All together now: every major ammonia technology licensor is working on renewable ammonia

By Trevor Brown on June 01, 2018

The second annual Power to Ammonia conference, which took place earlier this month in Rotterdam, was a tremendous success. It was again hosted by Proton Ventures, the Dutch engineering firm and mini-ammonia-plant pioneer, and it had roughly twice as many attendees as last year with the same extremely high quality of presentations (it is always an honor to speak alongside the technical wizards and economic innovators who represent the world of ammonia energy).

However, for me, the most exciting part of this year’s event was the fact that, for the first time at an ammonia energy conference, all four of the major ammonia technology licensors were represented. With Casale, Haldor Topsoe, ThyssenKrupp, and KBR all developing designs for integration of their ammonia synthesis technologies with renewable powered electrolyzers, green ammonia is now clearly established as a commercial prospect.

Ammonia’s performance as a fuel has never been a question (ammonia dual fuel with liquid oxygen powered the air-speed and altitude record-setting flights of NASA’s X-15 in the 1960s).

The real question is: can ammonia fuel be carbon-free? The ammonia molecule contains no carbon, and yet we make it from fossil fuels. If we can’t reduce ammonia’s carbon footprint, the potential for ammonia fuel to decarbonize global economies is minimal. However, if ammonia can be produced with low or no carbon emissions, it could become the carbon-free fuel and energy storage medium that allows deep decarbonization of global industry, transportation, and power sectors.

It is in this context that I celebrate the fact that all four ammonia synthesis technology licensors are now engaged on green ammonia production.

Haldor Topsoe

In Rotterdam, Haldor Topsoe presented an update of its vision for integrating electrolyzers with its ammonia synthesis technology.

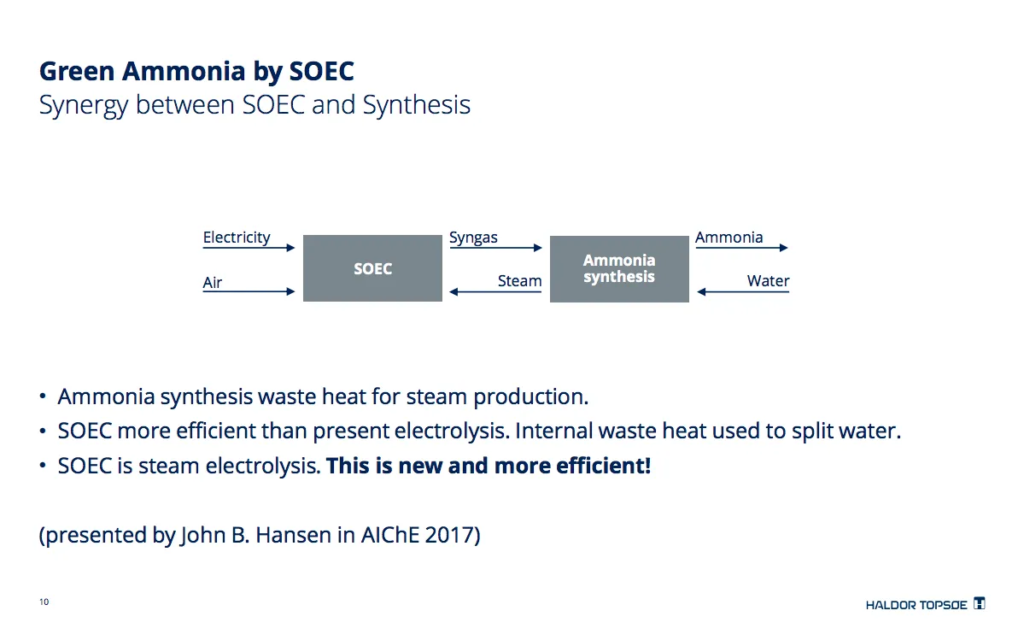

This highly integrated process was introduced at last year’s NH3 Fuel Conference, and is based on a solid oxide electrolysis cell which has been under development for decades.

According to last year’s NH3 Fuel Conference presentation:

The energy efficiency is very high due to ability of the SOEC to use steam generated from the synthesis reaction heat in the ammonia synthesis loop and the favorable thermodynamics of high temperature electrolysis.

John B. Hansen, Solid Oxide Cell Enabled Ammonia Synthesis and Ammonia Based Power Production, NH3 Fuel Conference, 11/02/2017

