Industrial demonstration of ammonia cracking: exploring global progress

By Kevin Rouwenhorst on April 16, 2025

During the AEA’s Annual Conference 2024, the status of ammonia cracking was explored in detail. A wide range of applications is currently favored for ammonia cracking, including historical applications like metallurgy and heavy water production. New applications include engines, fuel cells, gas turbines, and hydrogen production at energy import hubs. These applications range in size from a few kilograms of hydrogen production per day, to hundreds of tons of hydrogen production per day.

Click to expand. Hydrogen purity requirements for PEM Fuel cells and for Hydrogen pipelines. Source: AEA.

Across applications, the requirement for hydrogen purification of the cracked gas (syngas = hydrogen and nitrogen mix) downstream of the actual cracker (furnace) varies widely, from no purification required, right up to strict requirements for PEM fuel cell grade hydrogen. Hydrogen purification is not required for either of the two historical commercial applications for ammonia cracking (metallurgy and heavy water production), nor for some of the new applications, for example when the syngas can be used directly as fuel in power generation, e.g. for co-firing in retrofitted gas turbines. For the integration of ammonia cracking with – for example – low-temperature PEM fuel cells, the most stringent hydrogen purity requirement of 99.97 mol.% H2 (ISO standard for PEM fuel cell grade hydrogen; ISO 14687:2019) can be met with mature and readily available PSA (pressure swing adsorption) technology, or by integrating membrane reactors. There is an interesting overlap here in hydrogen purity requirements for two new applications for ammonia cracking at opposite ends of the size scale: low-temperature PEM fuel cells, and large-scale energy import hubs.

Pipeline-quality hydrogen production via ammonia cracking at energy import hubs has gained substantial attention in east Asia and western Europe. Post cracking and purification, hydrogen is intended to be fed into extensive pipeline networks for distribution to industrial users of hydrogen. The technology providers for large-scale ammonia cracking technology typically fall into two categories, namely (1) ammonia licensors (Casale, KBR, ThyssenKrupp Uhde, and Topsoe), or (2) industrial gas companies and EPCs (Air Liquide, Air Products, Linde, Johnson Matthey, Technip Energies). The exception to this trend is Duiker Clean Technologies (an ammonia burner technology supplier).

There is also a wide variety of companies focusing on smaller- and small-scale ammonia cracking technology, including AEA members AFC Energy (ammonia cracking for stationary power applications), Ammonigy (ammonia cracking for gas turbine blending), Amogy (electrically heated tubular ammonia cracking for fuel cell applications), Fortescue & Siemens (Palladium membrane-based ammonia cracking), GenCell Energy (ammonia cracking for stationary power applications), H2SITE (Palladium membrane-based ammonia cracking), Mitsubishi Heavy Industries (steam-heated ammonia cracking), and Syzygy Plasmonics (photocatalytic ammonia cracking).

Ammonia cracking technology for large-scale hydrogen production

The process steps for ammonia cracking are relatively similar among most technology providers. This is unsurprising, as most ammonia cracking technologies are based on the existing steam methane reforming process for converting gas to hydrogen.

First, liquid ammonia is pressurized to around 30-40 bar, with subsequent evaporation. After pre-heating, the ammonia cracking reaction occurs in a furnace with multiple parallel reactor tubes, with external burners. The reactor tubes are operating at 600-900°C, and are filled with catalysts to accelerate the ammonia cracking reaction. Sometimes a “pre-cracker” is added upstream to the main furnace, to optimize the energy efficiency of the ammonia cracker.

Nickel-based catalysts will most likely be used in tubular ammonia crackers for pipeline-quality hydrogen production at energy import hubs. Smaller-scale ammonia crackers may use Ruthenium-based catalysts as well, while Iron-Cobalt alloy-based catalysts are currently used in ammonia crackers at heavy water plants. Various AEA members supply catalysts for ammonia cracking, including BASF, Catator, Clariant, Heraeus, JGC Corporation, Johnson Matthey, Nikki-Universal, and Topsoe.

While usually gas-fed, the external burners can be fired with hydrogen-nitrogen-mix, PSA tail gases and/or ammonia in a “clean fuel mode”. The furnace flue gas can also be treated with a DeNOX system to comply with local emission regulations.

Downstream of the ammonia cracking furnace, the reactor effluent is cooled and uncracked ammonia is removed, typically via scrubbing with water. The effluent ammonia can be fed back into the reactor, or is used as fuel for the burners. Thereafter, the hydrogen and nitrogen are separated via a PSA, to yield the purified hydrogen product, and a nitrogen rich off-gas stream (tail gas, which is routed to the burners of the ammonia cracking reactor).

