The Ammonia Wrap: no major obstacles for NoGAPS success and more

By Julian Atchison on June 08, 2021

Welcome to the Ammonia Wrap: a summary of all the latest announcements, news items and publications about ammonia energy.

Latest report from NoGAPS

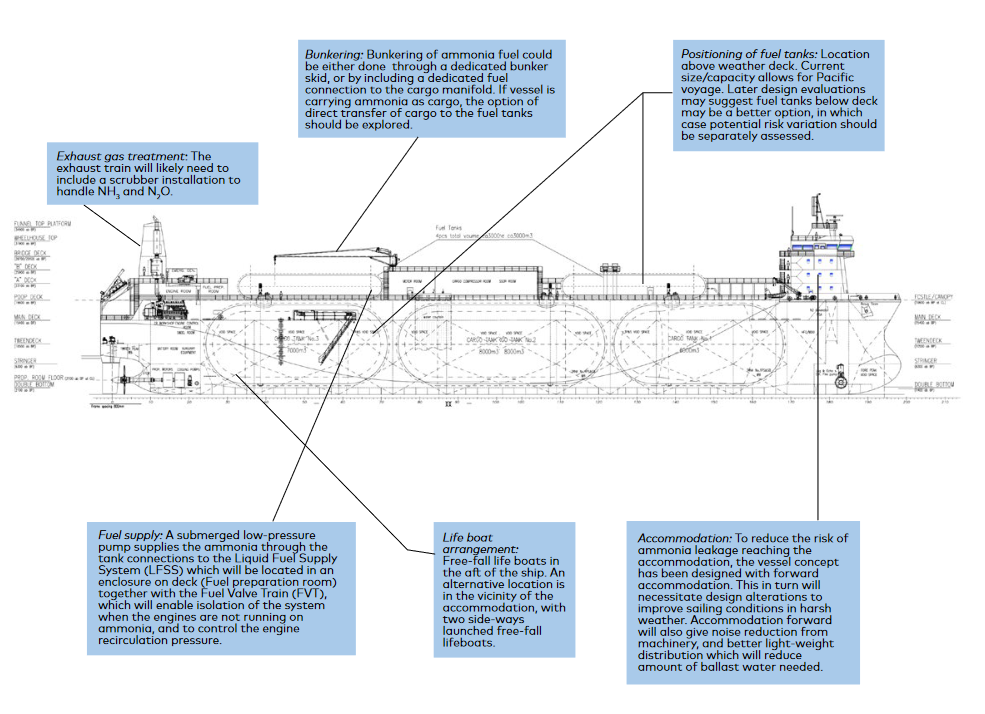

There are no technical or regulatory obstacles standing in the way of a future M/S NoGAPS (Nordic Green Ammonia-Powered Ship) hitting the water, and ammonia produced from green hydrogen represents a credible, long-term fuel option, according to the latest report released by the NoGAPS consortium partners. The challenges? Demonstrating a business case and securing government and/or public finance to accelerate progress. NoGAPS stated aim is to get an ammonia-powered, deep sea vessel on the water by 2025.

Viking Energy project takes another step

One of the early steps for the Viking Energy project has been completed, with researchers at the University of Strathclyde’s Maritime Safety Research Centre delivering their safety assessment for the use of on-board, ammonia-powered fuel cells. Despite the obvious benefits (and the proven feasibility of fuel cell solutions for small-scale shipping), there is a big gap in understanding the hazards and ideal mitigation strategies for on-board incidents. And, while Viking Energy is among several promising demonstration projects for small-scale shipping, the absence of large-scale projects is probably hindering the development of commercial technologies.

More collaborations for Yara

Three new partnerships this week for Yara:

- an agreement with NYK (and Nihon Shipyards) to join their ongoing study into the development of an ammonia-fueled, ammonia gas carrier.

- an MoU with Trafigura to collaborate on “the development and promotion of the use of ammonia as a clean fuel in shipping”. Trafigura’s joint venture with ship owners Frontline Ltd and Golden Ocean Group Ltd (known as TFG Marine) covers about 700 vessels and could potentially be one of the world’s largest maritime fuel procurement and supply alliances, generating substantial demand for clean ammonia fuel.