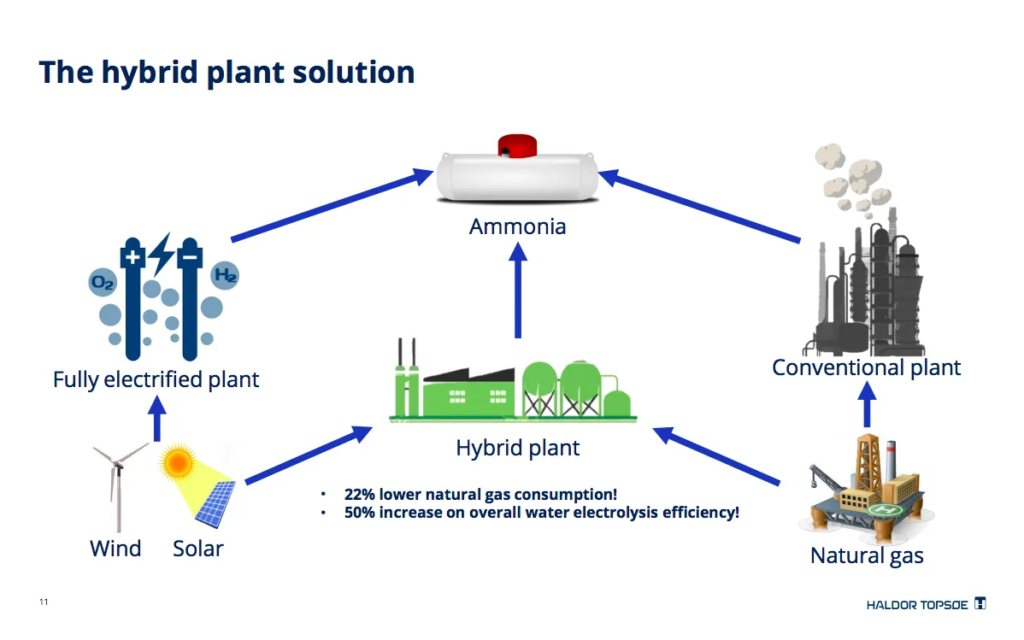

This technology is now a commercial prospect, with potential to be marketed not just for new builds but also as a revamp strategy for existing plants. The promise: a 22% reduction in natural gas consumption.

Haldor Topsoe’s updated vision, which it clearly hopes to market to the 60 ammonia plants it has built since 2000 and its 248 catalyst customers around the world (this represents a significant market share of global ammonia plants), is as follows:

1. Ammonia being produced from renewable energy, water and air

2. Ammonia being the preferred energy storage media in the power sector

3. Sustainable ammonia being produced cost competitive in world-scale capacities

4. Sustainable ammonia being used to feed the world and to power the world

Pat Han, NH3 Event presentation, May 2018

The emphasis, on both feeding the world and also powering the world, conveys Haldor Topsoe’s ambition for market growth.

ThyssenKrupp (Uhde)

You may already know that ThyssenKrupp, the German conglomerate that purchased ammonia technology licensor Uhde some years ago, is the world leader in alkaline water electrolysis, primarily serving the chlorine production industry. According to the presentation in Rotterdam, Uhde has “realized” some 130 ammonia plants worldwide over the last 90 years, and ThyssenKrupp has a 49% market share as “supplier for electrolytic hydrogen production,” having “realized” 600 electrochemical plants worldwide with an installed power rating of 10 GW. Now that ThyssenKrupp owns Uhde, the marriage of electrolyzer manufacturer and ammonia synthesizer is complete.

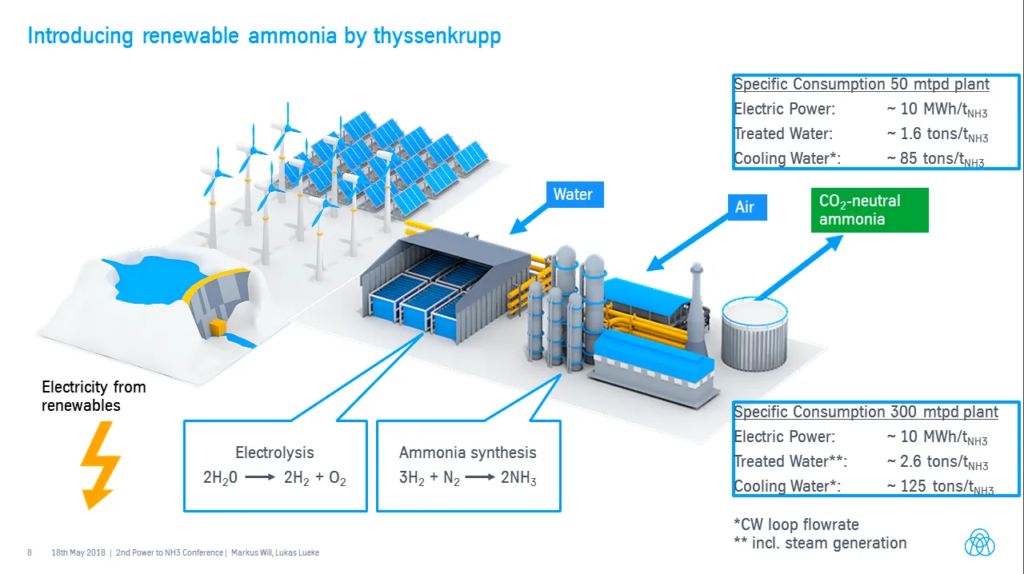

ThyssenKrupp is now marketing a 50 ton per day ammonia plant (requiring 20 MW power), and a 300 ton per day ammonia plant (120 MW). These are modular designs that can be constructed offsite, reducing capital costs.

