This Week in Hydrogen

By David White on September 27, 2018

A guest commentary by David White, principal of RESEARCH STRATEGY CONTENT. An earlier version of this article was published at LinkedIn Pulse on September 17, 2018.

September 10–14 gave us five remarkable events both evidencing and advancing the rise of hydrogen in transportation and energy. Any one of them would have made it a significant week; together they make a sea change.

ONE

On Monday, September 10, California governor Jerry Brown signed into law SB-100, accelerating targets of the state’s Renewable Portfolio Standards to 60% by 2030 and mandating 100% “zero-carbon” electricity by 2045. Zero-carbon electricity is a whole different animal than the state’s RPS, including not only eligible renewable energy resources (primarily wind, solar, geothermal, and biomass), but also large hydro, nuclear power, and natural gas with carbon capture and storage.

Curiously, Brown—primary architect of 2017’s United States Climate Alliance, a cadre of states and cities committed to the Paris Climate Agreement—was not a particular advocate of the bill. He preferred instead a previous legislative tactic that had linked SB-100 to another energy bill, AB-813, that regionalize the Western power market. But that tactic had stalled both bills in the previous legislative session. And while there was talk of Brown vetoing SB-100 on its own, that didn’t happen. Its author, President pro tempore of the California state senate, Kevin de León, rejected a range of amendments from both union and utility lobbyists, maintaining a bill that was both direct and flexible enough to attract broad support among environmentalists, cleantech, faith groups, labor, and business.

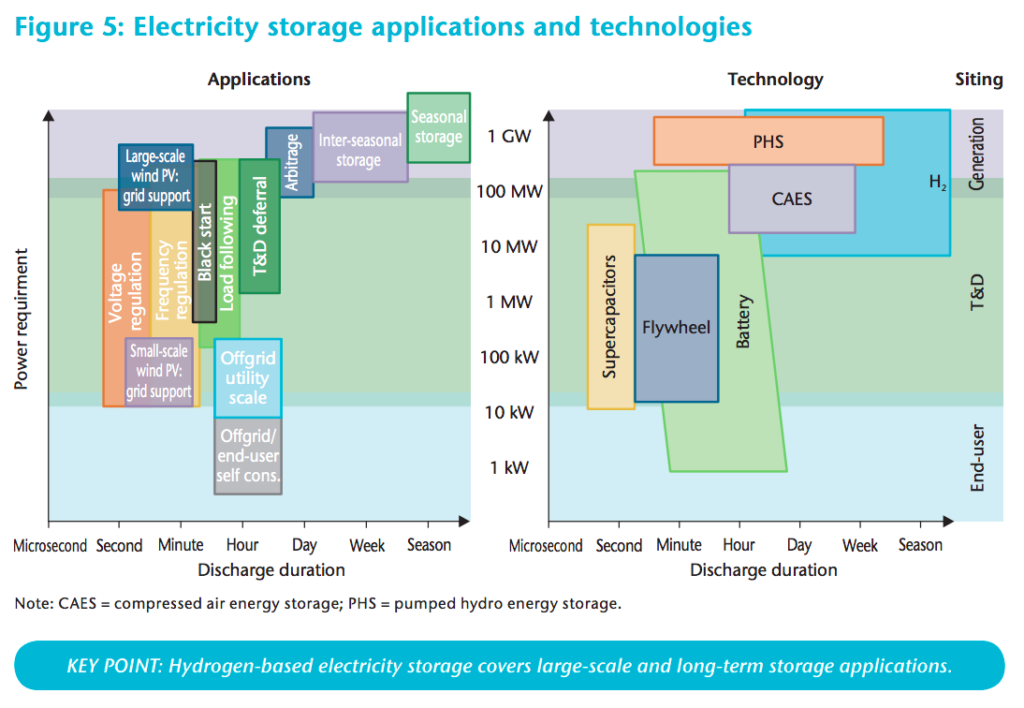

Analysts concur that achieving 100% zero-carbon electricity, or even 60% renewable electricity, will require much more stored energy and much longer energy time shifts than the four hours provided by batteries. And some of that will be hydrogen storage. As the International Energy Agency (IEA) illustrates, hydrogen is the only economically feasible extant technology for achieving storage duration longer than one week, and comprehends shorter periods as well.

