Ammonia infrastructure: panel wrap-up from the 2020 Ammonia Energy Conference

By Julian Atchison on January 22, 2021

Infrastructure is key to realising the full potential of ammonia energy, enabling new markets and expanding the existing ones. By 2050 the hydrogen (and by extension, ammonia) market could be 20 times larger than it is today. What future possibilities are there to expand global ammonia production (currently 180 million tonnes per year) or trade volumes across the world’s oceans (currently 18 million tonnes per year)?

On November 18, 2020, the Ammonia Energy Association (AEA) hosted a panel discussion moderated by Daniel Morris from KBR, as well as panel members Anthony Teo from DNV GL, Oliver Hatfield from Argus Media, and Michael Goff from Black & Veatch as part of the recent Ammonia Energy Conference. The panel’s insights from a number of different perspectives – market analytics, ship building and operating, as well as pipeline engineering – demonstrated ammonia’s potential to become a low- or zero-carbon fuel of choice for the future. Current infrastructure can be adapted, new infrastructure can be built and operated cheaply, and lessons from previous fuel transitions can be taken on board to make the uptake of ammonia energy as smooth as possible.

Adaptation of existing infrastructure was a common theme through the presentations. Daniel Morris concluded that we need to reimagine our existing global ammonia infrastructure to maintain its value and relevance. Although costs for green ammonia at existing global sites is still variable (due to uncertainty in the cost of sourcing clean energy), there is significant overlap between “heat maps” of global ammonia ports, global ammonia maritime trading routes, and the cheapest projected green hydrogen costs from large scale wind-solar hybrid setups. Small adjustments in approach and thinking will realise the full potential of this opportunity, and it is obvious that businesses realise the extreme risk in delaying decarbonisation.

As a bonus, conversion of existing LNG-focused maritime assets into ammonia analogues will also be possible. Michael Goff told the audience Black & Veatch had just released a white paper assessing the feasibility of converting LNG import terminals to ammonia import terminals, with the conclusion that costs will be very manageable.

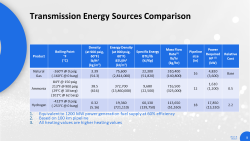

Even building new ammonia transport infrastructure will be highly cost-effective. In his presentation Michael shared a series of calculations comparing the transport of hydrogen, ammonia, and natural gas along a 100km pipeline to a standard-sized maritime vessel. Owing to its increased density and smaller pipeline diameter required, ammonia can be moved at the necessary flow rates for half the cost of natural gas. Hydrogen pipelines are roughly double the cost of natural gas, or four times the cost of ammonia pipelines. Once you also factor in that ammonia does not require compressing to transport (just pumping infrastructure), the cost comparison will likely be even more favorable. Favorable ammonia pipeline transport costs open up a whole new range of possibilities for global ammonia production and transport, bringing land-locked remote renewable energy sources into play.

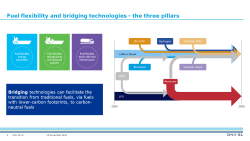

Anthony Teo put forward the maritime perspective, and reminded us that the LNG boom has valuable lessons and predictors for what’s to come with ammonia. Just twenty years ago LNG was considered a radical proposal for marine fuel, but as regulations changed and emissions reduction ambitions were announced, hearts and minds were shifted. LNG demand from the maritime sector now quadruples every five years, and we’ve seen dramatic surges in the number of LNG-fueled and LNG bunkering vessels. The same trends are likely for ammonia, though it may seem a far off prospect right now. Anthony’s other key infrastructure considerations were fuel flexibility and bridging technologies: keep your fuel options as open as possible with vessel technology and shore-side infrastructure, and use lower-carbon fuels where available to smooth the transition process. To assist the future-proofing process and give shipbuilders and owners the confidence to pick the right low- and zero-carbon fuels, DNV GL launched an exhaustive online catalogue of alternative bunker fuel assets, its Alternative Fuel Insight platform (you can request access here). A complete global map of ammonia infrastructure has now been added to the platform, thanks to an agreement between DNV GL and Argus Media. Anthony also told the audience to keep an eye out for an upcoming DNV GL white paper on ammonia as a marine fuel, and to make sure they watch the Marine Ammonia panel for a deeper dive into the business case around ammonia as a marine fuel.

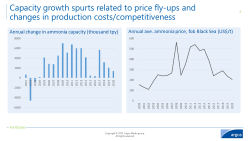

Will the future market for low and zero carbon ammonia be supply constrained or demand constrained? Oliver Hatfield is confident that supply will not be a constraint, with no major barriers to building new ammonia production capacity now and into the future. In fact, there’s only been one net negative year for changes in global ammonia production capacity this century, despite the current global fleet running at about 81% utilisation. Existing ammonia plant economics are driven by access to cheap hydrogen feedstock and adjacency to end-use markets for nitrogen – the first consideration in particular bodes extremely well for green ammonia, and especially in places like Australia where there’s access to abundant, cheap renewable energy sources. What Oliver thinks may be necessary, however, are market interventions to boost low and zero carbon ammonia markets (this was echoed by the other panelists). Renewable and fossil ammonia may not compete directly in the same market, such is the current cost disparity. This doesn’t mean we need to sit around and wait for green/renewable ammonia to come down in price. We need to be prepared to let grey and blue ammonia be used in the short term. Making ship owners (for example) swallow the double cost of tech/engine R&D and purchasing green ammonia is too big an ask at this point. But the future is bright, with no major barriers in the way of us beginning this transition today.

Argus Media (in partnership with the AEA) will be presenting their first ever Green Ammonia Virtual Conference March 24-25. Join us online to hear from industry leaders on all the hottest topics in the development of the green ammonia market. More details and registration info here.

If you wish to view the archived video of the ammonia infrastructure panel discussion, please register for the conference to access all session recordings. You can also browse and download all of the Ammonia Energy Conference 2020 presentations.