Taking the market’s temperature: European Hydrogen Bank awards €720 million

By Oscar Pearce on May 16, 2024

The auction

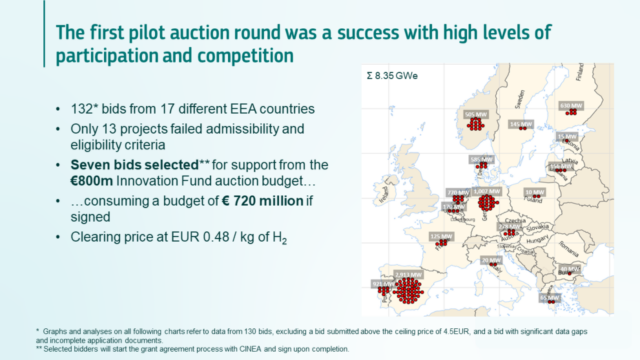

Click to expand. The European Hydrogen Bank’s auction attracted bids from 17 EEA nations (European Hydrogen Bank, Apr 2024).

The European Hydrogen Bank has awarded nearly €720 million to seven renewable hydrogen and ammonia projects in the EEA. The winning bids will receive €0.37 – €0.48 in subsidies per kilogram of renewable hydrogen, and will collectively produce 1.58 million tons of renewable hydrogen over ten years.

The subsidies are funded by Europe’s Innovation Fund, which draws on revenue from the EU’s Emissions Trading Scheme. The auction is a Contract-for-Difference (CfD) scheme, similar (but not identical) to the H2Global Instrument. Hydrogen plant developers submit proposals to the EU, seeking subsidies to bridge the gap between the cost of producing hydrogen and the expected offtake price to be paid by customers. Amongst other key criteria, projects scored higher if they had offtake contracts already in place, or were at a pre-contractual stage of discussions. Looking ahead, the grant agreements from the auction will be signed by November 2024, with renewable hydrogen production to begin in a maximum of five year’s time.

The winning bids

7 projects were ultimately successful in the auction. These projects are targeting a variety of markets, ranging from maritime fuel to fertiliser, and are located across Spain, Portugal, Norway and Finland. The projects also vary significantly in volume, from 17 to 511 kilotons H2 over the 10 year span the subsidies will apply. 3 of the 7 projects will produce ammonia, namely MP2X (Portugal), Catalina (Spain) and SKIGA (Norway).

| Project | Coordinator | Country | Bid price (€/kg) | Volume (kilotons H2 over 10 years) | Primary output | Primary market sector(s) |

| MP2X | Madoquapower 2x | Portugal | 0.48 | 511 | Ammonia | Maritime, Fertiliser |

| Catalina | Renato Ptx Holdco | Spain | 0.48 | 480 | Ammonia | Fertiliser |

| SKIGA | Skiga | Norway | 0.48 | 169 | Ammonia | Ammonia imports to Germany |

| HYSENCIA | Angus | Spain | 0.48 | 17 | Hydrogen | Steel, Fertiliser |

| Grey2Green-II | Petrogal S.A. | Portugal | 0.39 | 216 | Hydrogen | Refinery |

| El Alamillo H2 | Benbros Energy S.L. | Spain | 0.38 | 65 | Hydrogen | Unspecified |

| eNRG Lahti | Nordic Ren-Gas Oy | Finland | 0.37 | 122 | Hydrogen | e-Methane |

To accelerate progress towards its own hydrogen and ammonia production goals, the German government has announced €350 million in funding for proposed projects located in Germany that were unsuccessful in the European Hydrogen Bank’s auction process. These national subsidies will go to the German projects that achieved the highest ranking in the auction. The auction results show that, although Germany had the second most project bids, it also had one of the highest levelised costs of renewable hydrogen production, affecting final rankings. Projects in EU countries with low levelised costs that missed out on funding include those in Sweden and Greece.

The European Commission indicates that other EU states could replicate this “Auctions-as-a-Service” mechanism in future European Hydrogen Bank auctions.

Hints about the emerging EU demand market

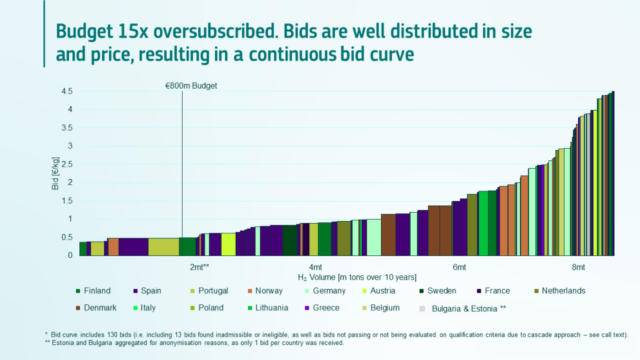

Click to expand. The total value of bids far surpassed the available budget (15x). The bids originated in a range of EEA nations (European Hydrogen Bank, Apr 2024).