TWO

Also on Monday, Brown went several steps further by signing Executive Order B-55 calling for the entire state, not just its electric industry, to achieve “carbon neutrality” by 2045. This means in transportation, building heating and cooling, industry, and all the energy services beyond electricity that utilize fossil fuel and account for 84% of California’s carbon emissions. (Electricity is only 16%.) Notice a third term is introduced here: first, renewable energy; second, zero-carbon; now, carbon neutrality— which leaves room for negative emission and carbon offset mechanisms like sequestration, planting forests, and removing carbon from the atmosphere. Under carbon neutrality, industries could continue to emit plenty of CO2, as long as that tonnage is offset by equal amounts of negative emissions.

The order has no effect in law, but sets a grand aspiration. It was Governor Schwarzenegger’s 2005 order setting carbon reduction targets for 2030 that got the whole legislative ball rolling. Likewise, Brown’s order serves as a guidepost and rallying point for legislatures and organizers. As the world’s fifth-largest economy, such a mandate would have enormous impact on innovation.

THREE

On Thursday, September 13, Hyundai released renderings of its gleaming new fuel cell electric truck two weeks ahead of the vehicle’s scheduled debut at IAA Commercial Vehicles 2018 in Hannover. The vehicle was later revealed to be an 18 ton cargo truck adapted from Hyundai’s XCient platform featuring two 95 kW fuel cell stacks, 32 kg tank capacity, and 400 km (250 mile) range. Under agreement between Hyundai and Swiss company, H2 Energy AG, one thousand trucks will be procured over five years for members of the mold-breaking H2 Mobility Switzerland, an association of fueling station operators, fuel wholesalers, logistics, distribution, and retail companies. Trucks will be available on a per-kilometer basis similar to a total-cost-of-ownership lease plan wherein fuel, warranty, and maintenance are included in the terms.

As sexy as this truck is, there’s a deeper, more eye-popping story here. Association members collectively own more than 1,500 fueling stations and 1,700 heavy duty trucks. Their strategy is to transition sufficient number of their own fleets to FCEV to warrant and sustain a self-perpetuating, country-wide hydrogen infrastructure without government subsidy. And THAT’S never been tried anywhere!

The group has determined hydrogen refueling stations can be profitable filling up just 10 trucks per day (~300 kg H2). With 1,000 fuel cell trucks on Swiss roads, 50 to 80 new refueling stations will be supported throughout the country. Their presence enables others to adopt FCEVs with confidence, which in turn raises demand for more stations. An entire H2 production and logistics infrastructure is kick-started with just 1,000 trucks. Moreover, the association is committed to 100% renewable hydrogen everywhere in the system.

While we’re on delivery … The move by Hyundai is clearly part of a larger investigation of fuel cell platforms for goods and package distribution. Everybody’s in the game:

- UPS showed off the first of its Class 6, 150 mile range, diesel-to-fuel-cell conversions last year. Under a US Department of Energy grant, 16 more Navistar Internationals will be retrofit with Hydrogenics HD 30 power modules for the parcel giant.

- FedEx put its first fuel cell electric delivery van into regular service earlier this year—a Workhorse Class 5 battery electric enhanced with Plug Power fuel cells. Plug’s ProGen cells charge up the battery en route, extending the vehicle’s range beyond 160 miles, a 166% increase over battery power alone.

- Seven-Eleven Japan has tapped Toyota to provide two compact fuel cell delivery trucks to restock its Tokyo stores next spring, with more coming after the trial. These vehicles will have a 125 mile range and (of course) Mirai fuel cells. But the plan is much bigger than that—adapting Mirai stacks to power stationary retail locations, and reusing automotive batteries to collect solar energy from onsite PV panels.

