Novel Ammonia Production Technologies: Catalysts, Sorbents, Electrochemistry & Other Technology Pathways

By Kevin Rouwenhorst on January 21, 2026

An in-depth technology review by AEA Technology Manager Kevin Rouwenhorst.

The Haber-Bosch process has been the dominant ammonia production pathway for over a century, revolutionizing the agricultural and ammonia-derivative industries. During his Nobel Laureate acceptance speech in 1918, process co-inventor Fritz Haber proclaimed “It may be that this solution is not the final one”, hinting at alternative pathways in the future. Indeed, the Haber-Bosch process is incredibly energy intensive, operating at high-temperature (350-550°C in the ammonia synthesis reactor) and high-pressure (above 100-450 bar). Historically, this has not been an issue, as steady-state operations with high degrees of heat integration allowed for energy efficient operations, particularly at large scales. It should also be noted that the Haber-Bosch process can also be operated flexibly, albeit with compressors operating with a relatively high power load when reducing production to below 50% of nominal capacity.

But, with the emergence of renewable energy, novel technologies that can harness variable energy inputs (and operate at less extreme pressures) may be beneficial compared to the Haber-Bosch process. Various companies are developing novel ammonia production technologies. These can be broadly categorized as (1) improved catalysts, (2) sorbent enhancement, (3) electrochemical ammonia synthesis, and (4) other technology pathways.

Improved catalysts

Industrial ammonia plants use multi-component iron-based catalysts, which were discovered over a century ago by Alwin Mittasch and co-workers. Over the past decades, gradual improvements have resulted in higher catalyst activity (and thus process efficency), but the overall catalyst formulation has remained remarkably similar. The largest vendors for iron-based ammonia synthesis catalysts are Clariant, Johnson Matthey, and Topsoe.

Kellogg (nowadays KBR) was the first licensor to introduce catalysts other than iron-based catalysts in industrial plants, between the 1990s and 2010. In its KAAP (Kellogg Advanced Ammonia Process), a four-bed ammonia converter was used, with iron-based catalysts in the first three catalyst beds, and with Ruthenium-based catalysts in the fourth catalyst bed. The higher conversion allowed the KAAP to operate at pressures down to 90 bar, decreasing operational expenditures. A promoted Ruthenium-based catalyst was used, supported on activated carbon. Although initially promising, the high cost of Ruthenium in recent decades made the process uncompetitive, and some plants have revamped with just iron-based catalysts in the fourth bed, to capitalize on the recycling value of the Ruthenium.

In recent years, various companies are now developing novel ammonia synthesis catalysts, aiming to operate at lower temperatures for improved process flexibility, and to decrease heat integration requirements.

Back in 2018, JGC Corporation started operating a 20 kilograms per day wind to ammonia plant at the Fukushima Renewable Energy Institute – AIST (FREA) in Japan. Rather than using an iron-based catalyst, the demonstrator used a promoted Ruthenium-based catalyst supported on cerium oxide (CeO2).

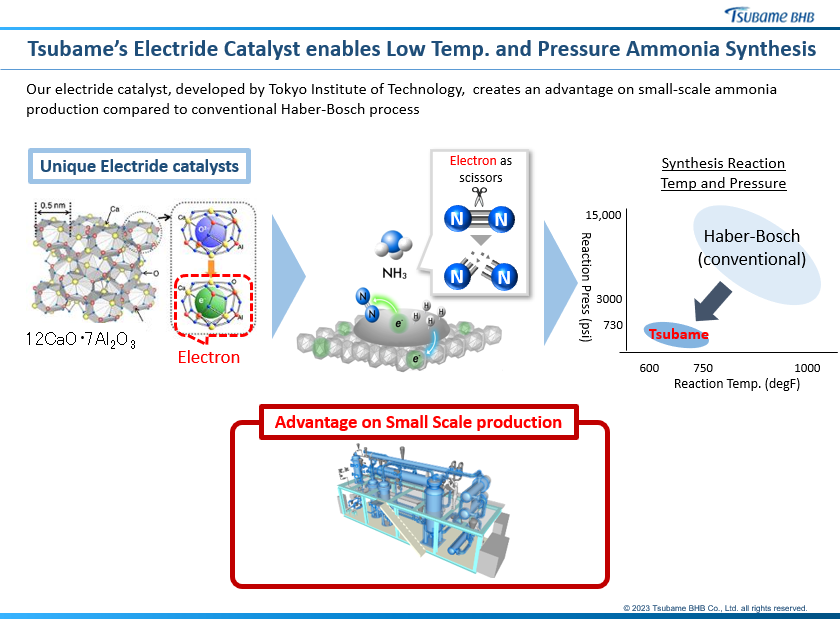

Click to enlarge. Electride-supported Ruthenium catalysts for ammonia production. From Tomoyuki Koide, Distributed Green Ammonia Production by Low Temperature and Low Pressure Synthesis Technology (June 2023).