Importantly, the projected energy efficiency of ThyssenKrupp’s integrated process is 10 MWh per ton ammonia, roughly equivalent to 36 GJ per ton, or equal to today’s global average for ammonia plant efficiency.

The truly distinctive element of ThyssenKrupp’s joint presentation by Markus Will, representing the ammonia business, and Lukas Lüke, representing the electrolyzer business, is the company’s ability to scale up production. Its existing electrolyzer supply chain is capable of producing more than 1.2 million m2 of electrodes each year, which is enough to meet installed power of more than 600 MW per year.

It is perhaps also relevant to point out that Uhde built the only industrial-scale electrolytic ammonia plant still operating worldwide, many decades ago, in Peru. (All these revolutionary new ideas are, of course, old ideas newly remembered.)

I’m hoping that, at the next conference, ThyssenKrupp might describe the techno-economics behind the final slide of its 2018 presentation, which contained a teaser image of an offshore wind turbine powering a conceptual offshore ammonia synthesis plant.

Such a design has obvious attraction, especially in Europe where offshore wind is increasingly cost-competitive. This is a subject I wrote about last month and the International Energy Agency continues to promote offshore wind as an opportunity for ammonia production.

Casale

Casale might hold the advantage over these other companies, having been deeply engaged in Power to Ammonia for some years already, in part as the technology licensor to Proton Ventures’ mini-ammonia plants. Certainly, Casale’s presentation at the Rotterdam conference gave less overview and more deep-dive into overcoming the technical challenge of operating an ammonia plant on intermittent renewable power.

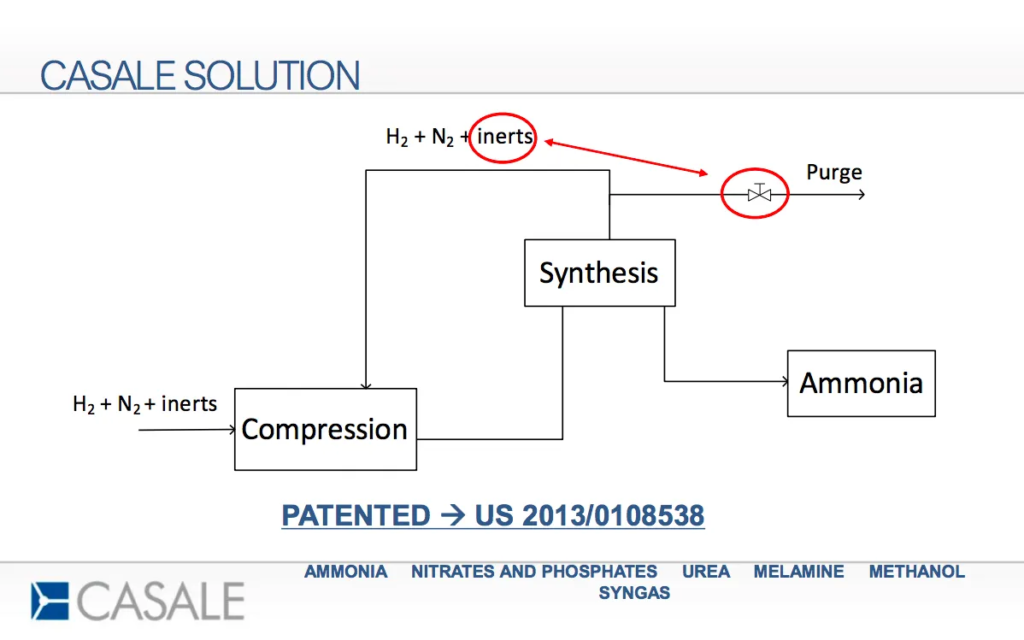

The key to Casale’s strategy for managing plant load variation, which it patented back in 2013, is its handling of the inerts. These unreactive gases in the synthesis loop are usually overlooked, in deference to the hydrogen-nitrogen mix, but they could be crucial to maintaining plant operating conditions at times when renewable-powered electrolytic hydrogen production is curtailed.

While other companies are feverishly working to develop complex technological solutions for the integration of renewables to ammonia production, Casale has already refined its sales pitch for this operational strategy: “Nice and easy,” which means “Reliable.”

Casale’s strategy allows ammonia plants to handle both short-term and long-term variation, but it also allows the future renewable ammonia plant operator to take advantage of price variation, ramping up or down to maximize the value of an asset coupled to the electricity market. In this perspective, ammonia is not the only product: the plant can also provide ancillary grid services or load management (demand side management) services by switching off.

KBR

I look forward to reporting on KBR’s presentation at next year’s event. Welcome to the party!

[The full conference proceedings are only available online to attendees of the conference. If you weren’t there but would like access to the presentations, please contact the organizers.]

You can also read the full article at AmmoniaIndustry.com.