Bunker Ammonia: carbon-free liquid fuel for ships

By Trevor Brown on March 23, 2017

The shipping industry is beginning to evaluate ammonia as a potential “bunker fuel,” a carbon-free alternative to the heavy fuel oil (HFO) used in maritime transport.

International trade associations are leading the effort to decarbonize the sector, in alignment with targets set by the Paris Climate Agreement. Their immediate challenge is simple to state but hard to solve: “ambitious CO2 reduction objectives will only be achievable with alternative marine fuels which do not yet exist.” In the long-term, however, researchers recognize that “fuel cell-powered ships are likely to dominate, drawing their energy from fuels such as hydrogen and ammonia.”

Statement of the problem

HFO is one of the dirtiest fossil fuels available. It is, literally, the bottom of the barrel.

The shipping industry currently emits about 1 gigaton of CO2 per year, or 2.33% of global emissions, according to Low Carbon Pathways 2050, a “$4m multi-university and cross industry research project … that details a number of potential pathways for the shipping industry’s transition to a low carbon future.”

To meet the targets defined by the Paris Agreement, the study determines that the shipping industry would need to achieve “net zero emissions by approximately 2035 (1.5°C) and 2070 (2°C).”

Its key findings conclude that the industry needs to do two things: first, act swiftly and second, identify a viable carbon-free liquid fuel.

• Shipping will need to start its decarbonisation imminently – as stringency increases over time, increasingly high-cost mitigation steps are required. The later we leave decarbonisation, the more rapid and potentially disruptive it will be for shipping …

• A substitute for fossil fuel will still be required as energy efficiency improvements alone will not be sufficient in the medium to long term.

• Energy storage in batteries and renewable energy sources will have important roles to play, but are likely to still leave a requirement for a liquid fuel source.

Lloyd’s Register, Low Carbon Pathways 2050, 10/18/2016

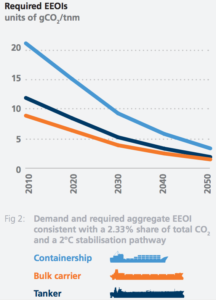

The shipping industry’s emissions are a product of three factors: “the carbon intensity of shipping’s energy supply, the energy efficiency of shipping and the demand for shipping.” Demand is increasing, however, as a function of global population growth. As for efficiency, the industry has already made significant improvements, reducing emissions “by more than 10% between 2007 and 2012,” but it faces a quandary for future gains: the acknowledged mechanism for increasing efficiency further is to decrease speed, which is, ultimately, self-defeating.

According to one of the co-authors, Carlo Raucci of the Shipping in Changing Climates project, “we need to advance thinking beyond marginal gains in energy efficiency and alternative fossil fuels [like LNG] if we are to identify the sector’s least cost decarbonisation pathways.” Therefore, a carbon-free bunker fuel must be identified.

Bunker Ammonia: carbon-free liquid fuel

Another report, Navigating Decarbonisation, was published last month by UMAS and the Carbon War Room. One of its authors made the same point, saying that the industry needs to embrace “either a radical change in fuel or a radical change in speed.” Navigating Decarbonisation concludes:

Whilst low carbon fuels (bio or synthetic fuels such as hydrogen or ammonia) may be necessary in the timescales modelled in this report to enable international shipping’s low carbon transition, under current technology costs these were not economically viable.

UMAS, Navigating Decarbonisation, 02/20/2017

This study assumes, however, that ammonia can only be used in fuel cells, which are expensive to install – hence “not economically viable” – but overlooks ammonia’s potential in combustion engines.

Ammonia is emerging as an economically viable fuel for dual fuel engines, where it can be used as a substitute for natural gas, according to a report published last year by market research firm Technavio.

The use of ammonia gas as a fuel source in dual-fuel applications is relatively a novel idea. A significant reduction in CO2, NOx, and PM emission levels is observed when ammonia is used as a fuel. Ammonia is considered to be a high-octane fuel, which possesses high level of resistance to pre-ignition. It is found that engines using ammonia as a fuel source have enhanced power output compared to when gasoline or diesel is used in the same engine. Both these properties of ammonia when combined provide significantly high engine efficiency.

Technavio analysis: Global dual fuel engine market 2016-2020, 07/21/2016

Technavio notes that shipping represents roughly 65% of the market for dual fuel engines, which are “gaining popularity in the marine industry as a growing number of vessels are using these engines over conventional diesel or gas engines … enabling the crew to adhere to various marine pollution (MARPOL) regulations regarding propulsion engine emissions.”