- and Yara’s YURI green ammonia project in Western Australia will become one of the first pilot projects certified under the “Zero Carbon Certification Scheme”: a new initiative from the Australian-based Smart Energy Council. Certification is such a crucial piece of the ammonia transition puzzle, and – as well as currently developing our own, international, low and zero-carbon ammonia certification scheme – the Ammonia Energy Association is a founding partner to the Zero Carbon Certification Scheme in Australia.

thyssenkrupp to invest in cracking R&D

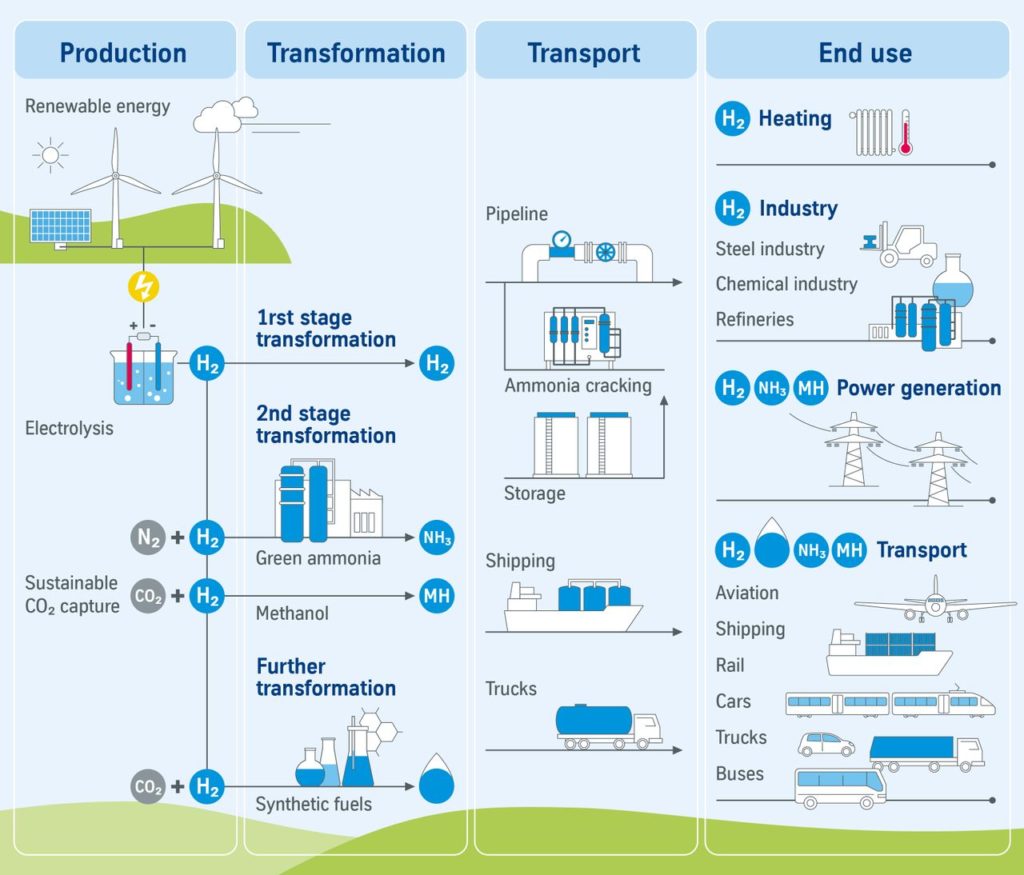

As a part of their ongoing work into the “modularisation and standardisation” of large-scale green ammonia plants, Thore Lohmann (Executive Director of ammonia and methanol business at thyssenkrupp’s Uhde division) confirmed the organisation is investing in cracking R&D to help realise the full potential of ammonia as an energy carrier. Lohmann sees hydrogen from cracked ammonia as a key feedstock for industrial processes and alternative fuel for heating applications.

