JERA’s new growth strategy: significant role for ammonia

By Geofrey NjovuJulian Atchison on May 31, 2024

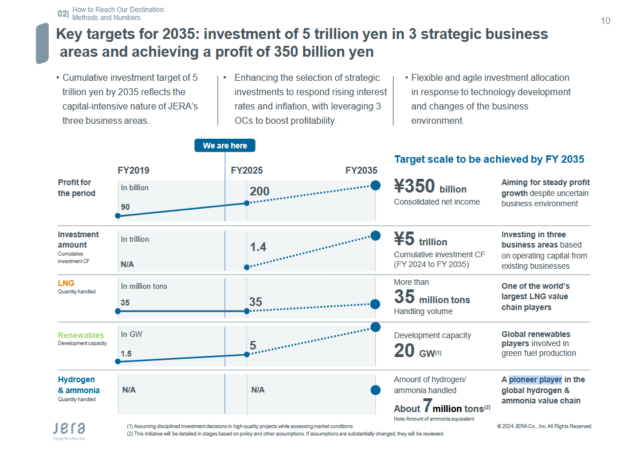

Click to expand. JERA’s key targets for its long-term growth strategy to 2035, including 7 million tons of ammonia handled per year. Source: JERA.

Japanese energy giant JERA has unveiled its long-term growth strategy to 2035, focused on three strategic market segments: LNG, renewables and hydrogen & ammonia. In the LNG segment, JERA is aiming to increase its current handling volume (35 million tons). In the same period, the company aims to grow its renewable energy portfolio by more than 13 times to 20 GW (from the current 1.5 GW). And from near-zero volumes today, JERA has set its sights on being a “pioneer player” in the emerging global value chain for ammonia, aiming to handle 7 million tons every year by 2035.

The total capital investment by JERA in these segments will be ¥5 trillion (or $6 billion), with at least ¥1 trillion to be spent in each.

100% ammonia substitution by the 2040s

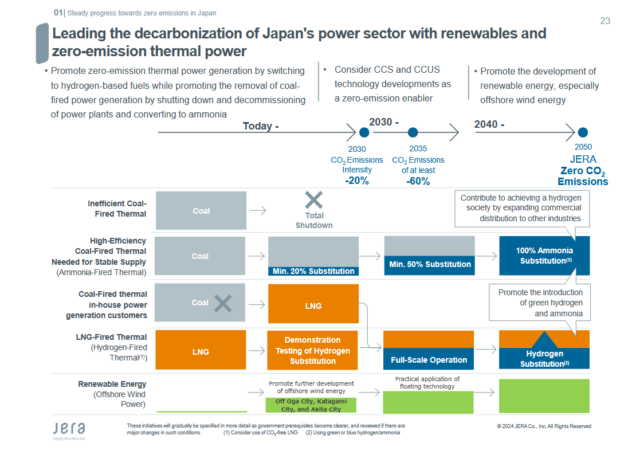

Click to expanse. Substitution of hydrogen and ammonia in thermal power generation, contributing to zero operational emissions for JERA by 2050. Source: JERA.

In terms of operational emissions, by 2030 JERA aims to close all supercritical or less coal power plants, and have demonstrated ammonia co-firing is feasible for the remainder (ultra-supercritical power stations). For LNG-fired power generation, hydrogen substitution will be demonstrated in the 2030s, with subsequent implementation. By 2035, a minimum of 50% ammonia co-firing will be achieved for coal power plants, moving to 100% substitution in the 2040s. Combined with an increase in deployed offshore wind power, this takes JERA to zero operational emissions by 2050.

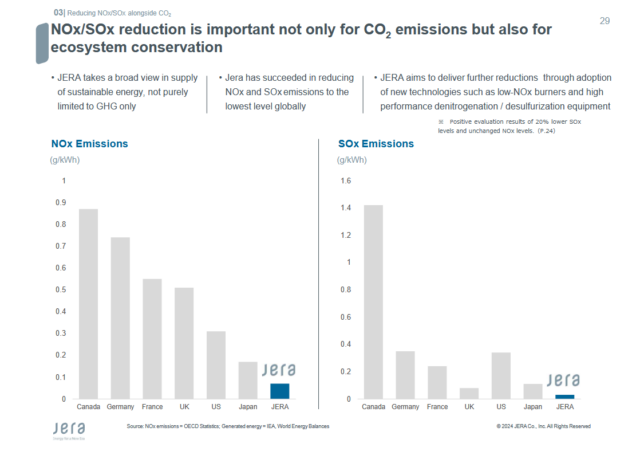

Click to expand. JERA reports that its current thermal power generation fleet has the lowest level of NOX and SOX emissions in the world – a standing it aims to maintain even with the switch to ammonia fuel Source: JERA.

Following the delivery of two cargoes of fuel ammonia to the Hekinan power station in 2023 to supply co-firing trials, two further ammonia fuel shipments are expected to dock this year. A key part of the co-firing tests in 2024 is performance testing, where JERA seeks to evaluate the NOX and SOX footprint of 20% co-fired power generation. In terms of NOX and SOX per kWh generated, JERA purports to have the lowest emitting power generation fleet in the world currently. The introduction of hydrogen and ammonia fuels will require new technology adaptations to maintain these levels, but JERA is committed to ensuring these emissions levels remain low.

The strategy also notes JERA’s efforts throughout the APAC region to push decarbonised power generation, including a co-firing feasibility study in the Philippines with Aboitiz Power.

A detailed breakdown of the strategy can be found here.

At JERA, we are not just adapting to the evolving global energy landscape; we are actively setting the pace. With out new growth strategy, we are positioning ourselves at the forefront of the energy transition. Our vision will be made possible through strategic collaborations with our global partners. Built on mutual goals and a culture of diversity and openness, we and our partners will join forces to embark on a journey to transform the energy sector.

Yukio Kani, JERA Global CEO & Chair, in his organisation’s official press release, 15 May 2024

With strong emphasis on capital market valuation comparing with global peers, JERA has set clear financial targets for profitability, capital efficiency and financial reliability to be achieved by 2035. JERA will actively allocate total capital investment of 5 trillion yen with flexibly adjusting investment balance over three business areas in response to market trends technological innovations and global policy shifts.

Hisahide Okuda, President, Director, CEO and COO of JERA, in his organisation’s official press release, 15 May 2024