The Emerging Ammonia-Methanol Dialectic

By Stephen H. Crolius on March 31, 2021

A new friend for ammonia?

Based on recent press reports, ammonia has a new friend: methanol. With the two upstart fuels being mentioned together with increasing frequency, they seem poised to develop on parallel paths as each seeks market applications where it can become a mainstay solution.

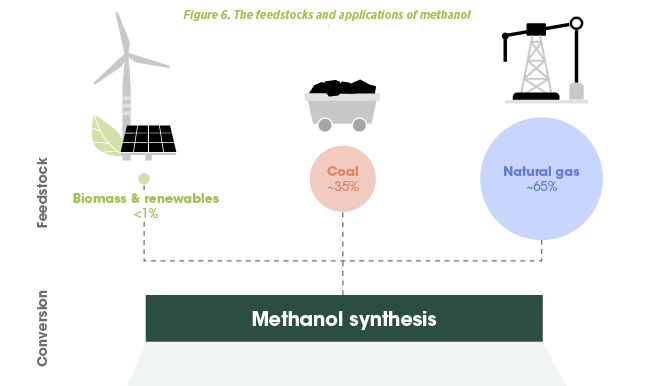

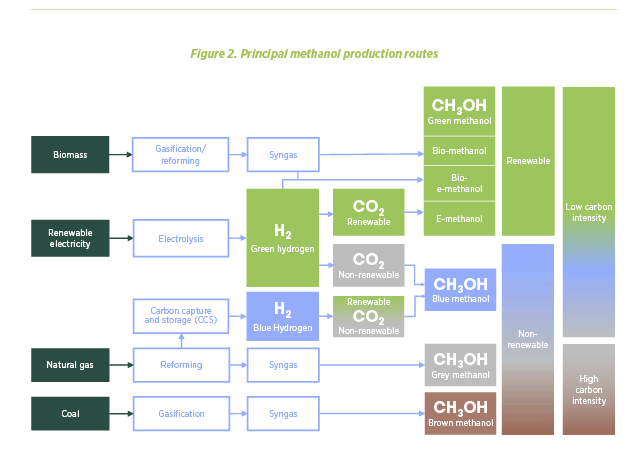

According to Innovation Outlook Renewable Methanol, a report co-authored by the International Renewable Energy Agency (IRENA) and the Methanol Institute and released in January 2021, “Around 98 million tonnes (Mt) [of methanol] are produced per annum, nearly all of which is produced from fossil fuels (either natural gas or coal).” Annual production of ammonia is currently around 180 million tonnes which is derived primarily from the same two feed stocks. Like ammonia, the interest in methanol as a fuel is contingent entirely on the availability of climate-friendly versions that can help users meet greenhouse gas reduction goals.

