Renewable ammonia: key projects & technologies in the emerging market

By Kevin Rouwenhorst on October 11, 2022

The fifth webinar in our series Ammonia Project Features focused on renewable ammonia, and the emerging pioneer projects in the market. Marc van Doorn (Head of Green Development in Hydrogen, Ammonia and Fertilizer, Grupo Fertiberia) and Imanol Arrizabalaga Prado (Sales and Business Director South Europe, Nel ASA) discussed progress to date at the Puertollano project & technologies used at the first large-scale, electrolysis-based hydrogen facility in Europe. Installed by renewable energy giant Iberdrola, the facility is among the first solar-to-hydrogen facilities globally, and feeds the existing fertilizer plant of Fertiberia in Puertollano. The recording is publicly available via our Vimeo channel (you can also download the speaker presentations).

First of a kind: Puertollano

In the coming decades, hundreds of million tonnes of renewable ammonia will be required annually to decarbonize current markets and meet demand for future applications, such as zero-carbon fuel. But currently, only a few commercial projects have been realized.

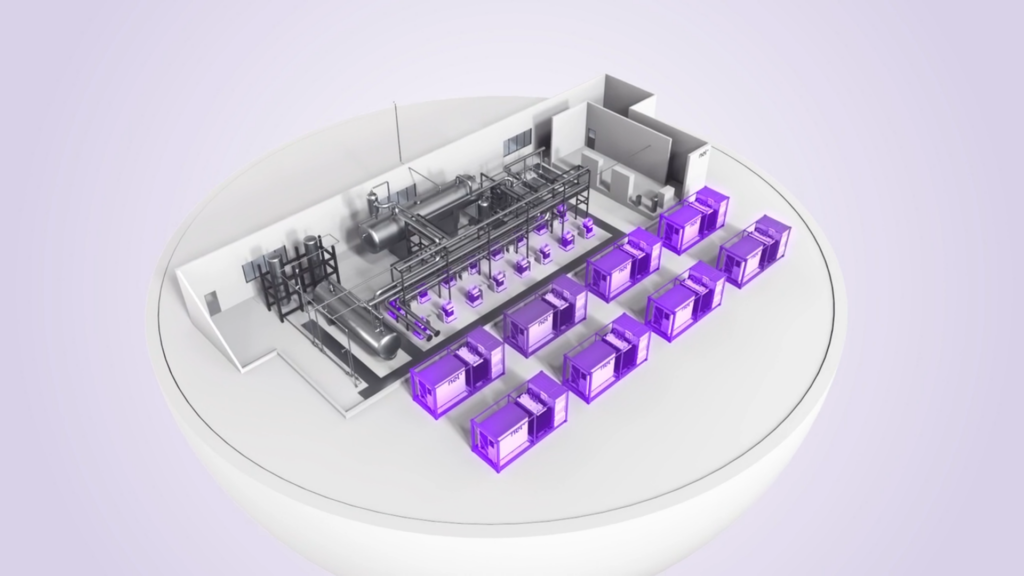

One of these is the partial decarbonization of Fertiberia’s fertilizer facility in Puertollano, which has a total ammonia production capacity of 200,000 tonnes per annum. Iberdrola operates the new solar to hydrogen facility, which will produce about 3,000 tonnes of renewable hydrogen per annum (or 17,000 tonnes of renewable ammonia) from 100 MW solar PV, a 20 MWh battery, 20 MW electrolysis capacity, and 11 pressurized hydrogen storage tanks (take a video tour of the site here). PEM electrolyzers from NEL were selected for this project. The first drops of renewable ammonia have recently been produced at the Puertollano site of Fertiberia. Currently, the plant operates in a hybrid operation with the remainder of hydrogen produced from natural gas feedstock.

The renewable hydrogen production facility in Puertollano was installed and inaugurated by Iberdrola, and is currently in the process of tuning and trials. According to Fertiberia, it is “kilometre zero of sustainable fertilization of the future”. In other words, it allows for learning-by-doing and generates precious operational experience, meaning that operational issues can be resolved before scale-up. The learnings from Puertollano can be used for future, large scale projects with hundreds of MWs of electrolyzer capacity.