Aside from the injection of much-needed funding, these auctions have served a vital purpose in price discovery and revealing demand trends.

The total bidding pool – 130 bids and 15x the total budget value – reveals strong industry interest (see left). The smooth bid value curve is a promising sign for future auctions, suggesting that the successful recipients in this round are not outliers.

Off-take distribution

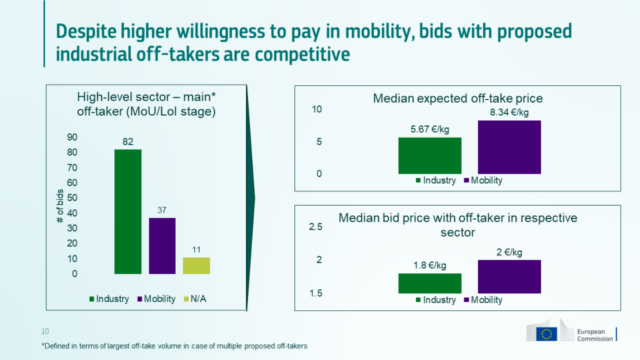

Click to expand. Despite higher anticipated prices from mobility offtakers, bidders with industrial offtakers requested lower subsidies and accounted for a larger share of the bids. (European Hydrogen Bank, Apr 2024).

The total bidding pool was also revealing in terms of off-take distribution (see right). Projects with proposed or confirmed industrial off-takers outstripped those with mobility off-takers in the number of bids (82 to 37). Bidders with industrial offtakers also requested a lower median subsidy (i.e., bid price) at 1.8 €/kg, compared to 2 €/kg. This is despite bidders expecting that industrial offtakers will actually pay lower off-take prices than mobility offtakers (5.67 €/kg compared to 8.34 €/kg).

Off-take price structures

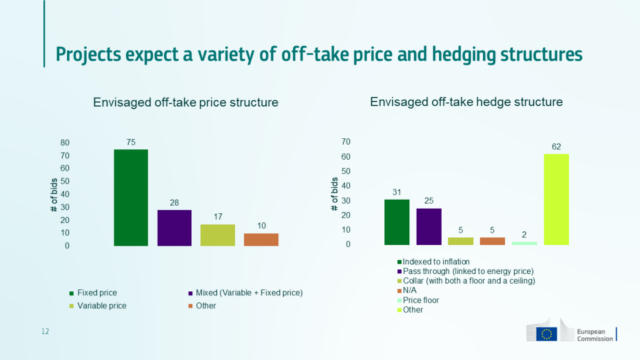

Click to expand. Bidders gravitated towards a fixed offtake price, while using a range of hedge structures. (European Hydrogen Bank, Apr 2024).

Bidders in the auction embraced a range of offtake price and hedging structures. Most schemes will use a fixed offtake price over the ten years (ideal for developers), though variable and mixed approaches were taken by some. Proposed hedge structures were less consistent, with a mix of indexations to inflation or energy costs, price ceilings and price floors in use. Hedge structures are ideal for buyers, as they give flexibility and allow for volatility, usually by indexing the production cost of hydrogen to another price (like fossil-based hydrogen). The soundness of these hedge structures was a key criteria assessed as part of determining the “financial maturity” of each bidder.

Likely off-take sectors

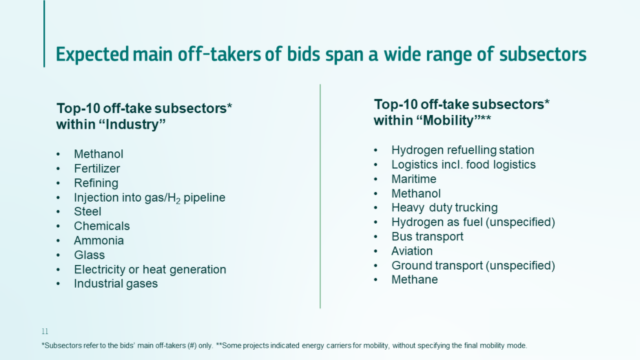

Click to expand. The top-10 off-taking sub sectors from both the industry and mobility categories. (European Hydrogen Bank, Apr 2024).

Finally, in terms of off-taking subsectors, the European Hydrogen Bank has released the Top-10 from both industry and mobility. The subsectors (see left) demonstrate the breadth of emerging use-cases for renewable hydrogen and ammonia.

For full results and further information, see the European Commission’s summary of results and press release. The Commission plans to launch a second European Hydrogen Bank auction by the end of this year.