In a “clean fuel mode”, the overall hydrogen yield is typically in the range of 78-81% (138-144 kilograms of hydrogen obtained per ton of ammonia feedstock), as calculated based on the hydrogen atoms from the ammonia feedstock ending up in the hydrogen product stream. When gas is used for the burners, the hydrogen yield increases to 96% (170 kilograms of hydrogen obtained per ton of ammonia feedstock).

Derisking of ammonia cracking technology: catalyst, nitriding & burner fuel

Ammonia crackers for large-scale hydrogen production are similar in design to steam methane reformers, and many parts of the process scheme are already proven at the necessary scale. However, demonstration of the full, integrated process under relevant conditions is still required to reach TRL 9 (Technology Readiness Level).

Before scaling such ammonia crackers, technology derisking is required, including derisking of all the necessary components and equipment (catalysts, reactor tubes, and external burners) at the required scale.

Firstly, catalyst derisking includes mechanical and thermal stability tests under relevant operating conditions, as well as catalyst performance with a commercial grade anhydrous ammonia feedstock (which contains 0.2-0.5 wt.% water).

Secondly, the metal tubes used in tubular ammonia cracking must be sufficiently resistant against nitriding, a phenomenon where the metallic material in the tube reacts with nitrogen. Nitrides negatively affect the mechanical performance of the reactor tubes, possibly causing ruptures. Monitoring the performance of reactor tubes under relevant conditions is required. The metal tubes used in heavy water plants (operating at much higher pressures of 120-150 bar) are typically based on Inconel 625 (a high Nickel-containing alloy).

Thirdly, most hydrogen production plants are based on gas feedstock, and thus use gas burners to power the steam methane reforming process. Burners with a high hydrogen content are industrially applied elsewhere, such as for ethane crackers. Some technology vendors opt to use up to 100% ammonia as a fuel for the burners. Dual-stage ammonia burners are already operated in desulphurization, with outlet NOX levels as low as 50-80 ppmv (3% O2 in dry flue gas) without a DeNOX system. NOX levels below 5-10 ppmv are possible with a conventional DeNOX system. Derisking and demonstration of such burners for industrial-scale ammonia cracking is still required.

So, what are some of the current projects moving forward with all this required derisking and demonstration?

Air Liquide: operating industrial-scale ammonia cracking at the Port of Antwerp-Bruges

A model of the Air Liquide SMR-XTM tube with the internal helix-heat exchanger.

Air Liquide’s steam methane reformers are referenced up to 720 parallel tubes per furnace, producing up to 496 tons of hydrogen per day. In the mid-2010s, Air Liquide developed the SMR-XTM technology, introducing a counter-current helix-heat exchanger inside the reactor tubes for steam methane reforming, to improve the energy efficiency of the overall process. Advantages of the process include a lower gas outlet temperature, and flexibility regarding steam production in the downstream process, including process designs without steam export.

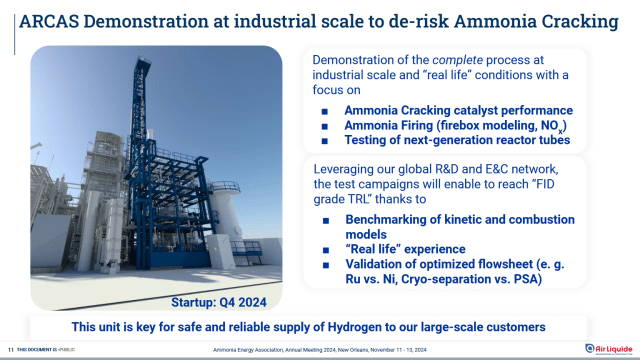

Air Liquide then adapted its SMR-XTM technology as a basis for its ammonia cracking technology. In a “clean fuel mode”, the reported hydrogen yield is about 139 kilograms of hydrogen per ton ammonia feedstock, or about 80%. In late 2023, Air Liquide announced that it will demonstrate its ammonia cracking technology under industrial conditions in the ARCAS project in Antwerp, Belgium, based on Air Liquide’s proprietary equipment.

Click to expand. Air Liquide’s ARCAS project for ammonia cracking. From Thomas Wurzel, NH3 cracking – technology de-risking accelerates time to market (Nov 2024).

In December 2024, Air Liquide received a 110 million Euro grant from the European Innovation Fund for the ENHANCE project, which aims to produce liquid hydrogen via ammonia cracking and subsequent hydrogen liquefaction. The production capacity will be around 30,000 tons of liquid hydrogen annually.

