2025: an ammonia energy rollercoaster

By Julian Atchison on December 17, 2025

End-of-year review by Julian Atchison, with contributions from Trevor Brown and Kevin Rouwenhorst.

Looking back at the ammonia energy roller-coaster that was 2025, some key themes stand out.

- The first complete renewable ammonia supply chains have emerged in northeastern China. Progress towards ammonia bunkering has also been made at the Australian end of the Pilbara-East Asia iron ore transport corridor, and in Rotterdam

- A handful of low-emission ammonia production projects came online this year, with more to follow in 2026. Early next year, there will be 600,000-plus tons per year production capacity operational in China

- A massive task lies ahead at the IMO to fill in the gaps on key regulatory details, ahead of renewed discussions on the net-zero framework in October 2026

- Government support for ammonia energy is improving, but failing to establish markets or push projects to FID

- In the technology space, marine engines, cracking, industrial heat, and utility-scale power generation came along in leaps and bounds

- The AEA rolled out an impressive series of projects in 2025: our certification pilot, LEAD, and partnership activities

- There remains so much work to be done in 2026 – join us to make the difference!

Taking care of business – the first complete supply chains emerge

As it is for any commodity, global harmonization is the ideal state for ammonia energy markets, unlocking the flow of trade. But with this state yet to materialize, complete supply chains are nonetheless starting to take form in specific locations.

These supply chains are focused on bunker fuel and exports. They integrate ammonia production, transport, storage, and last mile delivery to ammonia-fueled vessels and/or carriers. The supply chains also have specific target markets and customers, and are positioning themselves to respond to demand in various global locations.

Envision Energy’s Chifeng Net Zero Hydrogen Industrial Park, which now produces 320,000 tons of renewable ammonia per year.

In northeast China, two such supply chains stand out. Envision Energy’s Chifeng Net Zero Hydrogen Industrial Park recently came online, with the multi-phase project to have a final production capacity of 5 million tons of renewable ammonia per year. Truck transport from Chifeng is the current distribution method for the RFNBO-certified product, but Envision ultimately aims to construct a 300km liquid ammonia distribution pipeline, connecting production to export capabilities in Jinzhou Port, where an ammonia storage terminal and jetty is also under development. Further along the coast at Dalian, Envision demonstrated another key piece of the supply chain this year, bunkering COSCO’s Yuantuo 1 tugboat with ammonia fuel in July. Dalian Port is now capable of offering biofuel, methanol, LNG, and ammonia bunkering services, making it a critical alternative marine fuels hub in northeast Asia. There are plans to also offer ammonia bunkering in Jinzhou Port.

ADF’s planned ammonia storage and transport projects across China’s coastline. From Chen Jianqiang, Green Ammonia: The Energy Solution for the Zero-Carbon Era (Oct 2025).

A little further down the coastline of the Bohai Sea, China Energy Engineering Group Co., Ltd. (Energy China) is completing its own production, transport, storage and export supply chain. In its full scope, the Songyuan project will have 3 GW of newbuild renewable solar PV and wind, and is expected to produce a combined 800,000 tons of renewable ammonia and methanol (combined) annually. Renewable ammonia from Songyuan will be transported to Panjin Port (just near Jinzhou), where Energy China co-owns an ammonia storage and transport terminal with Jiangsu Andefu (ADF). ADF became China’s first exporter of liquid ammonia in 2011, and owns significant infrastructure, including the semi-refrigerated ammonia gas carrier vessel Sheng Hang Yong Le, and the under-construction, 50,000-plus m3 capacity Nanjing ammonia tank farm. This supply chain was further boosted in late December by the offtake and investment commitment by Belgian marine ammonia first mover CMB.TECH.

The Panjin Port hub will also be able to export ammonia from another recently operational production project: Jilin Electric Power’s Da’an plant. ADF is planning additional ammonia storage and transport hubs in other regions along the Chinese coast, including Nanjing and Shandong in the east of China, and Fujian and Guangxi in the south of China. Bolstering these two northeast China supply chains, the emergence of a hydrogen pipeline transport network across the Inner Mongolia region also opens up fascinating opportunities.

