India: a future ammonia energy giant

By Kevin Rouwenhorst on April 13, 2023

In our March episode of Ammonia Project Features, Syed Hussain Naqvi (ACME), Amrit Singh (IH2A) and Richard Nayak-Luke (UCL) discussed renewable ammonia projects and their potential in India. The recording is available on the AEA’s Vimeo channel, and you can download the speaker presentations.

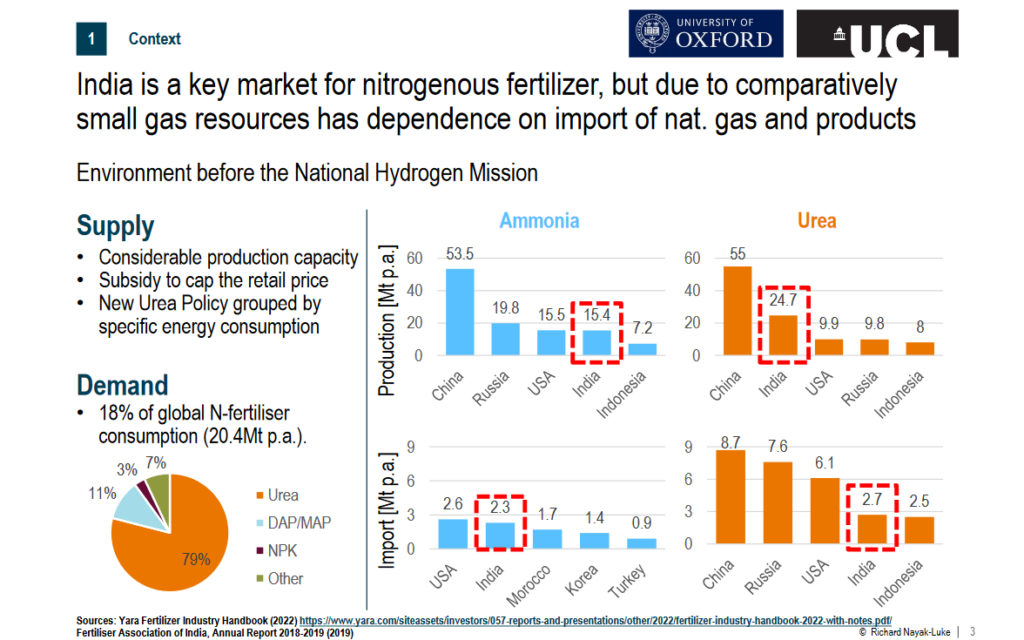

India is among the world’s largest ammonia producers, representing about 8% of current global production. Most of domestic production is directly converted to urea, which is subsequently used as fertilizer. But, significant quantities of ammonia and urea are also imported to meet demands. About 2.4 million tonnes of ammonia was imported in 2021 according to the World Bank, making India the second largest ammonia importer globally. The majority of imports are derived from the Middle East. Herein lies a significant opportunity, based on renewable energy generated in India.

ACME: Scaling-up pilot plants to one million-plus tonnes per annum

Domestic urea production may be difficult to decarbonize, due to the requirement of both ammonia and carbon dioxide as feedstocks. However, currently imported fossil ammonia can be replaced by imported renewable ammonia or domestically produced renewable ammonia.

ACME is developing various renewable ammonia projects within and outside India. These will serve both the Indian domestic market and the international ammonia energy market. ACME aims to be in the world’s top three renewable energy producers by 2030, and produce 10 million tonnes per year of renewable ammonia from its global plants.

As a first step towards world-scale renewable ammonia plants, ACME has been operating a solar to ammonia pilot plant in Bikaner, Rajasthan since November 2021. This pilot plant consists of 10 MW of solar PV capacity, 5 MW alkaline electrolysis capacity for hydrogen production with pressurized hydrogen storage, a PSA (pressure swing adsorber) for nitrogen purification, and a flexible ammonia synthesis loop that can go down to 30% load operation. This allows ACME to gain operational experience with fluctuating renewables, before scaling up to a million tonnes per annum ammonia production.

The operational strategy and setpoints for optimal operation can be determined from the pilot plant. Furthermore, the 5 MW electrolyzers used in the pilot plant will also be the size of the electrolyzer modules in ACME’s large-scale renewable ammonia projects, making many learnings directly transferable. The announced portfolio is a mix of renewable ammonia production in India and in the Middle East, including:

- The Oman Project in Duqm: 1.2 million tonnes per annum ammonia production for an investment of $6 billion. The TÜV Rheinland-certified renewable ammonia project will use KBR’s ammonia synthesis technology and ThyssenKrupp’s ammonia storage. The labour camps are already set up on site, with the first groundwork already performed. The commencement of operation of the first phase (300 tonnes per day ammonia) is expected between Dec 2024 and June 2025.

- Tamil Nadu, India: 1.1 million tonnes per annum ammonia production in Thoothukundi, based on 5 GW of solar PV capacity and 1.5 GW of electrolyzer capacity. A MoU was signed in July 2022.

- Odisha, India: 1.1 million tonnes per annum ammonia production near Paradeep Port. A MoU was signed in December 2022.

- Karnataka, India: 1.1 million tonnes per annum ammonia production. A MoU was signed in June 2022.

- Ain Sokhna, Egypt: 2.1 million tonnes per annum ammonia production. A MoU was signed in August 2022.

Excellent renewable potential

India benefits from excellent solar irradiance, making it an ideal location for solar PV deployment. According to IRENA, India has the lowest installed solar PV cost globally at $590 per kW in 2021. On the other hand, there is relatively low wind potential in India.