Japan-based Tsubame BHB provides proprietary low-temperature and low-pressure ammonia synthesis technology using a Ruthenium-based catalyst. The low-temperature Ruthenium-based catalyst supported on an electride (12CaO·7Al2O3 or C12A7:e−) developed in Professor Hideo Hosono’s lab at the Tokyo Institute of Technology (nowadays the Institute of Science Tokyo). The electride support enables enhanced electronic activation of the Ruthenium for nitrogen dissociation, which is usually the slowest step for ammonia synthesis catalysts. In December 2025, INPEX opened the Kashiwazaki Hydrogen Park in Niigata Prefecture, Japan, which features Tsubame’s technology (and catalyst) for 500 tons of ammonia production per year.

Click to enlarge. Copernic Catalysts’s novel base-metal catalyst versus a state-of-the-art iron-based catalysts. From Jacob Grose, A Drop-in HB Catalyst to Reduce Synloop OpEx by up to 47% (Nov 2024).

Boston-based start-up Copernic Catalysts has developed a base-metal catalyst (branded Neptune™), which is a drop-in option for existing Haber-Bosch ammonia plants. Copernic Catalysts claims that the catalyst is much more active than the conventional iron-based catalyst under mild conditions, and the company claims to significantly increase the capacity of ammonia plants via either a bolt-on or via a first-bed catalyst fill. This is due to the higher activity of its catalysts at low-temperature and low-pressure conditions, allowing for operation at 200-400°C and 50-150 bar. In November 2024, Copernic Catalysts closed an $8 million seed funding round.

Click to enlarge. RTI International’s catalyst development and process control, in collaboration with Casale. Sameer Parvathikar, Next-Generation Ammonia Technology Integration Platform (Dec 2025).

RTI International has developed a low-temperature and low-pressure catalyst, which it claims to have a ten times higher activity than iron-based catalysts and a four times higher activity than Ruthenium-based catalysts on a turnover frequency (TOF) basis. RTI International collaborates with Casale on the novel catalysts in a bench-scale 15 kilograms per day demonstration, which showcases 90% turndown with a ramp rate of >100% per hour.

Nium is a UK-based start-up, which aims to commercialize a novel type of ammonia synthesis catalyst. Conventionally, ammonia synthesis catalysts are designed based on two-dimensional surfaces, mostly using transition metals. Instead, Nium relies on catalysts with three dimensional structures, which allows for higher activity at lower temperatures. Rather than building one large ammonia synthesis reactor, Nium opts for “minions”, which are small-scale, modular reactors. Nium closed a $3 million seed funding round in June 2023.

New Zealand-based Liquium is a spin-off from Professor Franck Natali’s group at the University of Wellington, and aims to commercialize a novel catalyst, with a high activity for the existing operating conditions in the Haber-Bosch ammonia synthesis loop. Liquium’s latest catalyst generation is aiming for an industrial pilot facility as a next step, collaborating with various industry players.

Founded in 2024, Israel-based CatAmmon is developing next-generation ammonia synthesis catalysts and ammonia cracking catalysts. CatAmmon builds on five years of academic research led by Dr Gilad Lando and Professor Michael Zinigrad. CatAmmon uses ceramic catalysts, which eliminates the use of Ruthenium for operation at low-temperature and low-pressure (1.5 bar). CatAmmon has raised $1.85 million to date, backed by NetZero Tech Ventures, the Israel Innovation Authority, and TotalEnergies.

Sorbent enhancement

After the ammonia synthesis reactor, the ammonia needs to be separated from the unreacted hydrogen and nitrogen gases. When substantially more active catalysts are developed, ammonia can be produced at lower temperatures and lower pressures. However, the “traditional” ammonia separation technique via condensation becomes increasingly difficult to operate at lower operating pressures. In these cases, more selective separation technologies for deep ammonia removal are required, for example ammonia sorbents (absorbents or adsorbents).