A consortium is aiming to develop an ammonia bunkering hub at Port Hedland in northwestern Australia, with operations to commence by 2030.

In Australia – at one end of the critical Pilbara-East Asia iron ore transport corridor – an ammonia bunker hub is under development. At the Ammonia Energy Association’s APAC conference this year, the Pilbara Ports Authority launched the “Pilbara Clean Fuel Bunkering Hub” strategy, a roadmap aimed at the creation of a bunkering hub at Pilbara’s Port Hedland, focused on low-carbon marine fuels such as ammonia. The conference also saw updates from the most advanced ammonia fuel production project in the roadmap consortium: NH3 Clean Energy, and the awarding of Approval in Principle (AiP) for a new 10,000 m3 ammonia bunkering vessel design, to be used at the hub by 2030. In October, Mitsui O.S.K. Lines became the first shipping line and future fuel customer to join the bunker hub initiative, aiming for its under-development, Capesize bulk carrier vessels to be bunkered with ammonia in the Pilbara by 2030.

Bunker pilot partners from the April demonstration at the Port of Rotterdam. From Duna Uribe and Cees Boon, Ammonia bunkering pilot in the Port of Rotterdam (July 2025).

And in Europe, Rotterdam moved closer than ever to commercial operations for ammonia bunkering. We explored in-depth results from the Port’s first-ever ammonia bunkering pilot, conducted in April 2025, featuring a consortium of stakeholders throughout the marine fuel supply chain: ammonia supplier (OCI), vessel owner/operator (Trammo), bunker equipment & operations expert (James Fisher Fendercare), bunker barge operator (Victrol), local regulatory and safety authorities (DCMR Environmental Protection Agency, Rijnmond Safety Region), and local first responders (the Joint Fire Service). The exercise moved Rotterdam’s “Port Readiness Level” for ammonia bunkering to a level where, in 2026, the Port of Rotterdam is expected to allow ammonia bunkering on a project-by-project basis. In October, two of the pilot partners – OCI and Victrol – agreed to the joint development of a commercial clean ammonia bunkering supply chain in the Netherlands and Belgium.

Projects continue to come online, with more to follow

Ammonia production plants fed by electrolytic hydrogen came online in Chifeng (China), Da’an (China), Ludwigshafen (Germany), Burgos (Spain), and Iowa (USA) this year. Energy China indicates that its Songyuan project will come online early in the new year 2026, and Skovgaard Energy’s REDDAP demonstrator is due to come online by the end of the year.

The Chinese projects all share similar features: hundreds of MW of installed electrolysis capacity, multi-hundred thousand ton production capacities for ammonia, internationally-recognized certification for the ammonia product, and minimal grid connections to maintain stability.

By early next year, more than 600,000 tons of renewable ammonia will be produced annually from 1.1 GW of installed electrolysis capacity in northeast China. All of it is expected to be RFNBO-compliant.

This “blueprint” will be repeated again, with an additional handful of renewable production projects scheduled to come online in 2026 in China.

The other projects mentioned above are smaller, featuring immediate, onsite consumption of the renewable ammonia to produce downstream products: mining explosives (Burgos), fertilizers (Iowa), and chemicals (Ludwigshafen). Two of these – Burgos and Iowa – feature some of the first deployments of Talus’ containerised, modular ammonia system. The other features one of the largest electrolyser deployments in Europe (54 MW) at BASF’s manufacturing HQ in Germany, displacing 3.2% of gas-based hydrogen feedstock at the site.