- Let alone Anheuser-Busch’s 800-truck deal with Nikola.

FOUR

Back in my home town, the Port of Los Angeles announced on Friday, September 14, it had been preliminarily awarded $41 million from California Air Resources Board (CARB) to begin implementing a hydrogen fuel-cell technology framework for moving goods out of the port and around the region. The project, called Zero and Near Zero-Emission Freight Facilities (ZANZEFF), addresses the estimated 16,000 carbon-emitting trucks in and around the ports of Long Beach and Los Angeles, a number that is expected to double by 2030.

Phase One, costing $82,568,872—funded one-half by CARB and one-half by project partners Toyota, Kenworth, and Shell—will consist of ten new zero-emissions hydrogen fuel-cell Class 8 trucks developed jointly by Kenworth and Toyota. Built on Kenworth’s T680 platform, Toyota will provide its Mirai fuel cells plus tanks, batteries, and electric motors to these drayage vehicles.

Phase Two will fund two new large capacity hydrogen fueling stations developed by Shell and supplied with one ton of 100% renewable H2 per day. These will join three existing stations at Toyota facilities supplied by Air Liquide to create a five-station large capacity network enabling zero-emissions freight transport throughout the region.

Phase Three will expand deployment of zero-emission technologies (battery or fuel cell) in off-road and warehouse equipment, including the first two zero-emission yard tractors and increased number of zero-emission forklifts in Toyota’s port warehouse.

The award is expected to be formalized by end of year.

FIVE

Finally this week, and doubtless precipitating the signatures in Sacramento, San Francisco hosted the Global Climate Action Summit and, concurrently, the Hydrogen Council’s Global Leaders Forum—an invitation-only event for its now 53 member CEOs.

On Friday, September 14, Hydrogen Council Co-Chairs Benoît Potier, CEO of Air Liquide, and Woong-Chul Tan, Vice Chairman of Hyundai Motor Company, addressed the Summit’s plenary closing session to announce:

“… our new commitment to a goal of decarbonizing 100% of hydrogen fuel used in transport by 2030.”

Hydrogen Council commitment, Global Climate Action Summit, 09/18/2018

The statement both underscored and resolved an ongoing debate among hydrogen stakeholders about insistence on “renewable” hydrogen. Ninety-six percent of hydrogen today is produced from fossil sources, mostly natural gas. While there’s no carbon emitted where its used, there’s plenty where its made. Drivers, OEMs, and gas manufacturers have tended to set aside the fact that as hydrogen-fueled vehicles increase on city streets, so do carbon emissions, just somewhere else. Under predominant, fossil-based production methods, a world of hydrogen fuel cell vehicles is still a world emitting carbon for its transportation, albeit 20-30% less than petrol-chugging ICEs.