Today, only perhaps a few thousand vessels use dual fuel systems, which represents a small percentage of the global fleet – there is a long way to go, and a big opportunity for dual fuel engine suppliers.

Technavio is certainly looking to the future – there is no commercial dual fuel ammonia engine available today. Nor is there any installed ammonia fueling infrastructure – although, as one of the world’s most globally-traded commodities, there is already significant port loading infrastructure, handling experience, and safety knowledge.

There are also many ammonia engines in development, including by Caterpillar, a major supplier of maritime engine systems. In addition, some major industrial projects will soon demonstrate the environmental benefits of ammonia in dual-fuel combustion.

If the shipping industry is committed to acting quickly and identifying carbon-free liquid fuels (“which do not yet exist,” they say), it must evaluate ammonia as a short-term bridge fuel for engines, as well as a long-term energy source for fuel cells.

However, this is a forward-looking industry, intent on solving its own problems.

Mechanism for investments in low-carbon technologies

The International Chamber of Shipping (ICS), which represents “over 80% of the world merchant fleet,” is lobbying the International Maritime Organization (IMO) of the United Nations to enact a global carbon tax on bunker fuels. Its chairman, Esben Poulsson, described the industry’s attitude last month at the World Ocean Summit in Indonesia:

The position of ICS is that the clear preference of the majority of the industry is for a simple global levy based on fuel consumption …

Fuel is still by far a ship operator’s largest cost. Further and dramatic CO2 reduction therefore remains a matter of enlightened self-interest.

ICS, Reducing CO2 – Acting on the Paris Agreement

The cheapest bunker fuels currently cost roughly $300 per ton, while cleaner bunker fuels cost closer to $600 per ton. Fuel represents roughly 30% of a ship owner’s operating costs, although in recent years, when oil prices were higher, this was in excess of 50%. The International Monetary Fund (IMF) has recommended a carbon tax for the shipping industry of “about US$ 95 per tonne of fuel” – roughly a 30% surcharge on the most polluting bunker fuels, based on current prices.

The IMO moves at its own pace but its leadership is crucial: without global standards and due enforcement, the industry could face a self-defeating patchwork of regional regulations. For those unfamiliar with the shipping sector, enforcement has long been a challenge. If a ship owner doesn’t like the laws of his own land – for example, local reporting requirements or regional fuel efficiency standards – he can simply register elsewhere and operate under a “flag of convenience.” (This is why some landlocked nations with lax regulations, like Mongolia, have so many ships.)

It is therefore excellent news that the has IMO has announced plans “to develop a comprehensive Road Map for addressing CO2 emissions from international shipping – with initial CO2 reduction commitments to be agreed by IMO by 2018.” By 2023, when the final stage of the road map should be enacted, it aims to have “a global mechanism for ensuring that these IMO CO2 reduction commitments will actually be delivered,” supported by a “mandatory global CO2 data collection system.”

These efforts provide the market-based mechanism by which this highly competitive industry can make broad investments in new technologies. As another industry group, the Danish Shipowners’ Association, recently stated in another study, “a global fuel levy … will effectively finance CO2 reductions.”

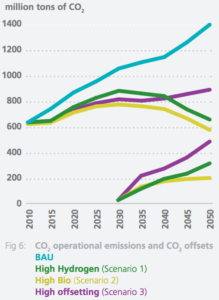

The study proposes a target for shipping that ensures reductions consistent with the overall ambition of the Paris Agreement. There are a number of different ways to achieve this, but the study recommends that to allow a gradual transition, net emissions will need to peak in 2025, with absolute emission reductions amounting to approximately 400 million tonnes in net emissions, by 2050. Consistent with the Paris Agreement, emissions will then need to reduce to zero during the second half of the 21st century.

Danish Shipowners’ Association / UMAS: CO2 Emissions from International Shipping: Possible reduction targets and their associated pathways, 11/03/2016

It often seems as though the articles at www.ammoniaenergy.org point to Japan – again, this is true. In the Hiroshima Prefecture, a hydrogen powered fuel cell ship began tests earlier this week, to understand and improve the fuel cell’s resilience to sea-salt and constant motion. As with many other Japanese ammonia-hydrogen research projects, they expect to have completed development of the fuel cell ship in time for the Olympic Games in 2020.

The shipping industry has pledged to fix its carbon problem, even though it believes it can’t be solved using today’s technology. Now is the time for ammonia engine developers to engage and offer a solution.