Scaling renewable ammonia production

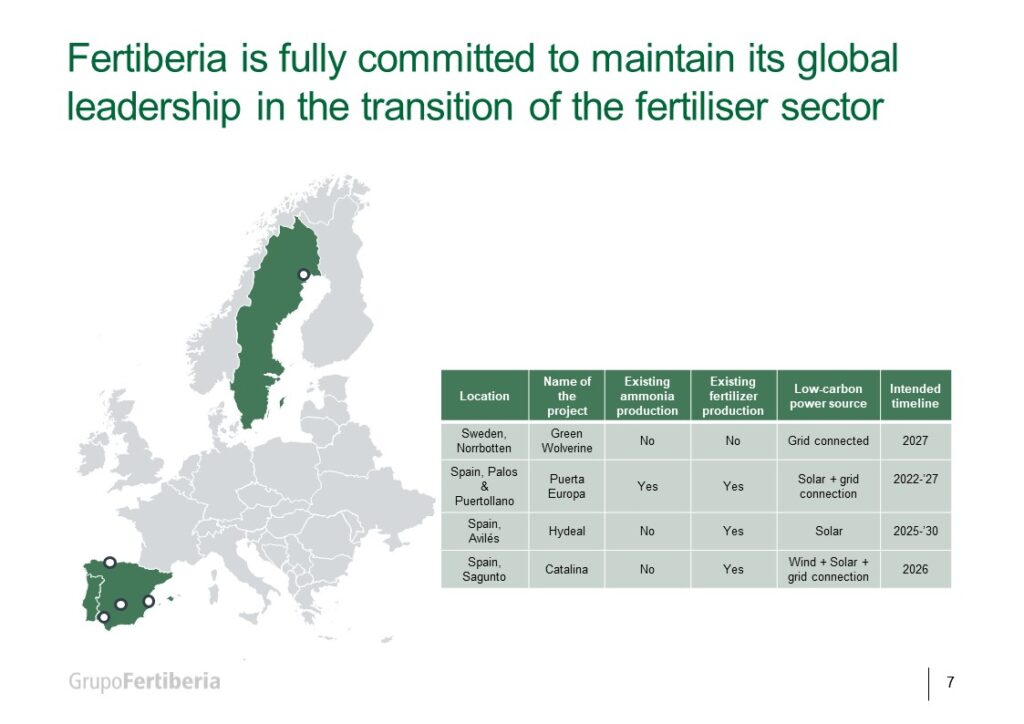

Fertiberia aims for net zero emissions from all of its fertilizer production facilities by 2035, which is only 13 years (!) from now. Thus, Puertollano is only the first of multiple fertilizer facilities that Fertiberia aims to decarbonize. The other announced projects are located in Spain and Sweden, totaling about 1.5 million tonnes of renewable ammonia per annum. Some projects are grid connected, while other projects are based on dedicated solar PV and/or wind.

Fertilizers are an existing application for renewable hydrogen, and nitrate-based fertilizers are considered low hanging fruit due to the absence of carbon in the product formulation. Urea-based fertilizer production, also in the portfolio of Fertiberia, is more difficult to decarbonize due to the carbon feedstock requirement. Natural gas may be replaced by biogas, decreasing the overall carbon footprint. Certification must be developed to distinguish between the carbon footprints of various ammonia and fertilizer production facilities, based on the carbon footprint of the feedstock.

Transitioning existing plants

Existing fossil-fed ammonia plants can be revamped to flexible ammonia synthesis loops for fluctuating hydrogen feeds. It should be noted, however, that the existing ammonia plants in Europe are above 40 years old on average, presenting an operational challenge. Thus, it may be considered to build only new “flexible” renewable ammonia plants.

Transitioning from natural gas-based hydrogen (via steam methane reforming, SMR) to renewable hydrogen (via electrolysis) has limited effect on the water/steam requirement. Stoichiometrically, SMR requires about 1.3 tonne steam per tonne ammonia, whereas electrolysis requires about 1.6 tonne water per tonne ammonia. Furthermore, downstream fertilizer production from ammonia via nitric acid production also releases water, which may be recycled to the electrolyzer. The byproduct oxygen from water electrolysis can be integrated with a nitric acid plant, reducing the air requirement and improving the energy efficiency.