Some of the projects scheduled to come online in 2026 include:

- Beaumont New Ammonia, a mega-scale, CCS-based project in Texas, USA (note: the plant is soon to be operational in a conventional fashion, but CCS-based hydrogen is due to start being supplied by Linde in 2026)

- Phase 2 of Envision Energy’s Chifeng project, adding another 300,000 tons production capacity of renewable ammonia

- Three additional projects in China, developed by China Tianying, Envision Group (the Xing’an League project), and Junrui Green Hydrogen Energy

- Fuel Positive’s smaller-scale, on-farm demonstrator in Manitoba, Canada

- Project YURI, Yara Pilbara’s 10 MW demonstrator plant in far north Australia feeding the adjacent Yara Pilbara Fertilisers site

- Two CCS retrofits on existing ammonia plants: LSB’s El Dorado facility in Arkansas, and Yara’s Sluiskil facility in Norway

- And of course, NEOM, the mega-scale project in Saudi Arabia

And – speaking of NEOM – we can’t go without mentioning Air Products’ and Yara’s new partnership focused on advancing two key low-emissions production projects: one due to reach FID mid-2026 (the Louisiana Clean Energy Complex), and NEOM, due to start commercial operations in 2027. Air Products will continue to act as the sole offtaker of up to 1.2 million tonnes per year of renewable ammonia from NEOM Green Hydrogen, but Yara will step up to commercialize any ammonia not sold by Air Products, maximizing value for both companies and further de-risking the project.

“Refer to guidelines to be developed…” – the massive task ahead at the IMO

The disappointing decision of IMO member states not to adopt the new net-zero framework came as a shock to many in the industry. The decision delays critical steps to deployment, and creates uncertainty for stakeholders all along the alternative fuels supply chain. Although we described some exciting bunker supply chain developments above, the IMO decision means that initiative and action is left to first-movers and those willing to take risks, and deployment will occur in a piecemeal, regional fashion.

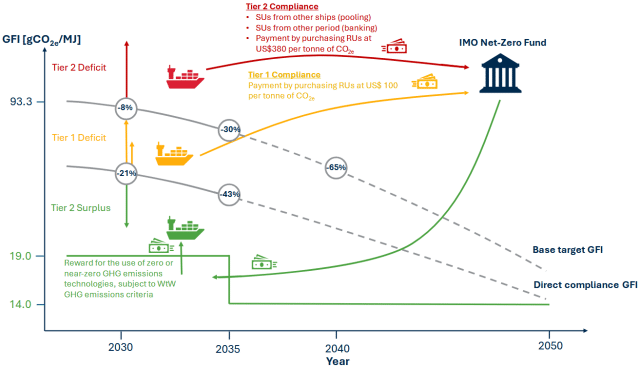

Visual representation of compliance thresholds for vessels under the new IMO regulations. From News Brief MEPC 83 (American Bureau of Shipping, Apr 2025).

In June this year, the AEA called on the IMO member states to adopt, then swiftly finalize the elements of the net-zero framework that lack definition. These include the methodology for the calculation of GHG fuel intensity (GFI), the definition of a ZNZ, the process for recognition of certification schemes, the price of Remedial Units beyond 2030, and the governing provisions of the Net-Zero Fund. These gaps manifested as the phrase “Refer to guidelines to be developed by the Organization”, which appears many, many times in the text of the net-zero framework submitted by the IMO Secretariat.

In hindsight, these gaps in the framework were enough to cause significant doubt in the minds of many stakeholders, particularly given the unprecedented political pressure placed on member states at the meeting. A mammoth task lies ahead to finalize as many of these details as possible, with discussions on adopting the net-zero framework to recommence in October 2026.

Luckily, this delay could prove to be beneficial. Work on lifecycle analysis guidelines for new fuels and the organizational and operational aspects of the proposed IMO Net-Zero Fund continued the day after the contentious vote. To some people’s surprise, the very next week after the MEPC delay, the Intersessional Working Group on the Reduction on Greenhouse Gas Emissions from Ships had an extremely constructive meeting. Important work like this will continue throughout 2026, away from the spotlight, and well in time for the next MEPC meeting in October. The AEA will continue to support and advocate for this critical work.

Hitting the water – operational and emissions data next on the priority list

2025 was the year of the marine ammonia engine.

