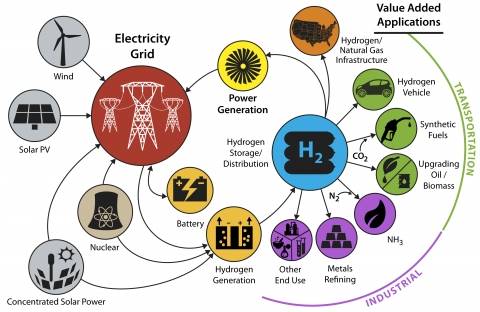

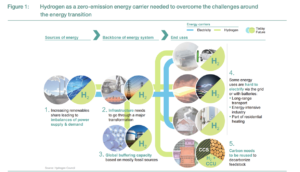

As presented in the graphics to the right, the consensus holds that hydrogen will be at the center of the sustainable energy economy of the future. By definition, hydrogen from fossil fuels will be off the table. Hydrogen from biomass will be on the table but the amount that can be derived sustainably will be limited by finite resources like land and water. This will leave a yawning gap (in the U.S., 80-90% of total energy consumption) that will be filled with the major renewables — wind, solar, and geothermal — and nuclear energy.

This may be as far as the consensus goes today, but more insight is emerging on the global system of production and use that could animate a hydrogen economy.

Ammonia Energy News has touched on this several times — see, for example, posts from October 13, 2016 and January 5, 2017 on the renewable resources of Australia and how they could be a source of energy for countries like Japan and Germany — but the idea acquired more substance in IEA Senior Analyst Cédric Philibert’s recent commentary Producing Industrial Hydrogen from Renewable Energy (covered in last week’s Ammonia Energy News), which looks ahead to hydrogen production and trade on a large scale across regions.

Philibert’s argument is grounded in the costs of producing renewable energy. In business strategy, relative cost position is a fundamental determinant of business success. Especially in commodity industries, the low-cost producer enjoys superior profits and an enhanced ability to invest in further cost reductions and growth initiatives.

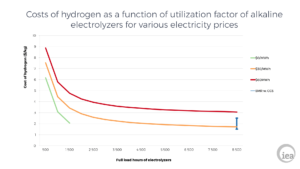

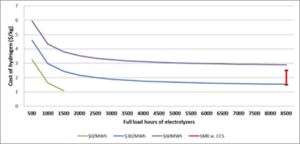

Philibert’s discussion landed within this context when he constructed his “cost of hydrogen” graph.

The graph identifies the price of electricity and the rate of capacity utilization as key factors that drive electrolytic hydrogen’s cost position relative to that of hydrogen from steam methane reforming (SMR). In the personal blog post referenced in the Ammonia Energy story, Philibert brings in a third cost driver: plant scale (reflected in the next graph, below).

The cost dynamics revealed by the two graphs can be summarized as follows:

- The price of electricity is the most important driver. Doubling the price from $30 to $60 per MWh increases the cost of hydrogen by approximately $1.50 per kg – a major impact when the base cost for SMR hydrogen is $1.00.

- Plant capacity utilization is extremely important at rates below 50%, (about 4,300 hours) accounting for multi-dollar deltas in hydrogen price per kg. At higher rates, it has a smaller impact, accounting for a cost decrease of just $0.50/kg as utilization increases from 50% and 100%.

- Plant capital cost is also most important when capacity utilization is low, but becomes less so when utilization crosses the 50% point. At full capacity, the effect of moving from $850 to $450 per kW of capacity leads to a drop of less than $0.50/kg.

It is often the case that tradeoffs are embedded within sets of cost drivers. In this case, one important tradeoff involves all three cost drivers. Electricity has one price if it is offered on a “firm” basis, and a different price if there is a less-than-100% guarantee of continuous supply at any level of demand. Electricity that is offered wholly at the convenience of the generator can have a very low price indeed. This means that high utilization can be guaranteed by negotiating a “close-to-firm” electricity off-take agreement, but the plant will be locked into a relatively high price of electricity. And a larger plant will benefit from economies of scale but will be more susceptible to periods of low utilization.

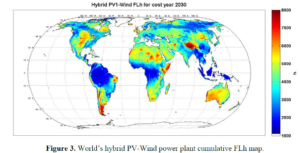

Philibert points out that this tradeoff can be broken by siting production in regions that feature two or more types of renewable energy resources — solar and wind, wind and hydro, etc. With this approach, it may be possible to take electricity at the convenience of the producers, still achieve an acceptable level of plant loading, and end up with the ability to produce hydrogen at a very competitive cost.

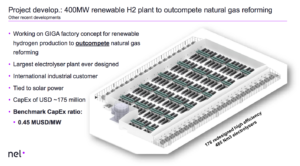

Nel, the Norwegian company that designed the project highlighted in Philibert’s personal blog post, certainly feels optimistic, pointing to its “GIGA factory concept for renewable hydrogen production [that can] outcompete natural gas reforming.” It is important to note the lack of any contingencies in this statement, such as “once a price is assessed on carbon emissions.”

To see how the cost drivers might be managed to reach this level of cost-competitiveness, consider the $0.00/MWh cost curve on Philibert’s second graph. It reaches $1.00/kg at a plant utilization of approximately 1,500 hours (17% of theoretical full capacity utilization). $0.00/MWh is not an attainable price in the real world. But $20.00/MWh may be – if the off-take agreements with the electricity producers permit substantial interruption in the supply of electricity. If the plant could achieve at least 50% utilization by drawing on a solar resource that is active during daytime hours and a wind resource that is most active at night, an average price for electricity could possibly be attained that would support hydrogen cost in the $1.00/kg ballpark.

Philibert’s commentary identifies regions with strength in both solar and wind resources. They include Western Australia, central Asia, the horn of Africa, the Sahara Desert, Patagonia, and the Great Plains of the U.S.

In general, these places are far from the population and industrial centers where most energy is consumed. And this means a fourth cost driver must be factored in: logistics cost. The cost to produce hydrogen may be $1.00 per kg in Patagonia, but by the time it is, for example, liquefied, stored at an outbound port (with cryogenic costs and boil-off losses), transported by ocean tanker (with cryogenic costs and boil-off losses), stored at a receiving port (with cryogenic costs and boil-off losses), and ultimately delivered to a customer – all using dedicated assets and infrastructure built substantially from scratch – it will cost many times that amount.

There appear to be just two serious candidates for achieving the goal of affordable logistics: chemical combination of hydrogen with nitrogen to produce ammonia or with toluene to produce methyl cyclohexane (MCH). Ammonia would seem to have an edge in this competition since it features simple, one-way handling while MCH will require a complicated system for returning the base toluene from the point of consumption to the point of production.

But for ammonia to prevail, there must be technologies on the consumption end that allow for the economical extraction of the energy embodied in the commodity. And this is why work being done on key ammonia energy technologies is so important — for example, ammonia-powered combustion turbines that can be deployed in combined-cycle generating stations for efficient conversion of ammonia into electricity, and fueling stations that can receive deliveries of ammonia and use plasma crackers to convert it on demand to hydrogen.

Let’s acknowledge that only part of the picture above fits within the current hydrogen consensus. Some elements, including ammonia’s role as the primary energy carrier, are still the subject of research and debate. But these elements are supported by the type of hard-headed economic considerations that tend to anchor serious societal investments. Ammonia has not quite merged into the hydrogen consensus yet. But truly, it is only a matter of time.