Alkaline and PEM electrolyzers

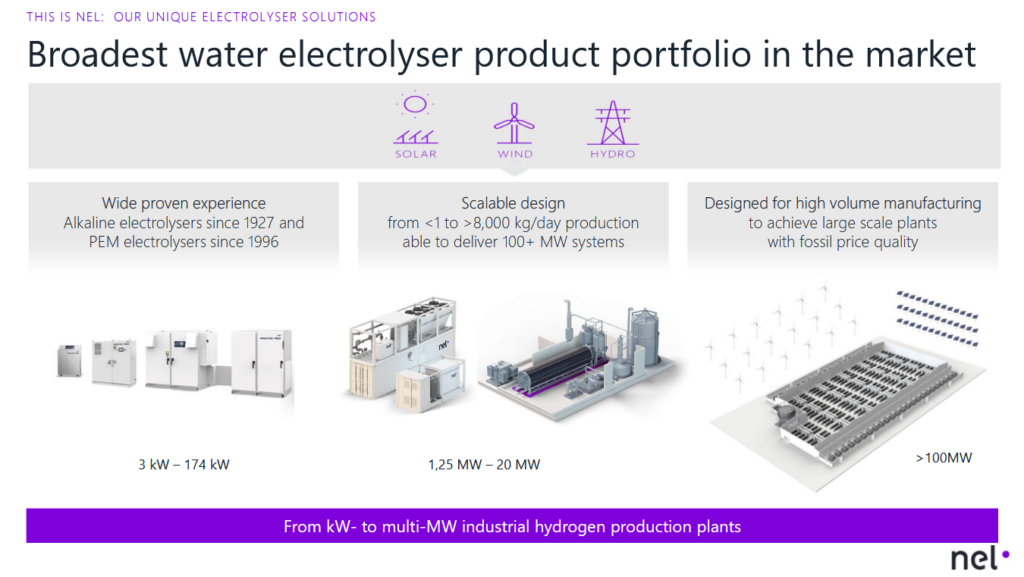

With roots dating back to 1927, Nel currently offers hydrogen technology covering the entire value chain, from production technologies to vehicle fueling stations. Thousands of the company’s electrolysers are installed around the globe, and Nel specializes in the manufacture of both alkaline and PEM units.

Depending on the project specifics, future electrolysis-based ammonia plants may use only alkaline or PEM electrolyzers, or combine the two electrolyzer technologies – especially in large scale projects with continuous production and renewable power feed. Alkaline electrolyzers currently benefit from a lower cost and efficient operations at full load capacity. PEM electrolyzers have a quicker intermittency response to renewable electricity fluctuations, and lower footprint requirement. A general supply chain risk of PEM electrolysis is the use of precious metals such as Iridium and Platinum, whereas Nel’s alkaline electrolyser units only requires small amounts of nickel to manufacture.

Ramping up electrolyzer manufacturing

One of the key aspects to decrease the cost of renewable hydrogen (and ammonia) production is the industrialization and scale-up of electrolyzer manufacturing capacity. Ramping up production capacity via automation improves quality and decreases manufacturing cost, while standardization and modularization reduces the risk and installation time for the client.

An example of progress in this space is Nel’s alkaline electrolyzer manufacturing plant in Herøya (Norway). Five years ago, Herøya had an annual capacity of 40 MW per year, but Nel has recently increased its manufacturing capacity up to 500 MW per annum. A second, fully-automated assembly line of additional 500 MW per annum has been launched for construction, expecting to come on line in mid 2024. The total future production capacity of 1 GW per annum follows the project commitments (size-wise) of Nel’s clients worldwide. Nevertheless, electrolyzer manufacturers still require commitments from governments & clients before scaling up manufacturing capabilities further.

More pioneer projects in the works

As another interesting example of pioneer projects to produce green hydrogen and green ammonia, Nel has been selected by Skovgaard Energy to provide electrolyzers for a world-first, “dynamic” green ammonia plant to be installed in Denmark, which is based on solar and wind electricity. The project is a Danish-government-funded pilot at Lemvig in western Jutland, Denmark, with Topsoe (as the ammonia-technology provider) and Vestas (wind turbine supplier) also collaborating. Learnings from this project with Nel electrolyzers will be key to preparing for ramp up to larger-scale renewable ammonia production, and achieving optimal operations with lower risks. Next to this, electrolyzer manufacturers such as Nel are currently performing important internal R&D programmes to reduce costs and improve the electrolyzer performance and flexibility, as electricity cost accounts for the majority of OPEX for renewable hydrogen production.

Next episode: to northwest Africa

Join us on Thursday 27 October @ 2PM CEST for the next episode, where we shift our focus onto two mega-scale, renewable ammonia projects in Northwest Africa: AMAN in Mauritania, and AMUN in Morocco. To discuss, we welcome Nouri Chahid (General Manager Morocco & Mauritania, CWP Global) & Lloyd Pinnell (Associate, SYSTEMIQ Ltd.), who will be joined in conversation by AEA Stakeholder Relations Manager Andrea Guati Rojo. Register today, and make sure to submit your questions for the speakers in advance.