Solar ammonia, available in Spain from 2021

By Trevor Brown on July 30, 2020

Last week, Iberdrola and Fertiberia announced plans to start producing green ammonia for “fertilizantes libres de emisiones” (emission-free fertilizers).

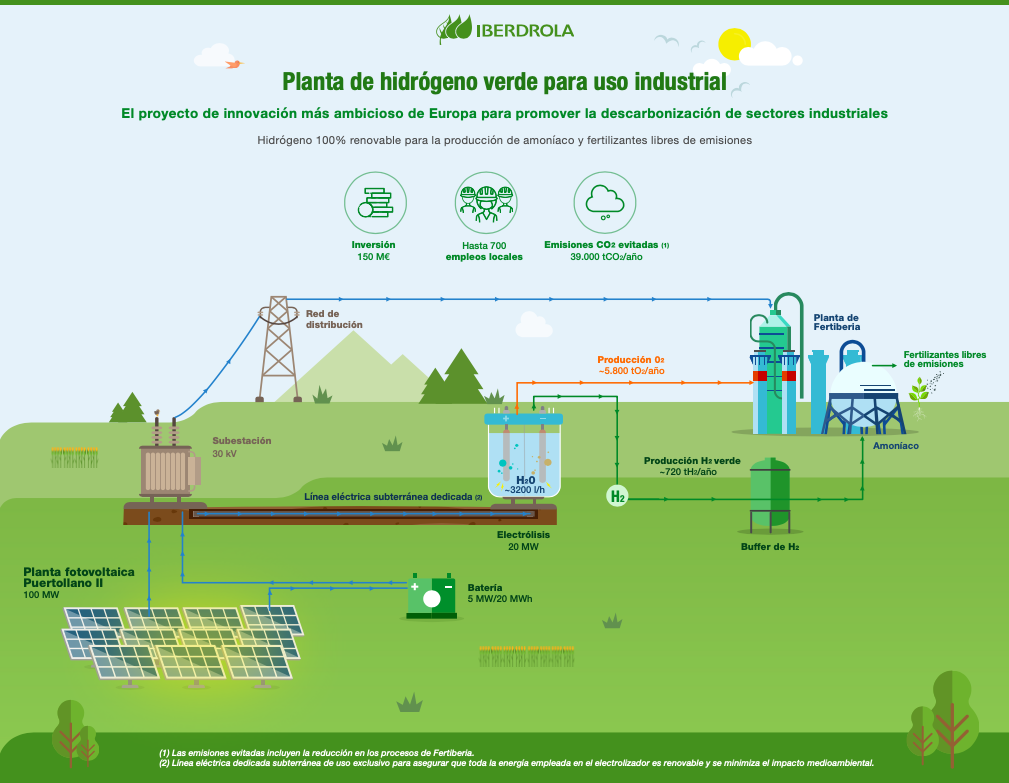

Iberdrola will invest EUR 150 million to build the 100 MW “Puertollano II” solar field, with a 20 MW electrolyzer bank to produce renewable hydrogen. Fertiberia will “update and modify” its existing Puertollano plant to consume this green hydrogen, reducing its natural gas use by “over 10%,” and producing green ammonia beginning in 2021.

Iberdrola and Fertiberia are allied in their commitment to the sustainability of the industrial sector. The companies have signed an agreement, which will trigger an investment of 150 million euros, to construct the largest plant to produce green hydrogen for industrial use in Europe. The Spanish companies are to build the plant in Puertollano and it will be operational in 2021 …

“The partnership with Iberdrola allows Fertiberia to take a further step in its ambition to become a european reference for sustainable solutions for agriculture and to lead the paradigm shift required for the energy transition in the chemical sector, thanks to the manufacture of green ammonia from domestic renewable energy sources”, indicates Javier Goñi, the president of Fertiberia.

The project will help move forward in maturing the technology for green hydrogen production and turn it into a solution for efficient decarbonisation in the medium term, both for the industry that uses it as a raw material and for processes that are difficult to decarbonise.

Iberdrola announcement, Iberdrola and Fertiberia launch the largest plant producing green hydrogen for industrial use in Europe, July 24, 2020

Planta de hidrógeno verde

There are some noteworthy details in the plans announced by Iberdrola and Fertiberia.

First, the system uses buffers to align the variable solar power with the steady-state Haber-Bosch ammonia process. This includes a 5 MW / 20 MWh battery on the electron production side, and a hydrogen storage tank (no capacity specified) on the molecule production side. There is also a grid connection.

Second, the fertilizer plant will purchase both of the products coming out of the electrolyzer: while the hydrogen is feedstock for green ammonia, the oxygen will be used in the nitric acid plant. As I understand it, the impact of using pure oxygen, as opposed to air, would be to increase the efficiency of the nitric acid production process and decrease the emissions.

Third, this will be operational next year, in 2021. That is to say: this isn’t a feasibility study, or a commitment to do something in the future. It is real project, and it is being implemented now.

The speed at which green ammonia projects are developing cannot be understated. While the economics may be unforgiving today — as I quote below, Iberdrola will be selling this green hydrogen at a loss — there is a price impact of building each of these plants. Not only will the capital cost be driven down, through electrolyzer volumes leading to manufacturing cost reductions, but the industry learning curve improves. Technology innovation, business model innovation, and market innovation are all moving parts in this equation.

(For example, while this project may have excellent reasons for relying solely on solar inputs, other projects, like the 1.2 million ton per year green ammonia plant in Saudi Arabia announced earlier this month by Air Products and NEOM, improve their economics by combining complementary wind and solar inputs. This increases the capacity factor of the electrolyzers, and therefore decreases the capex per ton.)