Numerous solids and liquids have been proposed as sorbents for ammonia separation, such as activated carbon, covalent organic frameworks, deep eutectic solvents, eurefstics, ionic liquids, metal organic frameworks, metal halides, oxides, porous organic polymers, and zeolites.

Click to enlarge. Ammobia’s low-temperature and low-pressure ammonia production technology with up to 80% single pass conversion. From Karen Baert, Ammobia’s Haber-Bosch 2.0 : Low-capex, flexible ammonia synthesis technology (Nov 2024).

Ammobia is a US-based start-up, developing low-temperature (300°C) and low-pressure (20 bar) ammonia production technology. The company integrates low-temperature ammonia catalysts with solid sorbents for ammonia separation for up to 80% single pass conversion in its reactor. In April 2024, Ammobia closed an oversubscribed, $4.2 million funding round, and recently announced closure of a new $7.5 million seed round with investors including Shell, Air Liquide, MOL, and Chevron. This will allow Ammobia to scale up from its bench-scale, 1 kilogram per day plant (TRL 4-5) to a pilot-scale, 50 kilograms per day plant (to reach TRL 6) in 2026.

Click to enlarge. The Sorption Booster of Ammisorb. From Anastasiia Karabanova, Ammisorb: Efficient Separation for Decentralized Green Ammonia (Oct 2025).

Ammisorb is a Danish start-up spun out from the Danish Technical University (DTU) and commercializing the “Sorption Booster” for efficient ammonia separation. The company uses solid metal halide salts, which are able to remove over 99% of the ammonia from the reactor effluent at near-ambient conditions. This builds on the demonstration in the EU-funded ARENHA project. Next to Ammisorb, the DTU also spun out Amminex around two decades ago, which used metal halides for solid ammonia storage for fuel cell applications.

Numerous other universities are also active in developing sorbent-enhanced ammonia production technologies. Examples include the work at the University of Cambridge for ammonia synthesis beyond equilibrium using solid sorbents, and the work at the University of Minnesota (including a recent collaboration with Texas Tech University), for sorbent development and in-field testing with wind energy at the West Central Research and Outreach Center (WCROC).

Click to enlarge. Dispersion analysis of an AmHyTech ambient ammonia storage (bottom) and a conventional ammonia release (top). Source: AmHyTech.

US-based AmHyTech is commercializing a storage and transport approach that allows ammonia to be handled as a stable liquid across a broader range of temperature and pressure conditions, including near ambient temperature and atmospheric pressure. The method relies on a fully reversible physical stabilization process that modifies intermolecular interactions, effectively shifting the practical phase behavior of ammonia — without altering its chemical composition. By enabling liquid-phase operation under mild conditions, the system addresses one of the central limitations of conventional ammonia logistics, which require either high-pressure containment or cryogenic refrigeration. Low-cost storage materials can be used, and AmHyTech claims this decreases capital investment by a factor two to three compared to pressurized storage. In the event of an accidental release, gaseous ammonia emission rates are approximately 8,000 times lower than for liquid anhydrous ammonia storage, significantly reducing acute exposure risk. AmHyTech is also developing an ammonia electrolysis technology, as an alternative for gas-fired ammonia cracking.

Electrochemical ammonia synthesis

Over the past decades, numerous research groups around the world have investigated electrochemical ammonia synthesis. The promise is directly producing ammonia from water and nitrogen in an electrochemical cell with renewable electricity, rather than requiring a separate electrolyzer for hydrogen production and a separate Haber-Bosch plant for ammonia production.

Companies developing electrochemical ammonia synthesis can be divided into three categories (1) direct electrochemical ammonia synthesis, (2) Lithium-mediated electrochemical ammonia synthesis, and (3) electrochemical nitrogen oxides reduction to ammonia.

Icelandic company Atmonia is a spin-off from the University of Iceland and is developing direct electrochemical ammonia synthesis, using non-noble catalysts. In October 2025, the company demonstrated laboratory-scale ammonia production, as also validated using isotope labelling to prevent false positives for electrochemical ammonia synthesis. The company received two Horizon Europe grants, namely VERGE and FIREFLY.

