Solid oxide electrolysis: building capacity

By Kevin Rouwenhorst on May 22, 2023

ISPT: Next level solid oxide electrolysis

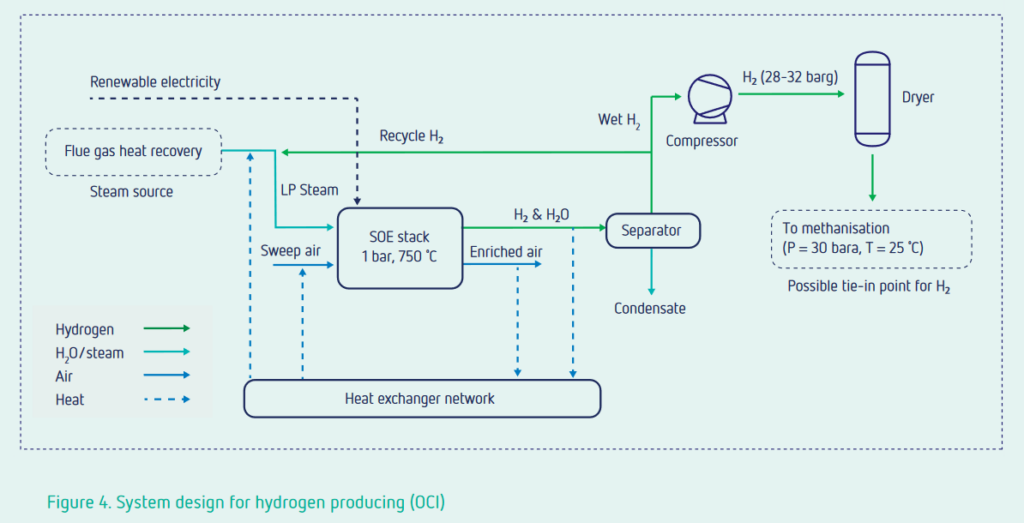

Recently, the Institute for Sustainable Process Technology (ISPT) published a report on industrial case studies for solid oxide electrolysis. The study has consulted technology providers Bosal, Bloom Energy, Sunfire, and Topsoe. One of the applications considered was installing a 80 MW solid oxide electrolysis stack (92 MW electricity consumption for the system) at OCI’s ammonia plant in the south of the Netherlands.

The study concludes that about 40 kWh of electricity input is required for the system per kilogram of hydrogen production, if the electrolyzer is fed with steam. This equates to a hydrogen production rate of 2,300 kg per hour. The energy efficiency of steam-fed solid oxide electrolysis is 20% higher than for water-fed electrolyzers such as alkaline electrolysis and PEM electrolysis. If solid oxide electrolysis is fed with water instead of steam, the efficiency difference is substantially smaller.

ISPT estimates that the base case, total installed cost of a 1 GW solid oxide electrolysis plant at about 5200 USD/kW (4800 €/kW). But by the end of this decade, that cost can be reduced by 75% (1300 USD/kW) through:

- Increased current density (from 0.7 A/cm2 to 1.5 A/cm2)

- Scale-up of manufacturing

- Larger cell areas (up to 800 cm2 and 100 kW), more cells and stacks per hotbox (60 large cells of 800 cm2 and 16 stacks per hotbox, 1.5 MW per hotbox)

- Bigger modules (up to 9 MW). System design of 90 MW, for balance of plant.

It should be noted that US-based solid oxide electrolyzer manufacturer Bloom Energy already puts its electrolyzer cost at 1100-1300 USD/kW.

Bloom Energy: Oklahoma and Nujio’qonik

Previously at Ammonia Energy, we explored in-depth the 10 MW of solid oxide electrolysis capacity to be installed at the existing ammonia plant of LSB Industries in Pryor, Oklahoma. Bloom Energy will deliver the solid oxide electrolyzer cells in 2024, and claims over 5 years of stable performance (as long as at least 5% load is maintained).

Bloom Energy will also provide solid oxide electrolyzer cells for Phase 1 of the Nujio’qonik Green Hydrogen project. Located in Newfoundland and Labrador, Nujio’qonik will be based on 600 MW onshore wind generation, with renewable ammonia production planned to start in March 2026. The plant design will include heat recycling to feed the high-temperature solid oxide electrolyzers. Just this week, Korean investment firm SK Eco Plant joined World Energy Green Hydrogen (GH2) as project partner, with an initial investment of $50 million.

Topsoe: a second solid oxide electrolysis manufacturing plant

Danish ammonia licensor, catalyst manufacturer and electrolyzer manufacturer Topsoe recently announced its intent to build a $300 million factory for solid oxide manufacturing in the United States. This allows for manufacturing close to offtake, as the demand for electrolyzers is expected to increase substantially in the coming years due to the 3 USD per kilogram hydrogen tax credit under the Inflation Reduction Act (IRA).

Incidentally, Topsoe has already signed an electrolyzer offtake agreement with New York-based First Ammonia, which has agreed to purchase the first 500 MW of solid oxide electrolyzers made at Topsoe’s other manufacturing plant. Under-construction plant in Herning, Denmark, this facility will have an annual capacity of 500 MW of solid oxide electrolyzers by 2024, with a scale-up potential to 5 GW per annum. The deal with First Ammonia is for 5 GW total of solid oxide electrolysis cells.

Solid oxide electrolysis + nuclear power in Indonesia

Solid oxide electrolysis can be coupled with heat and power from nuclear power generation, as was demonstrated at the Idaho National Laboratory last year. Ammonia licensors KBR and Topsoe are investigating integration of solid oxide electrolysis and advanced nuclear reactors in industrial consortia.

Topsoe is also part of a just-announced project with Copenhagen Atomics, Alfa Laval, Aalborg CSP, and Indonesian ammonia producer Pupuk Kaltim for a nuclear-powered ammonia production plant. A 4 billion USD investment is expected to produce at least 1.1 million tonnes of ammonia per year. Copenhagen Atomics will provide modular molten salt thorium reactors, which will be integrated with Topsoe’s solid oxide electrolysers and ammonia synthesis technology. Alfa Laval will provide desalination and heat exchangers, while Aalborg CSP will provide thermal energy storage technology.

Newbuild, zero-carbon ammonia production

In theory, electrolysis-based ammonia plants should benefit from the operation of solid oxide electrolyzers. It’s estimated that about 0.7 tonnes of steam are produced per tonne of ammonia from the ammonia converter, with heat generated due to the exothermic nature of the ammonia production from hydrogen and nitrogen. High-temperature solid oxide electrolyzers are ideally fed with steam, so integration with Haber Bosch ammonia production presents a great opportunity. Even installing a mixture of electrolyzer technologies to take advantage of steam integration represents a significant improvement in energy efficiency, compared to installing totally water-based technologies. Indeed, LSB’s Oklahoma project will pair Bloom Energy’s solid oxide electrolyzers (10 MW) with alkaline electrolyzers (20 MW) in the first phase.

Thus, solid oxide electrolysis technology can provide substantial advantages for zero-carbon ammonia production. If the economics work and sufficient minimum electricity load can be provided, solid oxide electrolysis can be a key part of the toolkit for decarbonizing ammonia production.