Global Hydrogen Review 2024: FID doubles, low-emission ammonia takes center stage

By Kevin Rouwenhorst on October 15, 2024

The International Energy Agency (IEA) recently published its Global Hydrogen Review 2024. While the cumulative production capacity reaching Final Investment Decision (FID) has doubled compared to last year’s report, a large portion of the low-emission hydrogen production pipeline is currently in the early stages of development. Promisingly, low-emission ammonia comprises a significant portion of the mature project pipeline and offtake volume.

Locations for water electrolysis and fossil fuels with carbon mitigation

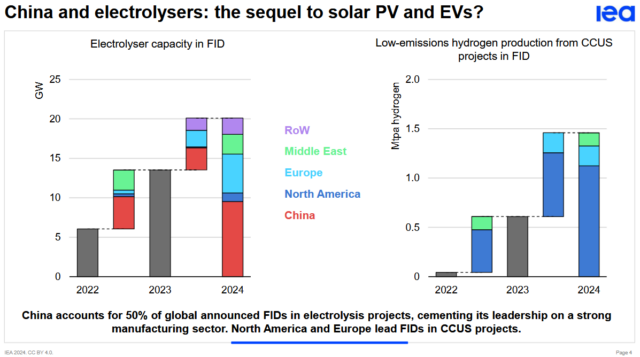

More than 90% of the 49 million tons of hydrogen (276 million tons of ammonia equivalent on mass basis) of announced projects in the IEA database are still in the early stage or feasibility study stage, with more than three quarters being electrolysis-based projects. However, the pipeline of low-emission hydrogen projects reaching FID has doubled from 1.7 million tons in 2023 to 3.4 million tons in 2024. Out of these projects, around 55% is based on water electrolysis and 45% is based on fossil fuels with carbon mitigation. Typically, the fossil fuel projects with carbon mitigation are significantly larger projects than water electrolysis projects (an exception being NEOM in Saudi Arabia).

Click to enlarge. Low-emission hydrogen capacity at FID from water electrolysis and from fossil fuels with carbon mitigation. From Global Hydrogen Review 2024: Technical webinar (IEA, 2024).

Around 20 GW of water electrolysis capacity has reached FID, with nearly half coming from China and about a quarter from Europe. This is well in line with electrolyzer manufacturing capacity, where China has around 60% of capacity in 2023, followed by Europe (20%), and the United States (15%). In China, electrolysis-based hydrogen will be cheaper than hydrogen from unabated coal by 2030, according to the report. Hydrogen projects based on fossil fuels with carbon mitigation are mostly located in North America, and particularly the US Gulf Coast.

Offtake: Low-emission ammonia takes center stage

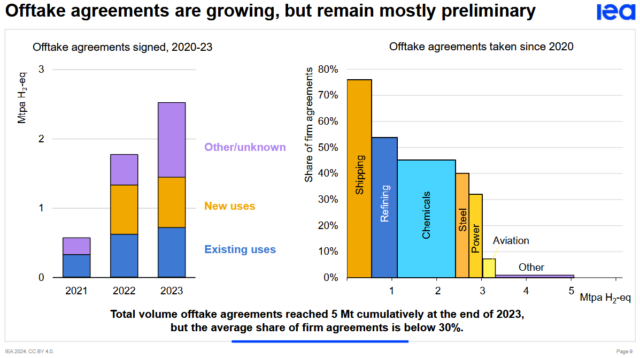

A clear discrepancy is emerging between low-emission production and demand. Policy ambitions aim for 11 million tons of low-emission hydrogen by 2030, while the projects reaching FID only account for 3.4 million tons. Also, low-emission ambitions for 2030 are about 3 million tons lower than last year. Clear policy actions are required to drive demand. The IEA highlights the contracts for difference schemes in Germany (H2Global), and the EU mandates for low-carbon aviation and shipping fuels as examples to follow. Overall, the share of firm offtake agreements is below 30% of a project’s total production capacity, with most agreements being preliminary in nature.

Click to enlarge. Offtake agreements by sector. Note: Ammonia is part of the Chemicals sector, but ammonia can also be used for Shipping and Power. From Global Hydrogen Review 2024: Technical webinar (IEA, 2024).