Israel-based NitroFix is developing single-step electrochemical ammonia synthesis from water and nitrogen. The catalyst development is inspired by the biological nitrogenase enzyme, and the technology involves the development of a novel electrode architecture. NitroFix is currently building its first laboratory prototype, designed for continuous operation and targeting various kilograms of ammonia per day. The company has been awarded a BIRD Energy grant and has completed a seed financing round of $3.6 million.

UK-based Rhizo PTX is also developing a direct electrochemical ammonia synthesis technology. Their patent-pending Power-to-X device converts nitrogen and water into ammonia using a non-precious catalyst with a well-studied cell architecture. By leveraging mature cell hardware and balance-of-plant components, they expect to scale at pace from an R&D phase to a commercial reality. Rhizo PTX was founded by former Ceres Power scientists with industrial experience in developing electrochemical technologies. Having already produced a functional laboratory prototype, the team is now preparing for a Q2 2026 Seed Round to transition toward commercial-scale pilots for decentralised green ammonia production.

Owing to the challenge of direct electrochemical ammonia synthesis, various companies have opted for metal-mediated electrochemical ammonia synthesis (for example Lithium and Calcium). The first step is the electrochemical reduction of lithium salt (Li+ and OH–) to metallic lithium (Li), which deposits on the electrode. Then, the electrode with the lithium layer is exposed to nitrogen, reacting to form lithium nitride (Li3N). Subsequently, the lithium nitride is treated with water or another proton source such as hydrogen, which produces ammonia and lithium salt (and OH– if water is used), thereby closing the electrochemical loop.

Click to enlarge. The Jupiter Ionics Lithium-mediated electrochemical ammonia synthesis technology. From Charles Day, Jupiter Ionics – scaling Lithium-mediated nitrogen reduction for Green Ammonia (Nov 2024).

Australia-based Jupiter Ionics is a spin-off from Professor MacFarlane’s group at Monash University and is developing modular ammonia production technology via the Lithium-mediated pathway. Building on scientific publications in the journals Nature and Science that demonstrate highly selective (near 100%) nitrogen reduction to ammonia, the company is currently focused on system integration at the kilograms per day scale.

Click to enlarge. NitroVolt’s system for Lithium-mediated electrochemical ammonia synthesis. Source: NitroVolt.

Denmark-based NitroVolt is a spin-off from the DTU and is developing modular ammonia production technology via the Lithium-mediated pathway with hydrogen gas as the proton source, known as the “Nitrolyzer“. R&D cells demonstrated a 70-80% Faradaic efficiency at a current density of 60 mA/cm2. In 2024, NitroVolt closed a €3.5 million seed funding round, aiming to move from lab-scale technology to a demonstration unit with multi-kilograms of ammonia per day capacity for use on a farm. NitroVolt currently operates a four-cell stack configuration with 400 cm2 cells. Further numbering up of cells is foreseen.

France-based Swan-H makes use of a Boron-based mediator to activate the nitrogen, currently at the benchtop scale. The Boron mediator is reduced electrochemically, and becomes a radical to react with nitrogen. The Boron-nitrogen compound is then hydrolyzed with a proton source (water of hydrogen) to produce ammonia and this regenerates the Boron mediator to its original form. Swan-H claims that using a Boron-based species results in reduced energy consumption versus using a Lithium-based species.

Instead of atmospheric nitrogen (N2), nitrogen oxides (NOX) can be used as nitrogen source for ammonia. The overall process for electrochemical nitrogen oxides reduction to ammonia relies on two steps, including nitrogen oxides generation, and subsequent electrochemical reduction to ammonia. The required nitrogen oxides can be generated from air via a plasma reactor. Alternatively, polluted ground water, and low-level nuclear waste water can be used as a nitrogen oxides source (though recent research suggests these sources may be unsuitable for large-scale applications).

Click to enlarge. Pani Clean’s pilot for electrochemical ammonia synthesis unit, converting nitrogen pollutants in wastewater. Source: Pani Clean.

US-based Pani Clean is developing technology for electrochemical nitrate (NO3–) and nitrite (NO2–) reduction to ammonia, to clean polluted water streams rich in nitrates and nitrites, including effluence from the semiconductor industry, the food industry, and the defence industry. The first 7 kW prototype is operational and can clean 3,000 gallons of water per day (11,356 litres) to produce at least 5 kilograms of ammonia per day, powered by off-grid solar PV.

