Transitioning to ammonia & hydrogen power in Chugoku, Japan

By Geofrey Njovu on June 11, 2024

Click to enlarge. The strategy document identifies industrial areas in the Setouchi region where hydrogen/ammonia can be introduced for thermal generation. Source: The Chugoku Bureau of Economy, Trade and Industry.

In the westernmost part of the island of Honshu is the Chugoku region. Located within this region is Setouchi, which houses some of Japan’s largest industrial complexes.

The area relies on fossil-fueled thermal power plants for 53.2% of its total power, which is nearly five times the national average of 11.1%. Further, the area’s 3,500 tons of CO2 emitted per ¥1 billion ($6.4 million) of Gross Regional Product (GRP), is about twice the national average.

To address this, the Chugoku Bureau of the Ministry of Economy, Trade and Industry (METI) has hatched a new strategy. At the core of this plan is to reduce the carbon footprint of power generation by replacing fossil-based power generation with ammonia/hydrogen co-firing.

The strategy document (Japanese language) identifies several large industrial sites at which ammonia/hydrogen-fired thermal power generation can be introduced. Among others, industrial products from these sites include refined petroleum, chemicals, cement, steel, machinery, and semiconductors..

Decarbonisation initiatives already in play

The report highlights several ongoing initiatives familiar to Ammonia Energy readers. These include:

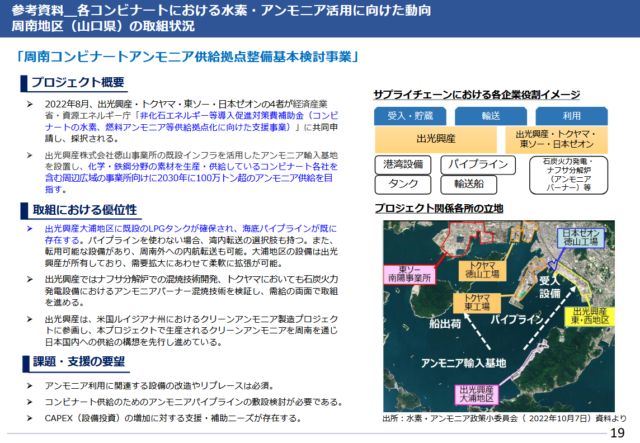

- a partnership between Idemitsu Kosan, Tokuyama, Tosh and Zeon Corporation to utilise existing infrastructure to develop an ammonia import base capable of handling over 1 million tons at the Shunan Petrochemical Complex. Earlier this year, Idemitsu announced it was part of a consortium developing a mega-scale ammonia production project in Louisiana, USA, with low-carbon ammonia to be imported via the new import base at Shunan

- the conversion of existing LNG assets at the Namikata terminal to make it a million-ton-per-year ammonia import hub

- and UBE Mitsubishi Cement Corporation’s ammonia co-firing demonstrations to produce cement clinker in Ube

The report also highlights several localised transition authorities considering the use of ammonia fuel (amongst other options): the Mizushima Complex Development Promotion Council, the Niihama Port Carbon Neutral Project, and the Sakaide Port Carbon Neutral Port Creation Council.

Also featured is a collaboration between ENEOS Corporation and JFE Steel Corporation to jointly develop a “CO2-free hydrogen” receiving, storage and supply base at the Mizushima Complex, utilising MCH as a hydrogen carrier.

Fuel requirements

Click to enlarge. An ongoing initiative by Idemitsu Kosan, Tokuyama, Tosh and Zeon Corporation to develop an ammonia import base capable of handling over 1 million tons at the Shunan Petrochemical Complex is highlighted in the new strategy report. Source: The Chugoku Bureau of Economy, Trade and Industry.

At 20% co-firing, the strategy estimates that, by 2030, the region will require about 3.21 million tons and 270,000 tons per year of fuel ammonia and hydrogen respectively. According to the report, the region does currently produces around 2 million tons of fossil-based ammonia each year (primarily via Ube Chemical’s Fujimigara complex), but nearly all of this production capacity will close within the decade. Imports will be necessary to fill the supply gap. All indications are that there are few possibilities for decarbonisation retrofits for these production assets, and the owning organisations have already factored in emissions reductions and cost savings from closing these facilities into their long-term strategies.

To fully decarbonise its thermal energy generation by 2030, the region would need about 16.03 million tons and 1.36 million tons of ammonia and hydrogen, respectively. This is compared to an existing global seaborne ammonia trading market of 17 million ton total.

Challenges to overcome

When surveyed, industrial stakeholders in the region highlighted the complexity/feasibility of equipment retrofits, securing finance for these conversions, and uncertainty about regulatory compliance as the key challenges to be overcome before ammonia fuel can be used. For their part, the Chugoku METI Bureau sees collaborations such as joint ventures, concentrated demand centres featuring common-use infrastructure, and partnership with other supply centres as key factors in scaling and de-risking the ammonia supply chain.

To put these numbers in some context, JERA recently announced its long-term strategy to decarbonise its own operations. The strategy projects the company’s ammonia handling capacity at 7 million tons by 2030, in addition to plans to increase its renewable energy and LNG portfolio. JERA aims to increase ammonia co-firing to 50% during the 2030s and then 100% substitution in the 2040s, further increasing this forecast demand.