WinGD, Everllence (formerly MAN ES), and Wärtsilä all presented at our global event in Houston, as did the partnership between Baker Hughes, Hanwha and PSM to deploy ammonia-fired gas turbines at sea. Everllence’s 2-stroke engine is now commercially available, Japan Engine Corporation has announced commercial readiness for its 2-stroke, dual-fuel engine, and WinGD’s units were installed onboard under-construction vessels in South Korea. In Japan, the retrofitted Sakigake tugboat continues to operate and provide valuable data, while Fortescue’s Green Pioneer continues to sail globally, making headlines wherever it goes.

Everllence has launched its new two-stroke, ammonia dual fuel engine, ahead of the first units being delivered to shipyards next year.

Emissions and operational performance of these engines has now come sharply into focus. This year, we have covered emission reporting from all the significant players for their 2-stroke and 4-stroke marine ammonia engines. Promising results from full-scale testing gives us confidence that nitrogen oxides and nitrous oxide emissions can be mitigated or eliminated altogether, paving the way for widespread deployment. Ammonia slip is a key consideration for four-stroke engines, requiring catalytic treatment of the engine exhaust, but (again) it is being demonstrated that this is achievable.

But, real-world operational data over long durations is still needed to validate this testing, and “independent measurement [of engine emissions] would help build confidence in ammonia’s expected greenhouse gas footprint”.

Government support – becoming more focused, but still failing to spark

Visual summary of results for ACME Cleantech in the recent renewable ammonia subsidy program from SECI.

2025 saw results announced from a series of high-profile government support programs for hydrogen and ammonia production. The EU announced the winners of its second Hydrogen Bank auction, and several member states opted to launch their own “Auctions-as-a-Service” mechanism to fund projects not successful at the federal level. The first of many projects to be awarded CfD funding under a Japanese government scheme were announced, including Resonac’s novel hydrogen from used plastics for ammonia pathway. In India, the Solar Energy Corporation awarded a series of fixed price supply contracts for the delivery of renewable ammonia to fertilizer manufacturers all over the country, including a contracted 370,000 tons per year from ACME Cleantech’s production project portfolio. H2Global is in the process of finalizing the results of several parallel supply-side auctions, segmented into regional lots. And, in Australia, the first two recipients of Hydrogen Headstart tax credits were announced, with Murchison Green Hydrogen and Orica to produce hydrogen for ammonia.

But even this swathe of targeted funding is struggling to push projects to FID and operations. Although no government subsidies are available yet in China, project developers there note that regulatory and approvals-based government assistance is doing a significant amount of heavy lifting. Without direct financial assistance, China is still the first location where renewable production projects are coming online. Granted, many of these developers are part of state-owned companies and wider consortia (where it is easier to connect to supply chain partners), but the coordinated, connected nature of project development is clearly working there. Promisingly, governments are vocal about remaining committed to learning and adjusting between funding rounds, particularly the EU. The next results from H2Global (adding to its existing Egypt-Rotterdam supply contract for renewable ammonia) will reveal more crucial data points, as the government-backed “market maker” continues to push towards crucial tipping points.

Ammonia cracking: leaping from feasibility to market establishment

Along with marine engines, ammonia cracking technologies are progressing in maturity. This year, we have seen a jump in the conversation around ammonia cracking, moving from feasibility to deployment.

Ammonia cracking is considered as one of the key steps to unlocking the movement of hydrogen-based energy at both the large and small scales.

Air Liquide announced that its ammonia cracking pilot facility at the Port of Antwerp-Bruges has produced its first molecules.

Short of producing the hydrogen molecule itself, bringing the far more easily-transported ammonia molecule onsite and converting it into usable hydrogen is viewed as a very attractive pathway for a range of industrial customers.

Air Liquide’s industrial-scale cracking demonstrator is now operational in Belgium. Another, being developed by thyssenkrupp Uhde and Uniper in Germany, will begin operations in early 2027. The push towards production of pipeline-quality hydrogen from an ammonia at key coastal locations in Europe – along with accessible tie-in points to key hydrogen pipeline transport networks – continues to grow in momentum, with even floating crackers being considered as a way to process ammonia exports. thyssenkrupp Uhde and Uniper have since agreed to move forward with six more cracking plants at key import locations around Europe, each with the capacity to process 7,200 tons of ammonia per day. Other established technology licensors – KBR, Topsoe, Casale, and others – are demonstrating their own technologies at large scale.