Click to enlarge. GenCell Energy’s Ammonizer. From Yossi Englander, Ammonia Synthesis – Local, Clean and Green (Oct 2025).

Israel-based GenCell Energy is developing the Ammonizer, a combined gliding arc plasma-based nitrogen oxides generation and electrochemical reduction technology. GenCell has scaled up its electrochemical cells from 1 cm2 in 2021-2022 to 272 cm2 in 2024-2025, leveraging its alkaline fuel cell know how. The Ammonizer alpha prototype is operational and capable of producing 50-100 grams of ammonia per hour.

Sydney-based start-up PlasmaLeap is developing a combined plasma-based process for nitrogen oxides generation, with subsequent electrochemical reduction to ammonia. PlasmaLeap is targeting an energy consumption of 20 kWh per kilogram of ammonia upon scaling up its eNFix reactors, down from 42 kWh per kilogram of ammonia achieved in 2023.

And US-based geNH3 is developing metal-nitride mediated electrochemical ammonia synthesis, using materials other than Lithium. A recent research paper demonstrated faradaic efficiencies of 50% and 27% for Calcium-mediated and Magnesium-mediated electrochemical ammonia synthesis. Recently, geNH3 successfully closed a seed funding round, aiming to scale up the technology to 2.5 kilograms of ammonia per day.

Other technology pathways

Numerous other potential ammonia production pathways exist, including geological processes, photochemical processes, plasma-based processes, chemical looping approaches, single-step synthesis, homogeneous synthesis, bio-inspired pathways, and ammonia purification from animal waste or waste water.

Click to enlarge. Graphical representation of Addis Energy’s subsurface ammonia production concept. From “Geological ammonia: Stimulated NH3 production from rocks”, Joule (Vol. 9, February 2025).

US-based Addis Energy is a spin-off from the Massachusetts Institute of Technology and aims to produce ammonia geologically from ferrous rocks, nitrogen and water. The geological production method uses the chemical potential of different iron ions in oxides, as well as the heat and pressure of the subsurface. Addis Energy received $4.5 million in ARPA-E funding from the US Department of Energy earlier this year. The company closed a $4.25 million pre-seed funding round in 2024, followed by an $8.3 million seed round in 2025.

Australia-based Facet Amtech is developing a highly scalable clean ammonia production process involving a low-energy alternative chemical pathway. The technology is underpinned by their novel oxygen-tolerant catalyst which directly co-converts water and air to ammonia in a single step at low temperatures and pressures. With no need for dedicated hydrogen production, air separation or extensive feedstock purification systems, coupled with improved end-to-end energy efficiency, Facet Amtech believes their technology offers a pathway to significantly reduced levelised cost of ammonia compared with Haber-Bosch synthesis. Their commercial plans are to demonstrate the economic and technical feasibility of the process via 1 kg/day, 100 kg/day and >4 tons/day pilot projects, ultimately targeting industrial scale production.

Various companies are developing chemical “looping” technology for ammonia production. Such processes separate the reaction steps required for ammonia production in time. For example, a material such as metal can first react with nitrogen to form a metal nitride, subsequently a hydrogen source is introduced to form ammonia and the metal nitride is converted to either the metallic state or a metal oxide or a metal carbide, depending on the hydrogen source (H2, H2O, or CH4). In case of a metal oxide or a metal carbide, subsequent reduction to the metallic state will be required.

Click to enlarge. Catalyst development in the AMMONIAC project. Source: Professor Behdad Moghtaderi.

University of Newcastle (Australia) Professor Behdad Moghtaderi is developing chemical looping technology for ammonia production in the AMMONIAC project. The process operates by cyclically, transferring nitrogen and hydrogen carrying particles between two reactors dedicated to nitrogen fixation and hydrogenation. The process operates at temperatures below 350°C and at pressures of 3-10 bar, eliminating the need for large compressors. In 2023, a $18 million partnership was announced with technology developer Element One, for developing and validating a prototype, and subsequent scale-up. In early 2025, a 100 grams per day prototype was demonstrated, with a 100 kilograms per day indicated as the next step.

Andros Innovations is developing low-temperature (300°C) and low-pressure (1 bar) chemical looping technology for ammonia production.