To learn, you must get on the learning curve, you cannot simply watch. The importance of this to the project is made clear when the announcement claims that Fertiberia “will be the first European company in the sector to develop expertise in large-scale green ammonia generation.”

Iberdrola’s Race to Zero

Earlier this month I wrote about another of Spain’s ten biggest companies, the oil and gas major Repsol, investing in ammonia as a carbon-free fuel for the future (Wärtsilä, Repsol, and Knutsen to test ammonia four-stroke engine). Repsol is one of the only major fossil energy companies to have a clear commitment to achieve net-zero emissions by 2050 and, in June, it announced it would begin to develop green hydrogen production in Bilbao.

Also in June, Iberdrola joined the Race to Zero, a UN-sponsored “global campaign to rally leadership and support from businesses, cities, regions, [and] investors for a healthy, resilient, zero carbon recovery.”

The ultimate goal of this initiative is to achieve an emissions-neutral economy by 2050. This will reduce future threats from the repercussions of climate change and contribute towards the creation of quality employment and a strong path for sustainable and inclusive growth.

… once the health crisis is over, we must plan the rebuilding of the economy, paying attention to governments’ stimulus packages. According to ‘Race to Zero’, the size and planning of these support measures — between US$10 trillion and US$20 trillion — will shape our economy for the coming decades.

Iberdrola announcement, Iberdrola is backing the ‘Race to Zero’, a global alliance to join forces towards a carbon-neutral economy by 2050, June 5, 2020

It is in this context that we can view Iberdrola’s “record 10,000 million euros investment this year.” As it states in the Puertollano announcement, “electrification is an essential lever for economic recovery and employment.”

And while the Puertollano project is a small part of Iberdrola’s 16 GW renewable energy portfolio in Spain, this is its first green hydrogen project and, as such, an opportunity to learn — and learn fast.

“We wanted to start with this site to jump-start the project, to make it real,” explains Agustín Delgado, head of innovation at Iberdrola … “You have heard about many hydrogen projects, but not too many of them are real,” he adds …

The persistent concern, however, around both blue and green hydrogen is the cost. It is much cheaper to make hydrogen from fossil fuels than it is to make clean hydrogen. While grey hydrogen costs about €1.5 per kilo to produce, green hydrogen costs €3.5-€5 per kilo.

“The first thing we are doing to decrease the cost of hydrogen, is that we need a cheap source of renewable electricity,” says Mr Delgado.

But even with the cheap solar power available near Puertollano, the green hydrogen project will not be profitable. Iberdrola will sell hydrogen and power to the fertiliser plant at a loss.

“We will hopefully get into a virtuous cycle, as the cost will decrease, and as the cost decreases we will get into more sites,” says Mr Delgado.

Financial Times, Solar provides fertile ground for ‘green’ hydrogen chemical plant, July 15 2020

Fertiberia decarbonizing a ‘hard to abate’ sector

According to the announcement, Fertiberia’s Puertollano plant is “already one of the most efficient in the European Union,” but it is still, like all conventional ammonia plants, a significant source of GHG emissions.

It isn’t obvious what impact a renewable hydrogen feed would have on an ammonia plant’s energy efficiency (presumably it is more efficient to use hydrogen directly than to produce hydrogen indirectly, but ammonia plants are already highly integrated and efficient), but the impact on its GHG emissions will be clear.

For every ton of green ammonia, roughly two tons of CO2 are avoided. For every ton of green hydrogen, roughly ten tons of CO2 are avoided. It is these absolute reductions in GHG emissions that matter.

Fertilizer has long been regarded as one of the “hard to abate” sectors, but projects like this will change that perception.

In recent decades, the sector has been focused on energy efficiency, which offers fertilizer producers very limited potential for absolute GHG emission reductions. Without fuel switching and feedstock switching (or carbon sequestration), ammonia producers can not achieve any significant improvement in GHG emissions.

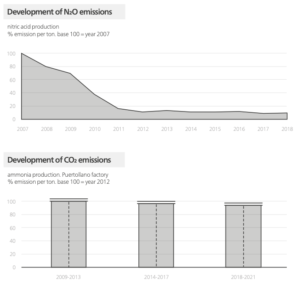

A pair of charts from Fertiberia’s 2018 Annual Report illustrates this point well. Technology improvements (specifically catalyst developments) have massively improved the N2O emissions from nitric acid production over the last decade, a reduction of roughly 90%.

Across the same period, there was almost no improvement in CO2 emissions from ammonia production.

Of course, this new 100 MW solar farm / 20 MW hydrogen electrolyzer will not vastly change that picture: they will only produce around 720 tons of renewable hydrogen per year, enough to make roughly 4,000 tons of green ammonia (about 2% of Puertollano’s annual capacity of 200,000 tons). This project is therefore quite similar in scale to other first movers in the fertilizer industry, like Yara’s Porsgrunn plant (hydro) or Phase 0 of its Pilbara green ammonia project (solar), or Ballance Agri-Nutrients’ Kapuni plant (wind).

Nonetheless, like those other projects, Fertiberia’s green ammonia will be completely decarbonized, to an extent unachievable through incremental efficiency improvements. And there is no limit to how much additional green hydrogen can be introduced in future years to decarbonize the rest of the plant’s output.

As Iberdrola’s Mr. Delgado said to the Financial Times, “as the cost decreases we will get into more sites.”