At the smaller scale, companies like AFC Energy (via a new subsidy Hyamtech) and H2SITE are rolling out solutions for onsite hydrogen production from ammonia. Companies including Amogy, Ammonigy, and Duiker continue to explore integration of their cracking technologies in a range of novel applications. After many years of talk, the rubber is hitting the road for ammonia cracking, and valuable operational experience will be gathered over the next twelve months.

Power and heat

Diagram of modifications required at the Hekinan power plant for commercial ammonia co-firing. From Masaki Ichiryu, JERA’s Decarbonization Initiatives: Exploring Results from the Ammonia Power Generation Demonstration at Hekinan (June 2025).

2025 also saw progress in two key technology areas for ammonia energy: power generation, and industrial heat. Manufacturing of ceramics (Foshan and Monalisa in China), bricks (Juwö and Ammonigy in Germany), aluminum rods (Foshan in China), and cement (MUCC in Japan) using ammonia fuel was demonstrated in a variety of global locations. On the power side, Pupuk & IHI partnered for trials in Indonesia, JERA is moving forward with commercial ammonia co-firing at its Hekinan coal power plant. IHI & GE Vernova, as well as Mitsubishi tested ammonia-fueled gas turbines at semi-commercial scale in Japan. And, in a long-awaited decision, a Keppel Infrastructure-led consortium was selected by the Singaporean government to progress plans for an integrated ammonia-fired power plant, terminal and bunker facility on Jurong Island.

2025 at the AEA – certification, partnerships, and taking the LEAD

2025 was also the year the AEA launched its ammonia certification system. The first pilot participants are now on board, and will be using design and/or operational data to certify their product, and trading certificates on the AEA’s registry. Work continues to ensure interoperability between the AEA’s system and those launched by other organizations.

With the certification achievement, the AEA now is broadening its focus. Member-driven initiatives centred on advocacy, safety, and technical standards will begin in 2026. Launched at COP30 in Brazil, the AEA is also part of an alliance to support acceleration and scaling toward sector-wide adoption of low-emission ammonia-based fertilizers (LEAF). The AEA will continue to work with our 45+ partner organizations around the world in maritime, finance, and R&D. We thank outgoing AEA Stakeholder Relations Manager Andrea Guati-Rojo for her amazing work over the last few years to build up this network, and wish her all the best as she continues work in the ammonia energy space.

The AEA’s Low-Emission Ammonia Data (LEAD), a market intelligence database for ammonia energy launched in 2025.

2025 also saw the launch of the AEA’s market intelligence database: Low-Emission Ammonia Data (LEAD). Interactive data sets, summaries, and infographics are updated quarterly, and include information about ammonia plants, ammonia-fueled maritime vessels, and ammonia infrastructure. AEA Technology Manager Kevin Rouwenhorst continues to provide incisive, valuable market intelligence, including technology landscape reviews.

2026 – the work continues

So, despite the successes and progress made in 2025, the year remains a missed opportunity for ammonia energy. To scale-up the gains made this year, urgent and significant work is needed to re-build confidence in ammonia as a low-emission energy commodity, and to begin speeding up deployment in key applications. This is particularly true in the maritime space, with the first large vessels powered by ammonia due to hit the water in 2026.

But – just like at the IMO, where member states returned to critical work the day after an energy-sapping, emotional setback – the AEA will continue to strive and push for ammonia energy. Our annual conference in Houston reflected this approach: we acknowledged and dissected the setbacks in our opening session, before diving straight into action, progress to celebrate, and the work ahead. Difficult, contentious, laborious, and finely detailed pieces of work lie immediately in front of us. The same would be true even if the IMO had voted in favour of its net-zero framework, or if the global portfolio of low-emission production projects hadn’t shrunk in the last year. Clean ammonia will energize the world, and we will continue work in 2026 to make that happen.

If you’re already an AEA member, you likely agree with this analysis! But – if you’re not a member – join us in 2026 to make this happen.