Climate-friendly methanol stokes interest

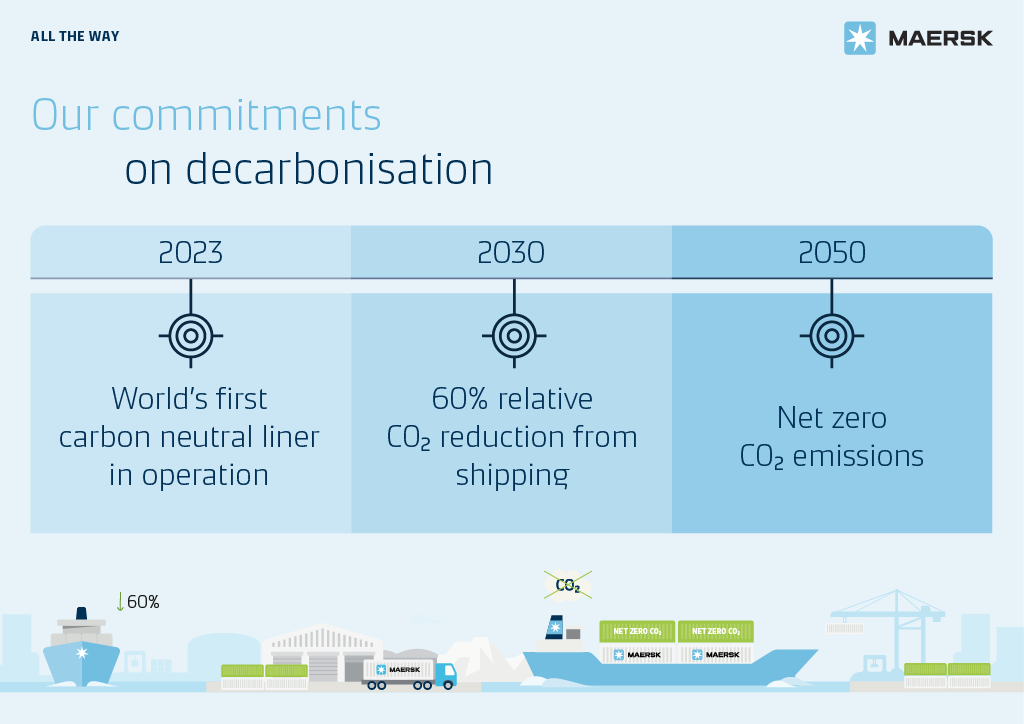

Immediate “availability of climate-friendly versions” is stoking at least part of the current interest in methanol. In the maritime sector, for example, Danish shipping company A.P. Moller-Maersk announced in February that “it will operate the world’s first carbon neutral liner vessel by 2023.” The vessel will be fueled by “carbon neutral e-methanol or sustainable bio-methanol.” The company’s press release goes on to note that “Around half of Maersk’s 200 largest customers have set — or are in the process of setting — ambitious science-based or zero carbon targets for their supply chains, and the figure is on the rise.” Understandably, the company wants to respond to its customers’ expressed needs as quickly as possible, and evidently deems that the methanol path is the most feasible way to do so.

Initiatives of this nature set the stage for the spate of ammonia-methanol juxtapositions. At the production end of the value chain, Haldor Topsøe, “a global leader in supply of catalysts, technology, and services to the chemical and refining industries,” and Nel, “a global, dedicated hydrogen company,” announced on March 25, 2021 that they will work together on “complete renewable electricity to ammonia and methanol solutions.” Nel produces PEM electrolyzers. Haldor Topsøe recently introduced its own variety of electrolyzers — solid oxide electrolysis cell (SOECs) – which complement its “eMethanol” synthesis technology, and its Haber Bosch ammonia synthesis technology. By joining forces to create an expanded menu, the two companies hope to appeal to a broader swath of plant developers in the chemical and energy industries than either could alone.

More ammonia-methanol maritime solutions emerge

Ammonia and methanol are linked more actively in an announcement from Italian maritime classification society RINA. A February 12, 2021 press release states that RINA and the Shanghai Merchant Ship Design & Research Institute (SDARI), a subsidiary of the state-owned China State Shipbuilding Corporation, “have signed a Joint Development Project Agreement to develop a ship design capable of being fueled by either ammonia or methanol.” A third party in the collaboration is the German engine and turbo machinery producer MAN Energy Solutions.

MAN ES has offered a methanol-based engine since the mid-teens, and has been developing an ammonia-based engine since 2018. Both employ a dual-fuel regime. With this approach, a pilot fuel is used whose combustion characteristics lend themselves to the initiation of combustion ignition. The pilot fuel is injected first into the combustion chamber, and then the main fuel – either ammonia or methanol — follows. Now, it appears, MAN ES is developing an engine that could shift between the two fuel types as conditions dictate (and on-board fuel handling facilities allow). This is a significant development since, as the press release notes, “A ship specifically designed and optimized for using ammonia and methanol as fuels offers a future proof, environmentally sustainable solution.”