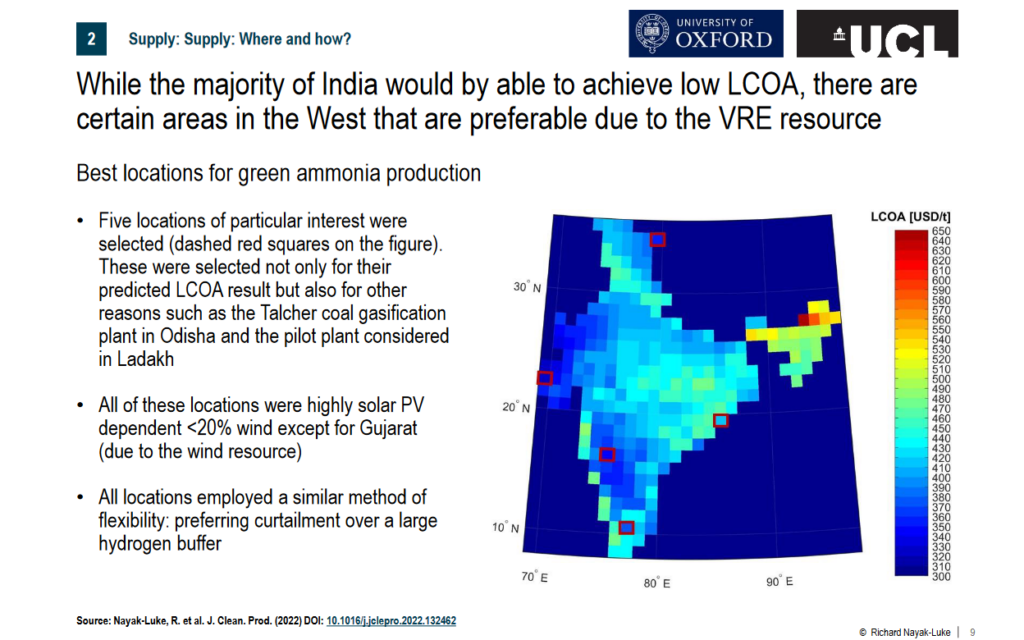

To assess the potential for renewable ammonia production, Richard Nayak-Luke and co-workers modelled the levelized cost of ammonia (LCOA) in India, based on 30 year solar and wind data (1990-2019) from the ERA5 database, using a 1 hour resolution. The researchers used a 30 year dataset to assess year-to-year variations in solar and wind profiles.

As expected, essentially all locations prefer solar PV as the sole renewable resource. Furthermore, there is substantial consistency within India with regard to the levelized cost of ammonia, although a few locations stand out. The project announcements of ACME in India align well with the lowest cost locations for renewable ammonia production identified from the research.

Flexibility of the ammonia plant is a key aspect for a low renewable ammonia cost. Technology licensors claim a minimum load factor in the range 5-40% of nominal capacity as achievable. Solar PV has a daily profile, such that the ammonia plant must be ramped up and down on a daily basis. Furthermore, the study from Richard Nayak-Luke and co-workers showed that oversizing the solar PV and curtailing part of the electricity is favored over a large hydrogen buffer.

“Round-the-clock” renewables

India has a highly integrated electricity grid. This implies that fluctuating renewables such as solar PV and wind can be connected to the grid, wherein these renewables can be connected with energy storage buffers, such as batteries and pumped hydro. India plans to have 18 GW of pumped hydro storage by 2032, which will be developed by companies such as Greenko (also a renewable ammonia developer).

Another pathway for back-up power is the use of ammonia as a fuel in gas peaker plants. During peak solar PV hours, electrolyzers can convert electricity to hydrogen, which is subsequently converted to ammonia. However, during the night, part of the produced ammonia can be converted back to electricity to keep the nitrogen purification and ammonia plant operating (at part load). The use of such gas peaker plants also allows for meeting peak demand of the Indian population centers.

In this context, ACME recently signed a MoU with IHI, which includes assessing the feasibility of ammonia-fired power generation. ACME aims to install a pilot gas turbine at its pilot plant for renewable ammonia production in Bikaner to gain operational experience. In this manner, ammonia plants can be sourced with round-the clock renewables.

National Green Hydrogen Mission

To realize the potential of India for renewable hydrogen and ammonia, India’s National Cabinet recently issued the National Green Hydrogen Mission. This includes a total of $2.4 billion in funding.

The India Hydrogen Alliance (IH2A) is an industry-led coalition focused on converting the National Green Hydrogen Mission to commercial scale projects. One of the key aspects herein is co-locating production and consumption centers in “Hydrogen Valleys” with a value chain approach and public-private partnerships (ie. similar to hubs being formed in Europe). This does not only include hydrogen production and utilization, as storage and infrastructure of hydrogen and derivatives will also be required. Otherwise, production and utilization centers will not be able to connect, and investments will result in stranded assets.

Electrolyzers with capacities of 150-plus MW are proposed in various hydrogen valleys. Amrit Singh Deo from IH2A argues that engineering capacity in India for realizing such large-scale renewable hydrogen and ammonia EPC projects is likely not a bottleneck. In addition, India can bank on an existing fertilizer industry receptive to such initiatives, as well as large-scale renewable electricity deployment throughout the country. Engineering remains popular in Indian universities and abroad, positioning the country well as it embarks on industrial decarbonization. If the right policy levers can be used, India is set to play a key role in decarbonizing its own ammonia demand, while also facilitating growth in the global ammonia energy market.