KBR: Derisking ammonia cracking technology in South Korea

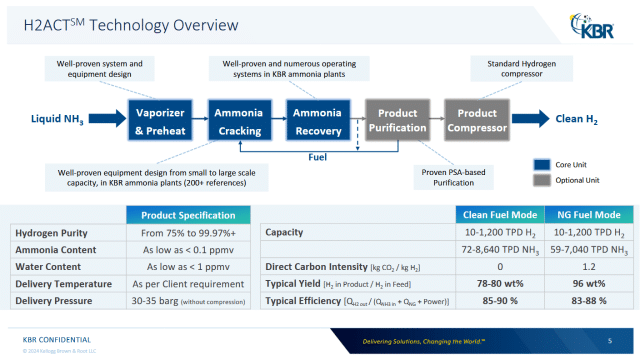

KBR has developed its ammonia cracking technology under the trademark H2ACT®. The single train capacity for KBR’s ammonia cracking technology is 10 – 1,200 tons of hydrogen produced per day, equivalent to 72 – 8,640 tons of ammonia cracked per day for a self-containing cracker (“clean fuel mode”). The hydrogen yield is from 139 kilograms of hydrogen obtained per ton of ammonia feedstock for a self-containing cracker with hydrogen-nitrogen burners. One of the aspects of KBR’s design is the use of a hydrogen-nitrogen mix (as opposed to a mix of hydrogen and ammonia) for the burners in a “clean fuel mode”, using burners already used by KBR in PurifierTM plants with similar fuel mix (high calorific value fuels such as syngas or NG with low calorific value fuels such as tails gases). If gas is used for the burners, the hydrogen yield can increase to 170 kilograms of hydrogen per ton ammonia.

Click to expand. KBR’s H2ACT® ammonia cracking technology. From Elena Stylianou, H2ACT: Empowering Energy Mobility through Large Scale Ammonia Cracking (Nov 2024).

KBR was selected by ISU Chemical for industrial hydrogen supply via ammonia cracking in Ulsan, South Korea. This project serves as derisking & demonstration of KBR’s industrial ammonia cracking technology. By 2027, the Suso project aims for 10 tons of hydrogen production per day, an industrial scale unit with all equipment, controls and safety systems fully developed and commercially designed.

KBR was also selected by Hanwha Impact Corporation to license and engineer an ammonia cracker for hydrogen co-firing in a gas turbine in Deasan, South Korea in September 2023. The ammonia cracker will have a capacity of above 200 tons of hydrogen production per day. A second contract for a near-identical project has just been awarded.

Topsoe: building on its heavy water plant legacy

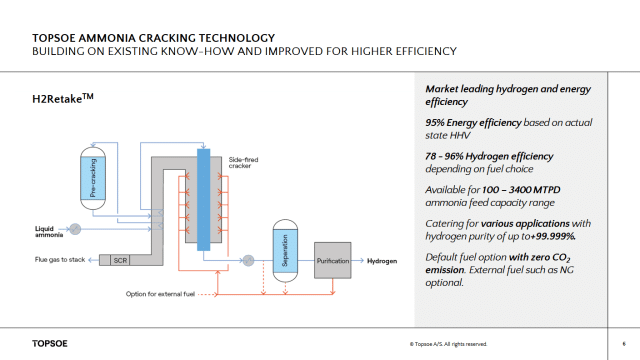

Click to expand. Topsoe’s H2RetakeTM ammonia cracking technology. From Paulo Brito, Ammonia cracking – TOPSOE’s innovative technology (Nov 2024).

Topsoe licenses its ammonia cracking technology as H2RetakeTM, and is also a catalyst supplier for ammonia cracking. The single train capacity for Topsoe’s ammonia cracking technology is 100 – 3,400 tons of ammonia cracked per day. If the ammonia cracker is heated with ammonia and/or hydrogen, about 139 kilograms of hydrogen are obtained per ton of ammonia feedstock. A higher conversion of ammonia to hydrogen is possible (around 170 kilograms of hydrogen per ton of ammonia), when using gas for the burners.

Topsoe’s current ammonia cracker technology is based on a fired tubular design (sometimes with a pre-cracker). Topsoe is also developing novel technologies for ammonia cracking, including autothermal ammonia cracking (similar to autothermal reforming) and electrified ammonia cracking.

Topsoe has operational references for heavy water production at five locations, with the first plant commissioned in 1978. The largest single train ammonia crackers converted 2,400 tons of ammonia per day (equivalent to 426 tons of hydrogen per day production), located in Arroyito, Argentina. Such ammonia crackers for heavy water production operate at 120 – 150 bar, using Iron-Cobalt alloy-based catalysts for ammonia cracking with operational references with over 100,000 hours with the same catalyst loading, albeit without any water in the ammonia feedstock.

Topsoe was selected by Approtium to license an ammonia cracker able to produce 75,000 tons of hydrogen per year, for hydrogen co-firing in a gas turbine in Ulsan, South Korea.