The Ammonia Wrap: Ørsted’s P2X vision for the North Sea, Gunvor’s new sustainability commitments, the finance world backs green hydrogen and Hydrofuel-Ontario Tech’s new partnership

By Julian Atchison on April 07, 2021

Welcome to the Ammonia Wrap: a summary of all the latest announcements, news items and publications about ammonia energy.

Ørsted unveils its P2X vision for the North Sea

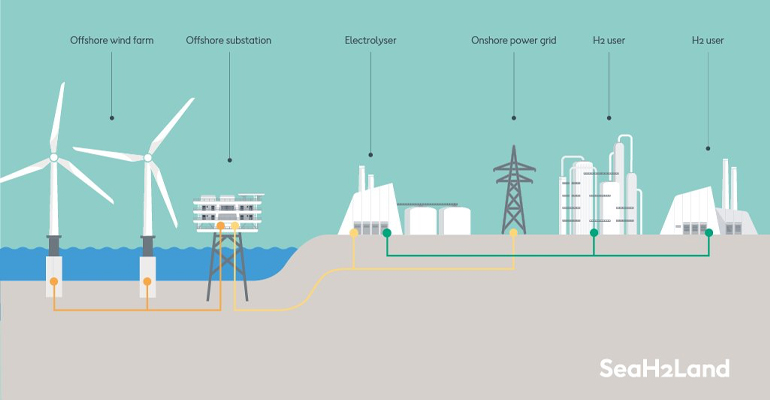

2GW of offshore wind turbines will power 1GW of electrolysers that feed directly to end users and transport pipelines in a new “North Sea Port cluster“. ArcelorMittal, Yara, Dow Benelux, and Zeeland Refinery will all support the development of the cluster and use the renewable hydrogen for the sustainable production of steel, ammonia, ethylene, and other products.

The cluster also allows for the further decarbonisation of Yara’s largest ammonia production plant at Sluiskil. In 2019 Ammonia Energy reported on an agreement between Dow and Yara to use waste hydrogen for ammonia production — one of the first decarbonisation “revamps” of an ammonia plant worldwide — and then in 2020 on Yara’s announcement that Ørsted offshore wind power and an on-site 100MW electrolyser would combine to produce 75,000 tonnes per year of green ammonia at the plant (beginning in 2024-5). We look forward to seeing how the SeaH2Land project develops and accelerates these plans.

For a deeper look at some of the challenges and opportunities associated with electrifying industry in north-west Europe we recommend two new resources: this in-depth video from Voltachem exploring how to build viable value chains in the region, and a detailed life-cycle analysis of wind-to-hydrogen production in the Netherlands. In the latter TU Delft, Leiden University and ENGIE collaborated to investigate whether the proposed vast scale-up of alkaline and PEM electrolyzers by 2050 will be sustainable. The answer? Yes!

Energy trader Gunvor commits $500 million to sustainability, emissions reductions

As part of a new set of sustainability commitments, Gunvor will establish a dedicated investment arm (Nyera, or New Era in Swedish) to identify and pursue $500 million in non-hydrocarbon investments, incorporate low and zero-carbon fuels like ammonia into its chartered shipping fleet, support the commercialisation of alternative fuels like ammonia, and explore opportunities to develop logistics and supply chains for green hydrogen and green ammonia.

Finance world backs green hydrogen

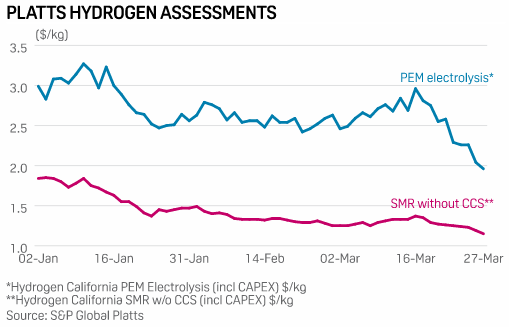

New hydrogen price assessments from Platts will inform the UK’s new national hydrogen strategy (we first reported on the development of these assessments in late 2019). S&P Global Platts will provide updates on three low-carbon pathways for hydrogen production: auto thermal reforming of natural gas with CCS, proton exchange membrane electrolysis and alkaline electrolysis.

Energy analysts at Barclays will begin covering electrolyser companies ITM, McPhy and Nel. With the potential for the global electrolyser market to increase in size 150-fold by 2030, Barclays see these three organisations as key to the emerging clean hydrogen industry.

And several participants in the US-based “Hydrogen Forward” project will join forces to become cornerstone investors in the FiveT Hydrogen Fund. Plug Power, Chart Industries and Baker Hughes will all contribute to FiveT: a clean-hydrogen-only private infrastructure fund dedicated to delivering clean hydrogen infrastructure projects at scale.

Hydrofuel and Ontario Tech join forces

A new letter-of-intent will see Hydrofuel support ammonia energy research at Ontario Tech University, as well as assisting with the commercialisation of new technologies. Ammonia-fueled power generation, fuel cells, converted diesel and gas engines and solar-to-ammonia production are all potential research areas to be funded, with contributions to be drawn from a fully-subscribed, $1.3 million investment offering. Hydrofuel have made huge progress in recent years with their conversion of diesel engines to ammonia-fed, both heavy transport and passenger vehicles.

A new blue hydrogen/ammonia collaboration

And ENEOS and Aramco have signed a new MoU to explore potential opportunities for establishing a blue hydrogen and blue ammonia supply chain between the Middle East and Japan. Similar agreements between ADNOC and GS Energy, as well as Aramco and Hyundai Heavy Industries (two Middle East-Korea partnerships) were covered in the Ammonia Wrap earlier this month.

Sign up for weekly AEA updates

Make sure you’re signed up for AEA email updates, including our weekly newsletter featuring wrap articles just like this one.