Investment in clean hydrogen production technology in the USA

Positive signals out of the US, where the Biden administration has announced the new “Hydrogen Shot” framework, designed to reduce the cost of clean hydrogen to US$1/kg by the end of this decade. The Department of Energy’s Request for Information process is open until Wednesday 7 July for interested stakeholders. This month the US government has also joined with the Danish and Norwegian governments to lead the “Zero Emission Shipping” Mission.

In the private space, South Korean conglomerate SK Inc. has just led a new round of investment funding that will help expand Monolith Material’s green hydrogen production facility in Nebraska.

World-first visualisation of ammonia combustion in a spark-ignition engine

We’ll let the video speak for itself! This is part of soon-to-be-released research from the Université d’Orléans.

Our numbers of the week

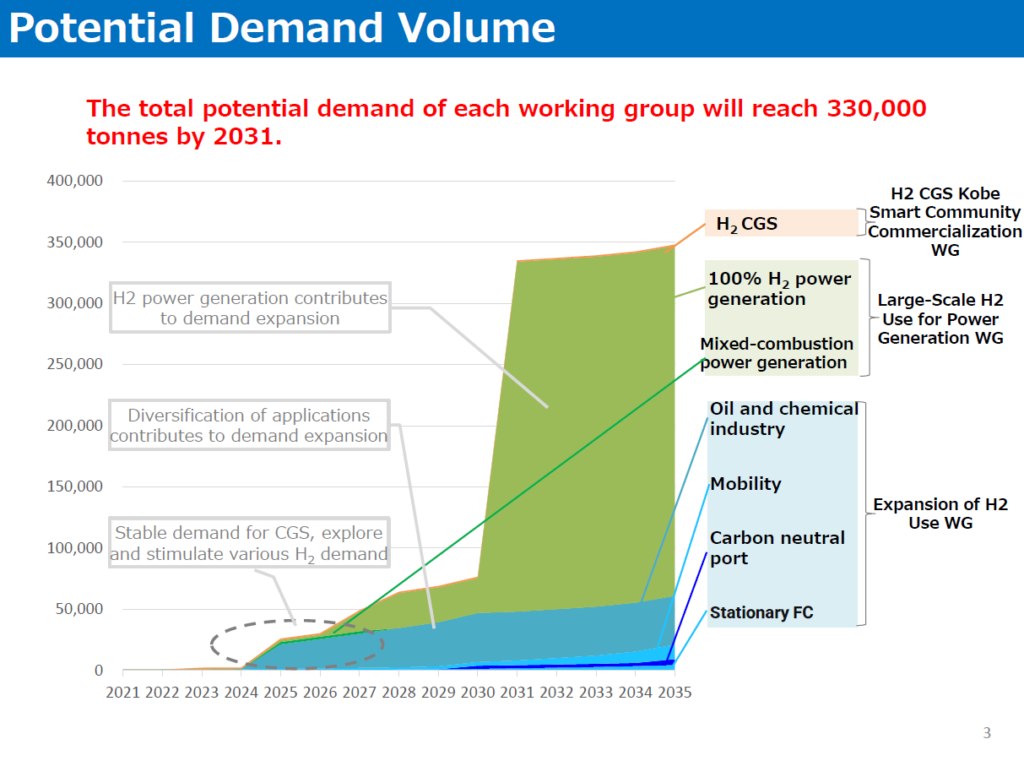

On the demand side, the Kobe/Kansai Hydrogen Utilization Council forecasts the Japanese region will require 330,000 tonnes hydrogen per year by 2031, mostly for power generation. Extrapolate that out over multiple regions and private projects and that’s a lot of green hydrogen that needs to be produced or exported to Japan by the end of this decade.

And Fortescue chairman Andrew Forrest has indicated where that supply may come from, with Fortescue setting itself a goal of providing 15 million tonnes of green hydrogen annually to the global market by the end of the decade (and first deliveries by 2023).

Get the Ammonia Wrap straight to your inbox every week

Make sure you’re signed up for AEA email updates, including our weekly newsletter that features ammonia wrap articles just like this one.