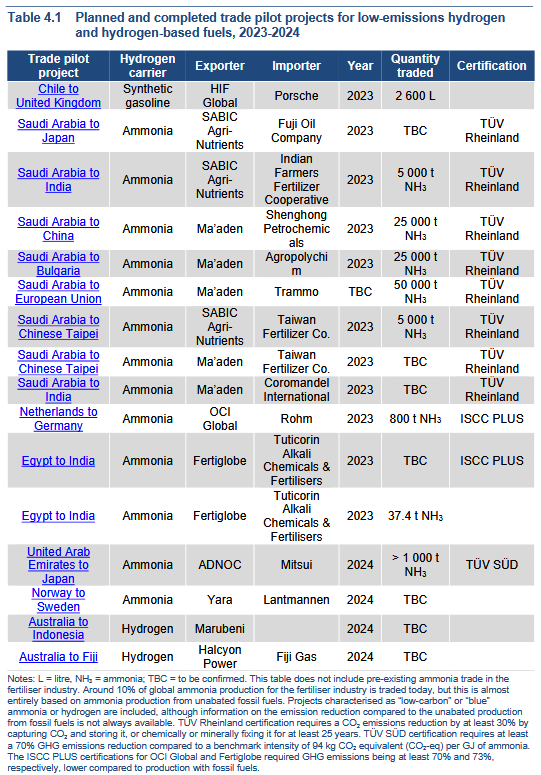

All export-focused projects with an identified offtaker in the IEA report are low-emission ammonia projects. The projects highlighted in the report are the Teal ammonia plant in Canada (800,000 tons per year offtake by Trammo), NEOM in Saudi Arabia (1.2 million tons per year offtake by Air Products), CF Industries in the United States (500,000 tons per year offtake by JERA), ACME’s GHC SPC in Oman (100,000 tons per year offtake by Yara Clean Ammonia), Fertiglobe’s Egypt Green Hydrogen Project (up to 397,000 tons per year offtake by Hintco), and ACME’s Project in Odisha, India (400,000 tons per year offtake by IHI). Ammonia is also the end product of all but three “trade pilot” projects highlighted in the report (those with tonnages already transferred to the customer or under contract for transfer).

Click to enlarge. Planned and completed “trade pilot” projects for low-emission hydrogen and derivatives, 2023-2024. Table 4.1 in Global Hydrogen Review 2024 (IEA, 2024).

There are a few clear reasons why ammonia is dominant among mature projects in the report. Firstly, export-based projects with intercontinental trade typically focus on ammonia as the energy vector. Ammonia production can be decarbonized via water electrolysis and gas reformation with carbon mitigation without the need for a circular carbon source. Ammonia is also the largest single user of hydrogen in the chemical manufacturing sector, and commercial demonstrations showcase the feasibility of ammonia as shipping fuel and for power generation.

Ammonia for power generation needs to be demarcated

It should be noted that ammonia is included as part of “chemicals” for hydrogen demand in the report. And, for offtake markets such as shipping and power generation, ammonia is grouped in with other hydrogen derivatives. But the grouping of ammonia into these broad categories can cause confusion. Ammonia fuel utilized for power generation is obviously not a part of “chemicals”, but will contribute in a significant way to global hydrogen demand. It is far more useful to demarcate ammonia production and utilization for energy applications specifically, rather than as part of a broad category.

Latin America and the Caribbean in focus: Replacing fertilizer imports

Numerous low-emission hydrogen projects have been announced in Latin American countries due to optimal renewable energy conditions. Brazil can rely on baseload hydropower to supplement solar PV and wind. In Chile, the Antofagasta region in the north of the country has some of the highest solar irradiation globally, while the Magallanes region in the south has some of the highest wind capacity factors globally.

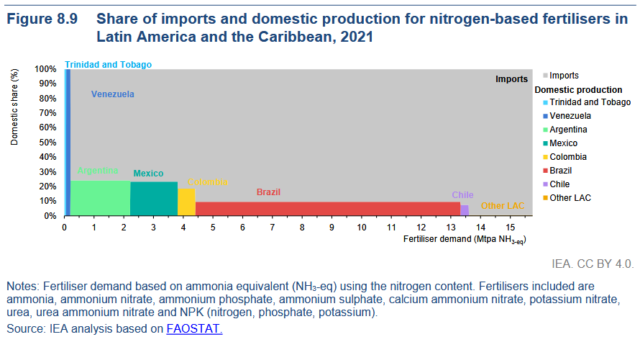

Click to enlarge. Share of domestic production and imports for nitrogen-based fertilizers in Latin America and the Caribbean. Figure 8.9 in Global Hydrogen Review 2024 (IEA, 2024).

Most countries in Latin America and the Caribbean currently import the majority of their nitrogen-based fertilizers. Ammonia is also imported to Chile for ammonium nitrate production (used to make blasting agents for the mining sector). Projects for replacing such imports with local renewable ammonia production have been announced, and local markets are the focus of the initial stages of most low-emission projects. Once local demand is met, a significant portion of the ammonia projects in Latin America plan to move their focus onto ammonia exports to Europe and East Asia.

Trinidad & Tobago is an outlier to other Latin American and Caribbean countries, as it is the world’s largest anhydrous ammonia exporter (owing to the low cost and easy availability of gas as a feedstock). In 2022, Trinidad & Tobago exported 3.2 million tons of ammonia, with the United States importing around a third of that volume. Around 1.7 million tons of hydrogen is produced in Trinidad & Tobago annually. Roadmaps to transition this production volume based on renewable energy and CCS have been launched. Trinidad & Tobago recently secured funding from the Green Climate Fund (GCF) for CCS implementation, to reduce emissions from ammonia production and methanol production.

However, only 0.2% of the announced low-emission hydrogen capacity in Latin America and the Caribbean has reached FID. One of the key reasons for this is the high cost of capital for renewable projects in Latin America and the Caribbean (eg. the cost of capital is around 10-12% in Brazil and Mexico, while it is 4-5% in West European countries). This is particularly relevant for renewable hydrogen and ammonia projects, given that such plants are dominated by the capital expenditure with relatively low operational costs. Also, infrastructure for electricity in this region must be strengthened in most locations to make GW-scale projects viable. Regulatory clarity is another factor. The report recommends that roadmaps and ambitions need to translate directly into policies and incentives for project development.