Fuel Economy Standards, and the Roles of Ammonia

By James Grieve on July 31, 2019

In the news this week, California and four automakers (BMW, Ford, Honda and VW) signed an agreement on fuel economy standards, rising 3.7% per year to about 50 MPG in 2026. This agreement, as well as previous California and Federal standards, give automakers flexibility to meet the standards with incentives and credits for new technology such as electric, hybrid, and alternative fuel vehicles.

Still behind the curve

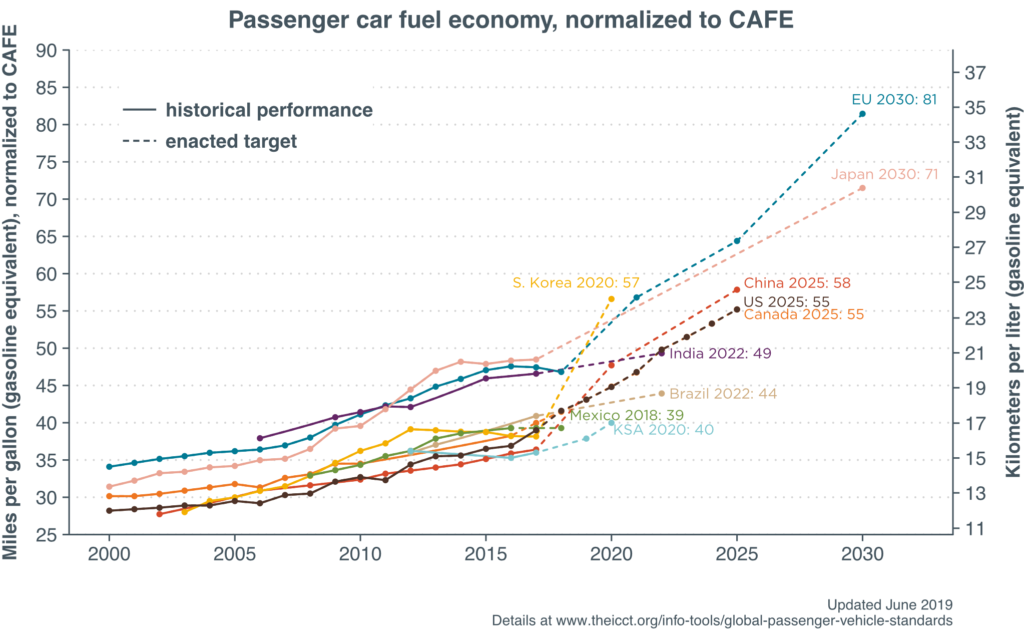

Standards drive innovation, and it’s no accident that Japan and Europe have a strong and globally competitive auto industry along with the toughest fuel economy standards. See the following chart from the International Council on Clean Transportation (ICCT).

The recent jump in fuel economy standards in South Korea is propelling the country to introduce advanced technologies such as electric and fuel cell electric vehicles (FCEVs). In the short term, a rapid change is expensive for the automotive OEMs (original equipment manufacturers). However, as a tipping point for battery and fuel cell vehicles is becoming apparent, being first to commercialize these technologies at scale could prove a huge advantage to Japan, South Korea, and Europe.

It is a complicated time for automotive product planning. USA customer demand for small / efficient cars is weak and while the transition to electric and fuel cell propulsion is underway, the market potential of these technologies in the next six years is far from certain.

Is there room for ammonia in this story?

Ammonia is likely to have a role as a carbon-free hydrogen carrier for PEM FCEVs, where hydrogen is produced and purified at the filling station. Ammonia could be used directly as a fuel in Spark Ignition Engines and Fuel Cells, but there are different opinions on the feasibility of using ammonia as a fuel for privately owned cars and trucks. I’m bullish on this personally. Ammonia is already used in many low emission diesel vehicles worldwide, in the form of urea, for SCR (selective catalytic reduction) aftertreatment. Direct ammonia is also used in some commercial vehicle SCR applications, with systems made by Faurecia / Amminex. Extended Range Electric Vehicles with ammonia engine or ammonia fuel cell APUs (auxiliary power units) seem very possible, but not without many years of research, development and validation.

The Hydrogen & Renewables Transition

The California / Automaker agreement provides certainty for product planning and allows these OEMs to have a more globally competitive product range. But it is not the end game. In December of 2018, Europe agreed on a 37.5% cut in automotive CO2 emissions by 2030. This is becoming technology forcing, because electric vehicles (powered by the rapidly decarbonizing grid) and low-carbon and carbon-free alternative fuels (used in hybrid and fuel cell vehicles) are essential in high volume if a full product range of larger and higher performance vehicles is to be marketed in this time frame. Further cuts by 2040 and 2050 will accelerate the roll out of electric and fuel cell vehicles.

The transition to Hydrogen and Renewables seems unstoppable. Let’s do our part with Ammonia technologies. Let’s get ahead of the curve.

A guest post by M. James Grieve, CTO of MicroEra Power and Chairman of the Ammonia Energy Association’s Technology Directions Committee. James has over 30 years automotive engineering experience with emission controls, engine management systems, solid oxide fuel cells, hybrid vehicles, and alternative fuels. He is named on over 40 patents. He worked previously with GM, and was a Chief Scientist for Delphi.