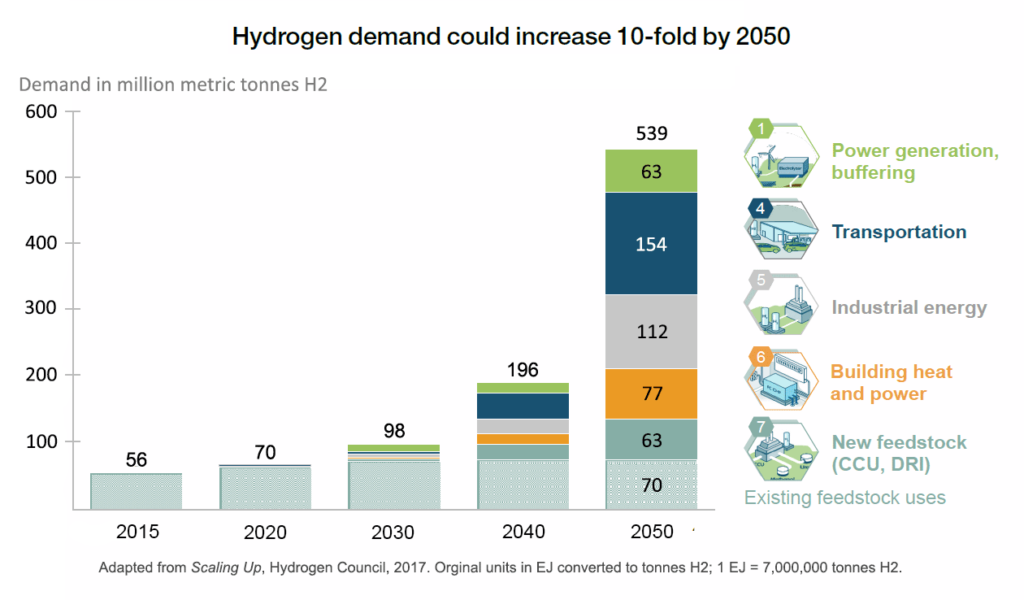

So how much hydrogen is that? The Hydrogen Council’s 2017 roadmap, Scaling Up, gives current global consumption at 55 million metric tonnes. Greater than 50% of it goes to making ammonia, and effectively none is allotted to transportation. What happens in 12 years if the Council’s vision comes true? What happens if 1 in 12 cars sold in California, Germany, Japan, and South Korea are powered by hydrogen? If 500,000 hydrogen trucks and a million fuel cell fork lifts are transporting goods? If 15 million hydrogen cars, 50,000 hydrogen buses, and thousands of hydrogen trains and ships are transporting people? How much hydrogen then?

In one sense, not all that much. The forecast curve for combined end-use sectors—Power Generation, Transportation, Industry Energy, Building Heat & Power, and New Feedstock—rises slowly to 2030. Total hydrogen demand almost doubles, but most of that is for existing industrial feedstock, not new uses. In the chart below, Transportation is still a skinny blue line representing maybe 0.4% of the nearly 100 million tonnes H2 consumed in 2030. Consider it 400,000 metric tonnes. While not much in terms of relative quantity, as decarbonized tonnes, it’s huge in terms of new production facilities and processes. Pathways to decarbonization are many: not only zero-carbon electrolysis of water, but also carbon-neutral methods such as fast pyrolysis of biomass, bio-methane SMR, carbon capture & storage / utilization, plus new technologies being investigated today. But none of these operate at industrial scale yet. Decarbonizing hydrogen in Transportation by 2030 is akin to building a whole new industry in just 12 years.

As challenging as that is, the most ambitious aspect of the Council’s goal is the stake-in-the-ground it sets for decades beyond 2030 when hydrogen mobility technologies mature and the Transportation sector soars. Total H2 demand doubles again by 2040, but Transportation balloons up 90 times(!), consuming roughly 36 million tonnes (judging by relative proportions of the 2040 bar). In the decade leading to 2050, total demand nearly triples, while Transportation quadruples to 154 million tonnes, consuming fully one-third the global hydrogen product. That’s an amount comparable to all the hydrogen made in all the world in the last three years. Three decades hence, if the Council has its way, all of it will be decarbonized.

We’ve seen a succession of encouraging milestones in the transition to hydrogen over the past two years, but the pace and magnitude of last week’s events were striking—evidence that critical mass has been reached. With the backing of transnational energy and transportation players, carbon-neutral electrofuels have become the inevitable way forward. These kinds of technical and regulatory advances will be coming bigger and faster from here on out. The hundredth monkey is here.

David White is principal of RESEARCH STRATEGY CONTENT, a market research, strategic partnering and brand consultancy focused in CleanTech, Renewable Energy and Carbon Reduction; presently engaged with offshore and domestic colleagues in development of multiple hydrogen production opportunities. An earlier version of This Week in Hydrogen was published at LinkedIn Pulse on September 17, 2018.