Finally, a cooperative venture announced on March 5, 2021 pairs ammonia and methanol at both the fuel production and use ends of the value chain. The party on the production side is OCI N.V., ”a leading global producer and distributor of nitrogen and methanol products” with headquarters in the Netherlands. The party on the use side is Eastern Pacific Shipping, a shipping company with headquarters in Singapore. Not surprisingly, MAN Energy Solutions appears again as the party at the center of the action.

The partnership involves using select conventional vessels from EPS’ existing tanker fleet that use MAN engines to be retrofitted, allowing them to be powered by methanol and ammonia which will be supplied by OCI. Also, EPS will construct newbuild vessels with MAN engines powered by the same two alternative marine fuels. OCI intends to charter the first retrofitted vessel from EPS.

Eastern Pacific Shipping, “EPS, OCI, and Man Partner to Adopt Methanol and Ammonia as Marine Fuel,” March 5, 2021

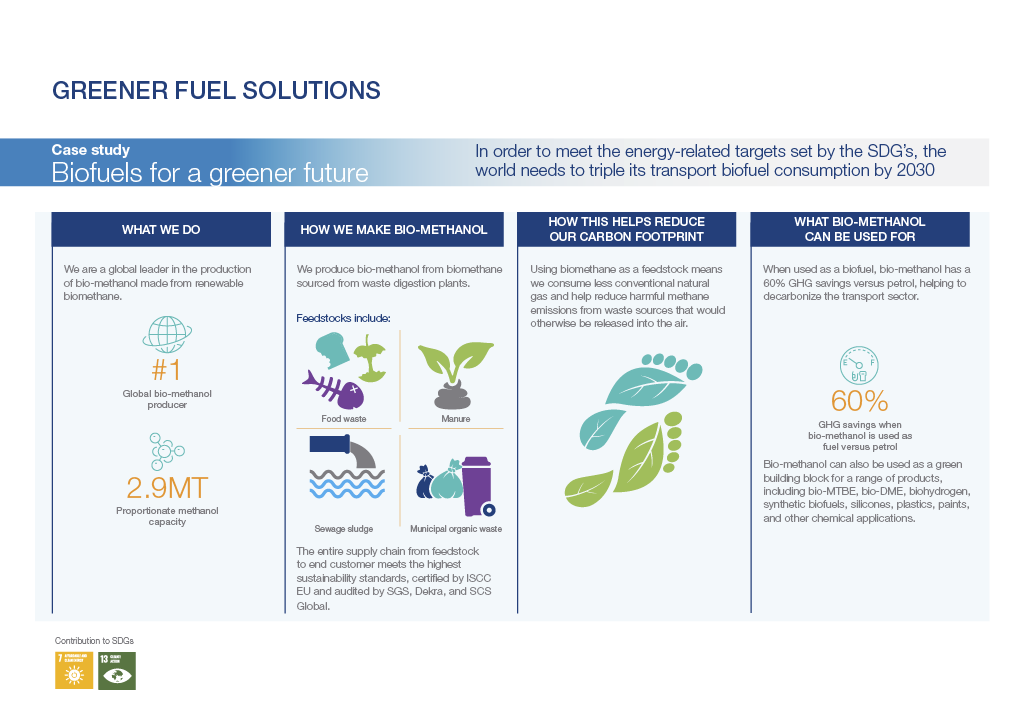

OCI’s BioMCN division describes itself as “one of Europe’s largest methanol producers and is the first company in the world to produce and sell industrial quantities of high-quality bio-methanol, a second-generation biofuel.” Its bio-methanol is derived from “biogas sourced from waste digestion plants.” OCI claims current bio-methanol production of 2.9 million tonnes across BioMCN and its OCI Beaumont (Texas) division. (A large container ship can carry order-of-magnitude 10,000 tonnes of fuel.)

Included in OCI’s March 5 press release is the announcement of a second memorandum of understanding, this one with German shipping company Hartmann Gas Carriers and, once again, MAN ES. The arrangement calls for OCI “to charter ammonia vessels built, owned and operated by Hartmann and its commercial arm, GasChem Services, that are operated using ammonia engines designed by MAN.”